Sales Tax Oklahoma

In Oklahoma, sales tax is an essential component of the state's revenue system, contributing significantly to the funding of various public services and infrastructure projects. This tax is applied to the sale of goods and certain services, and its administration is a critical aspect of the state's fiscal policy. The rate and applicability of sales tax can vary across different jurisdictions, making it a complex yet crucial topic for businesses and consumers alike. Let's delve into the intricacies of sales tax in Oklahoma, exploring its rates, exemptions, and its broader impact on the state's economy.

Understanding Sales Tax Rates in Oklahoma

Oklahoma’s sales tax system is a combination of state and local taxes, with rates varying based on the location of the transaction. The state sales tax rate is currently set at 4.5%, which serves as a base for the overall tax rate. This state-level tax is consistent across the state, ensuring a uniform approach to revenue generation.

However, the story doesn't end there. Oklahoma also allows for local sales taxes, which are imposed by counties, municipalities, and special purpose districts. These local taxes can significantly impact the total sales tax rate a consumer pays. For instance, in the city of Oklahoma City, the local sales tax rate is 2.25%, bringing the total sales tax rate to 6.75% for purchases made within city limits. Similarly, in Tulsa, the local sales tax is 1.75%, resulting in a total sales tax rate of 6.25%.

To illustrate the variance in sales tax rates, here's a table showcasing the total sales tax rates for a few major cities in Oklahoma:

| City | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Oklahoma City | 2.25% | 6.75% |

| Tulsa | 1.75% | 6.25% |

| Norman | 1.5% | 6% |

| Broken Arrow | 1.75% | 6.25% |

| Edmond | 1.5% | 6% |

Sales Tax Holidays in Oklahoma

Oklahoma also offers sales tax holidays, which are designated periods where certain types of purchases are exempt from sales tax. These holidays are designed to stimulate the economy and provide relief to consumers, especially for essential items. For instance, Oklahoma often has a back-to-school sales tax holiday, during which school supplies, clothing, and books are exempt from sales tax.

Additionally, Oklahoma has implemented a severe weather preparedness sales tax holiday, typically held in early March. During this period, items like flashlights, batteries, and weather radios are tax-free, encouraging residents to prepare for the state's frequent severe weather events.

Sales Tax Exemptions and Special Considerations

Oklahoma’s sales tax system is not a one-size-fits-all approach. It includes various exemptions and special considerations that cater to specific industries, businesses, and consumer groups. These exemptions can significantly impact the tax burden for certain sectors and individuals.

Food and Beverage Sales Tax

One notable exemption in Oklahoma’s sales tax structure is for prepared food and beverages. While the sale of tangible personal property is generally taxable, prepared food (e.g., meals in restaurants) and beverages (e.g., soft drinks, alcohol) are exempt from sales tax. This exemption extends to both on-premises and off-premises consumption, offering a significant relief to the food and beverage industry and its consumers.

However, it's important to note that while the food itself is exempt, related items like disposable plates, napkins, and cups are taxable as they are considered separate from the prepared food itself.

Manufacturing and Wholesale Sales Tax

Oklahoma also offers a sales tax exemption for manufacturing and wholesale sales. This exemption is designed to encourage economic growth and development in these sectors. Under this provision, sales from a manufacturer to a wholesale distributor, or sales from a wholesale distributor to another wholesale distributor, are not subject to sales tax.

This exemption is a significant advantage for businesses engaged in manufacturing and wholesale trade, as it reduces their tax burden and allows for more competitive pricing in the market.

Agricultural Sales Tax

Oklahoma’s sales tax laws also provide agricultural exemptions, recognizing the importance of this sector to the state’s economy. Sales of agricultural equipment and supplies, such as tractors, irrigation systems, and farming tools, are exempt from sales tax. This exemption helps to reduce costs for farmers and ranchers, making their operations more economically viable.

Retail Sales Tax and E-commerce

With the rise of e-commerce, Oklahoma has had to adapt its sales tax laws to ensure compliance and revenue collection from online sales. The state’s retail sales tax applies to remote sellers and marketplace facilitators who make sales into Oklahoma. This means that even if a business doesn’t have a physical presence in the state, it may still be required to collect and remit sales tax if it makes sufficient sales to Oklahoma residents.

Oklahoma's approach to e-commerce sales tax is designed to level the playing field between brick-and-mortar stores and online retailers, ensuring that all businesses contributing to the state's economy are paying their fair share.

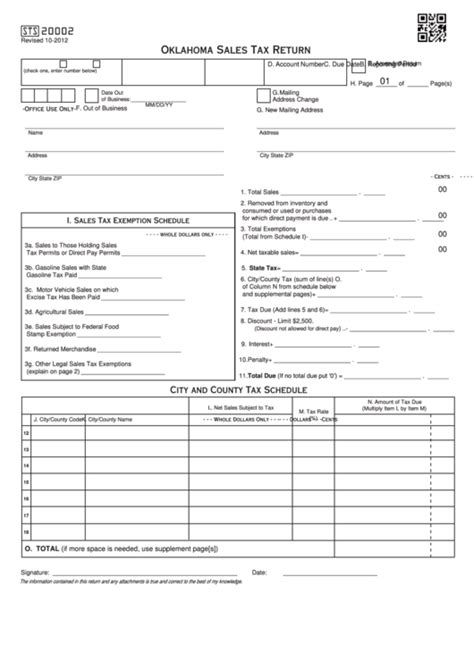

Sales Tax Collection and Remittance

For businesses operating in Oklahoma, sales tax collection is a critical responsibility. The process involves adding the appropriate sales tax to the sale price and remitting the collected tax to the state and local taxing jurisdictions. This process can be complex, especially for businesses with multiple locations or those selling taxable and exempt items.

To assist businesses in managing their sales tax obligations, Oklahoma provides resources and guidance through its Tax Commission. The Tax Commission offers tools like the Sales Tax Rate Lookup Tool, which helps businesses determine the correct sales tax rate for a specific location. They also provide sales tax registration services and guidance on sales tax filing and remittance requirements.

Sales Tax Audits

Oklahoma’s Tax Commission also conducts sales tax audits to ensure compliance with the state’s sales tax laws. These audits can be complex and time-consuming, often requiring businesses to produce extensive records and documentation. Non-compliance can result in significant penalties and interest charges, making it critical for businesses to maintain accurate records and understand their sales tax obligations.

Impact of Sales Tax on Oklahoma’s Economy

Sales tax is a vital source of revenue for Oklahoma, contributing to the state’s ability to fund essential services and infrastructure projects. It plays a crucial role in shaping the state’s fiscal health and its capacity to invest in its future.

Funding Public Services and Infrastructure

Revenue generated from sales tax goes towards funding public services such as education, healthcare, and public safety. It also supports infrastructure development, including roads, bridges, and public transportation systems. These investments are critical for the state’s economic growth and its citizens’ quality of life.

Economic Development and Business Incentives

Oklahoma’s sales tax structure, including its exemptions and special considerations, is designed to encourage economic development and attract new businesses. The exemptions for manufacturing, wholesale, and agricultural sales, for instance, reduce the tax burden for these sectors, making Oklahoma a more attractive location for investment and business growth.

Equity and Social Justice Considerations

While sales tax is an important revenue source, it’s not without its critics. Some argue that sales tax can disproportionately impact lower-income individuals, as they may spend a larger portion of their income on taxable items. This has led to calls for a more progressive tax system, where the tax burden is distributed more equitably across different income levels.

In response, Oklahoma has implemented sales tax exemptions for certain essential items like food and medicine, which can provide some relief to lower-income households. However, the debate around sales tax and its potential regressive nature remains an ongoing discussion in the state's policy circles.

Conclusion: Navigating Oklahoma’s Sales Tax Landscape

Oklahoma’s sales tax system is a dynamic and complex component of the state’s fiscal policy. It involves a delicate balance between generating revenue for essential services and infrastructure, and encouraging economic growth and development. With varying rates, exemptions, and special considerations, understanding and navigating this landscape is critical for both businesses and consumers.

As Oklahoma continues to evolve and adapt to changing economic realities, its sales tax system will likely undergo further refinements and adjustments. Staying informed about these changes is essential for businesses to maintain compliance and for consumers to make informed purchasing decisions. By understanding the intricacies of sales tax in Oklahoma, individuals and businesses can contribute to the state's economic vitality while also enjoying the benefits of a robust and progressive fiscal policy.

What is the current state sales tax rate in Oklahoma?

+The current state sales tax rate in Oklahoma is 4.5%, serving as the base rate for the state’s sales tax structure.

Are there any sales tax holidays in Oklahoma, and what are they for?

+Yes, Oklahoma offers sales tax holidays to stimulate the economy and provide relief to consumers. These include a back-to-school sales tax holiday for school supplies, clothing, and books, and a severe weather preparedness sales tax holiday for items like flashlights and weather radios.

Are there any sales tax exemptions for specific industries in Oklahoma?

+Yes, Oklahoma provides sales tax exemptions for industries like manufacturing, wholesale, and agriculture. These exemptions are designed to encourage economic growth and development in these sectors by reducing their tax burden.

How does Oklahoma handle sales tax for e-commerce businesses?

+Oklahoma requires remote sellers and marketplace facilitators to collect and remit sales tax if they make sufficient sales into the state. This ensures that all businesses contributing to Oklahoma’s economy, including those operating online, pay their fair share.

What resources does Oklahoma provide to help businesses understand and comply with sales tax laws?

+Oklahoma’s Tax Commission provides various resources, including the Sales Tax Rate Lookup Tool, to assist businesses in determining the correct sales tax rate for a specific location. They also offer guidance on sales tax registration, filing, and remittance requirements.