Sales Tax Rate In Ny

The sales tax rate in New York is a crucial aspect of the state's tax system, impacting businesses and consumers alike. This tax is applied to most retail sales and certain services, with rates varying across the state's numerous counties and municipalities. Understanding the sales tax landscape is essential for both local businesses and online retailers shipping goods to New York, as compliance with these regulations is vital to avoid legal and financial repercussions.

A Comprehensive Guide to New York's Sales Tax Rates

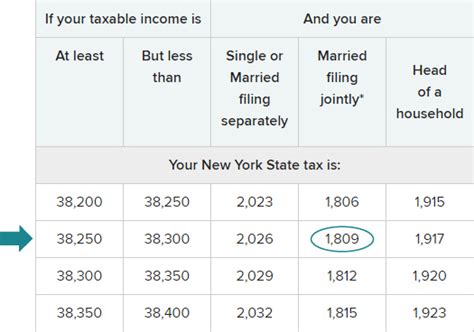

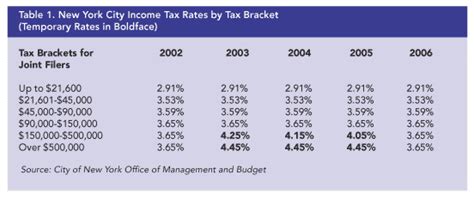

New York State imposes a uniform 4% state sales tax on most goods and certain services. However, it's important to note that counties and cities often levy additional local sales taxes, creating a complex landscape of varying tax rates across the state.

Statewide Sales Tax

The base 4% state sales tax is applicable statewide, making it the minimum sales tax rate for any transaction in New York. This rate is set by the New York State Department of Taxation and Finance and is consistent across all counties and cities.

Local Sales Tax Variations

On top of the statewide sales tax, local governments in New York have the authority to impose additional sales taxes, which can significantly impact the total sales tax rate for consumers and businesses. These local sales taxes can vary from 0% to 4.5%, creating a complex and diverse sales tax environment.

| County/City | Local Sales Tax Rate |

|---|---|

| New York City | 4.5% |

| Albany County | 3% |

| Nassau County | 4% |

| Suffolk County | 4% |

| Rochester (City) | 2% |

It's important to note that the above table provides only a snapshot of local sales tax rates, as there are numerous other counties and cities in New York with their own specific rates. These rates are subject to change, and it's the responsibility of businesses and taxpayers to stay informed about the latest tax regulations.

Exemptions and Special Considerations

While most goods and services are subject to sales tax in New York, there are certain exemptions and special considerations to be aware of. These include:

- Food and beverages: Most unprepared foods and beverages are exempt from sales tax, but prepared foods and drinks are taxable.

- Clothing and footwear: Clothing and footwear items costing less than $110 per item are exempt from sales tax.

- Prescription drugs: Sales of prescription drugs are exempt from sales tax.

- Educational and instructional materials: Certain educational materials, such as textbooks and supplies, are exempt from sales tax.

- Online sales: Online retailers must collect sales tax on shipments to New York if they have a sufficient physical presence in the state or exceed certain sales thresholds. This is known as economic nexus.

Sales Tax Collection and Remittance

For businesses, collecting and remitting sales tax accurately is a critical aspect of compliance. This involves:

- Registration: Businesses must register with the New York State Department of Taxation and Finance to obtain a sales tax certificate of authority.

- Calculation: Accurately calculating the sales tax rate for each transaction, considering the applicable state and local tax rates.

- Collection: Charging the correct sales tax amount to the customer at the point of sale.

- Reporting and Remittance: Regularly reporting sales and remitting the collected sales tax to the Department of Taxation and Finance, typically on a monthly or quarterly basis.

The Impact of Sales Tax on Businesses and Consumers

The sales tax landscape in New York has significant implications for both businesses and consumers. For businesses, especially those operating online or with a physical presence in multiple counties, managing sales tax compliance can be a complex and time-consuming task. It requires a robust understanding of the tax rates, exemptions, and filing requirements.

For consumers, the varying sales tax rates across the state can lead to price discrepancies for similar goods and services depending on their location. This can influence purchasing decisions and create a sense of confusion or unfairness if consumers are unaware of the tax rates in different areas.

Strategies for Businesses

To navigate the complex sales tax environment in New York, businesses can employ the following strategies:

- Utilize Sales Tax Automation Tools: Investing in software that automates sales tax calculation, collection, and remittance can significantly reduce the administrative burden and minimize the risk of errors.

- Stay Informed on Tax Regulations: Regularly monitor updates and changes to sales tax laws, especially when expanding to new counties or cities within the state.

- Offer Transparent Pricing: Provide clear and transparent pricing to customers, including the applicable sales tax, to build trust and avoid surprises at checkout.

- Outsource Sales Tax Compliance: Consider partnering with a tax compliance service provider to handle the complex aspects of sales tax management, especially for businesses with a broad reach across New York.

Advice for Consumers

Consumers can make more informed purchasing decisions by understanding the sales tax landscape in New York. Here are some tips:

- Research Local Sales Tax Rates: Before making significant purchases, especially online, research the applicable sales tax rate for your location to understand the total cost.

- Compare Prices: When shopping, compare prices across different retailers, both online and in-store, to factor in the impact of varying sales tax rates.

- Understand Exemptions: Be aware of the items that are exempt from sales tax, which can help you make more cost-effective choices.

- Question Unexpected Charges: If you notice unexpected sales tax charges, especially when shopping online, question the retailer to ensure the tax calculation is accurate for your location.

Conclusion: Navigating New York's Sales Tax Landscape

New York's sales tax system, with its diverse local tax rates and various exemptions, presents a unique challenge for both businesses and consumers. By understanding the landscape and employing effective strategies, businesses can ensure compliance and consumers can make informed purchasing decisions. Staying informed and adapting to the ever-changing tax regulations is key to success in this complex environment.

How often do sales tax rates change in New York?

+Sales tax rates can change annually or even more frequently, especially at the local level. It’s important to regularly check for updates to ensure compliance.

Are there any penalties for not collecting or remitting sales tax accurately?

+Yes, businesses that fail to collect and remit sales tax accurately can face significant penalties and interest charges. It’s crucial to stay compliant to avoid these repercussions.

How can I stay updated on the latest sales tax regulations in New York?

+The New York State Department of Taxation and Finance provides regular updates and resources on their website. Additionally, tax compliance software often offers notification services for regulatory changes.