San Diego Tax Rate

The tax landscape in San Diego, California, is a complex interplay of various tax structures and rates that impact both residents and businesses alike. Understanding these rates is crucial for financial planning and decision-making. This comprehensive guide aims to delve into the intricacies of the San Diego tax system, providing an in-depth analysis of the tax rates applicable to different entities and activities within the city.

Unraveling the San Diego Tax Structure

The city of San Diego operates under a comprehensive tax system, incorporating a range of taxes that contribute to the city’s revenue and infrastructure development. These taxes are levied on a variety of activities, from property ownership to business operations and sales transactions.

Property Taxes: A Significant Contributor

One of the primary sources of tax revenue in San Diego is property taxes. These taxes are assessed based on the value of real estate properties, including residential homes, commercial buildings, and land. The property tax rate in San Diego is set by both the city and the county, with the county rate being the higher of the two.

| Tax Jurisdiction | Tax Rate |

|---|---|

| City of San Diego | 1.0838% |

| San Diego County | 1.2018% |

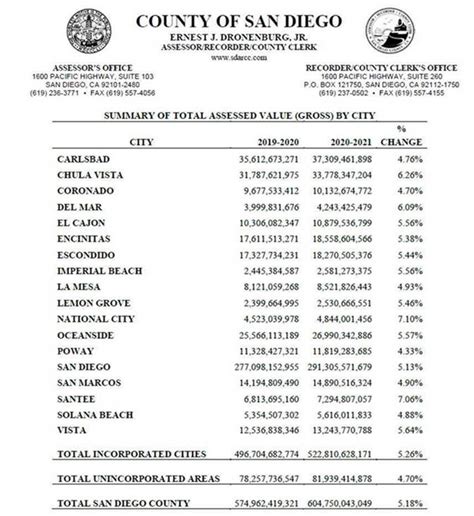

It's important to note that these rates are subject to change annually, influenced by factors such as budget requirements and adjustments to property values. Property owners can access their specific tax rates and information through the San Diego County Assessor's Office website, where detailed property assessments are available.

Sales and Use Taxes: Impacting Transactions

San Diego, like the rest of California, imposes a sales and use tax on the sale of goods and certain services. This tax is collected by retailers and is included in the purchase price of items. The sales tax rate in San Diego consists of a combination of state, county, and city taxes.

| Tax Jurisdiction | Tax Rate |

|---|---|

| State of California | 7.25% |

| San Diego County | 0.50% |

| City of San Diego | 0.50% |

The total sales tax rate in San Diego currently stands at 8.25%, which means that for every $100 spent on taxable items, $8.25 goes towards sales tax. This rate is applicable to most goods and certain services, but there are exemptions and special rules for specific items and situations.

Business Taxes: Supporting Local Enterprises

San Diego imposes taxes on businesses operating within its boundaries to support local infrastructure and services. These taxes vary depending on the nature of the business and its revenue streams.

- Business License Tax: Applicable to most businesses, this tax is based on the gross receipts of the business. The rate varies from 0.12% to 0.45% depending on the type of business and its revenue.

- Transient Occupancy Tax: This tax is levied on hotels, motels, and other transient lodging establishments. The rate is set at 12.5% of the rent charged for each occupancy.

- Public Utilities Tax: Imposed on businesses providing telecommunications, electricity, gas, and water services, this tax is based on the revenue generated from these services.

Businesses can refer to the San Diego City Treasurer's Office for detailed information on business tax rates and requirements, ensuring compliance with local regulations.

Navigating Tax Exemptions and Credits

While the tax rates in San Diego can be substantial, there are mechanisms in place to provide relief and incentives to certain entities. These include tax exemptions, credits, and incentives that can significantly reduce the tax burden for eligible taxpayers.

Property Tax Exemptions

San Diego, in alignment with California state law, offers various property tax exemptions to eligible homeowners and property owners. These exemptions can provide significant savings and are designed to support specific demographics and situations.

- Homeowner's Exemption: Available to owner-occupants of residential properties, this exemption reduces the assessed value of the property by up to $7,000, resulting in lower property taxes.

- Veterans' Exemption: Qualified veterans may be eligible for a property tax exemption of up to $155,000 on their primary residence.

- Senior Citizen's Exemption: Senior citizens over the age of 65 with limited incomes may qualify for a property tax exemption, reducing their tax liability.

Sales and Use Tax Credits

San Diego, in collaboration with the state, offers tax credits to encourage specific behaviors and support certain industries. These credits can be claimed against sales and use tax liabilities, providing a financial incentive for businesses and individuals.

- Manufacturers' Investment Credit: Manufacturers investing in new equipment and machinery can claim a credit of up to 3.5% of their investment, encouraging economic growth and job creation.

- Research and Development Credit: Businesses engaged in research and development activities can claim a credit of up to 15% of their qualified research expenses, fostering innovation and technological advancement.

Future Implications and Tax Strategies

The tax landscape in San Diego is subject to change, influenced by economic trends, legislative decisions, and budgetary requirements. Staying informed about these changes is crucial for effective tax planning and strategy development.

For instance, recent discussions around the potential expansion of the city's Transient Occupancy Tax to include short-term rentals could significantly impact the hospitality industry and travelers. Similarly, changes in business tax rates or the introduction of new tax incentives can encourage or deter certain business activities.

As such, it is essential for individuals and businesses alike to stay informed about the latest tax developments in San Diego. This includes regularly reviewing official tax publications, engaging with tax professionals, and participating in community discussions on tax-related matters. By staying ahead of the curve, taxpayers can ensure they are prepared for any changes and can leverage available opportunities to their advantage.

Conclusion

Understanding the tax rates and structures in San Diego is a complex but essential task for residents and businesses. By navigating the intricacies of property, sales, and business taxes, individuals and enterprises can ensure compliance, optimize their tax liabilities, and contribute effectively to the city’s economic growth and development. As the tax landscape continues to evolve, staying informed and proactive is key to making the most of the opportunities and challenges presented by San Diego’s tax system.

Frequently Asked Questions

How often do tax rates change in San Diego?

+

Tax rates in San Diego can change annually, typically influenced by budgetary requirements and adjustments to property values. It is advisable to check for updates at the start of each fiscal year.

Are there any online resources to calculate my tax liability in San Diego?

+

Yes, the San Diego County Tax Collector’s Office provides an online calculator for estimating property tax liabilities. For other tax types, it is recommended to consult with a tax professional or use reputable tax software.

How can I stay updated on changes to San Diego’s tax rates and regulations?

+

Subscribing to newsletters or updates from the San Diego City Treasurer’s Office and the San Diego County Assessor’s Office can provide timely information on tax rate changes and new regulations. Additionally, following local news sources and tax-focused publications can keep you informed.

Are there any tax incentives for green energy initiatives in San Diego?

+

Yes, San Diego offers various tax incentives for businesses and homeowners investing in renewable energy systems. These incentives include tax credits, exemptions, and rebates. Check with the San Diego County Assessor’s Office for specific details and eligibility criteria.

How do I apply for a business license in San Diego, and what are the associated taxes?

+

You can apply for a business license through the San Diego City Clerk’s Office. The associated taxes include a Business License Tax, based on gross receipts, and other taxes depending on the nature of your business. Consult the San Diego City Treasurer’s Office for detailed information on business tax rates and requirements.