Sales Tax New Jersey Car

When purchasing a car in New Jersey, it's important to understand the state's sales tax regulations. The sales tax is a significant aspect of the overall cost of buying a vehicle, and being well-informed can help you navigate the process efficiently. This article aims to provide a comprehensive guide to the sales tax applicable to car purchases in New Jersey, covering the basics, rates, exemptions, and other essential details.

Understanding Sales Tax in New Jersey

Sales tax is a tax levied on the sale of goods and services. In New Jersey, the sales tax is a state-level tax, meaning the state government sets the tax rate and administers its collection. The sales tax is applied to the purchase price of a vehicle, including any additional fees and costs associated with the transaction.

New Jersey's sales tax is unique in that it operates under a "vendor privilege tax" structure. This means that the tax is technically imposed on the seller (vendor) rather than the buyer. However, in practice, the seller collects the tax from the buyer at the point of sale, ensuring compliance with the tax regulations.

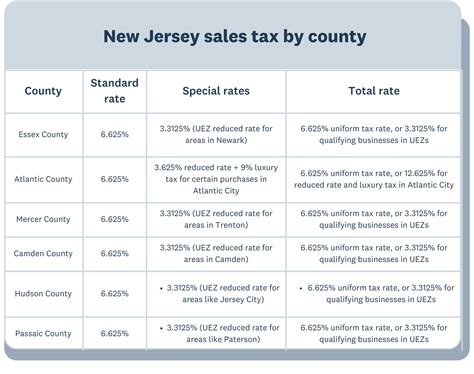

Sales Tax Rates

The sales tax rate in New Jersey is 6.625%, which is the state's base sales tax rate. This rate is applied uniformly across the state, making it straightforward to calculate the tax amount. However, it's important to note that certain jurisdictions within New Jersey may impose additional local taxes, which can increase the overall tax burden.

| Tax Rate Component | Rate |

|---|---|

| State Sales Tax | 6.625% |

| Additional Local Taxes (Potential) | Varies by Jurisdiction |

Calculating Sales Tax

Calculating the sales tax on a car purchase is a straightforward process. You can use the following formula to determine the tax amount:

Sales Tax = Purchase Price x Sales Tax Rate

For example, if you're buying a car for $30,000, the sales tax calculation would be:

Sales Tax = $30,000 x 0.06625 = $1,987.50

So, the sales tax on a $30,000 car purchase in New Jersey would amount to $1,987.50.

Exemptions and Special Considerations

While the standard sales tax rate applies to most car purchases, New Jersey does offer certain exemptions and special considerations in specific circumstances.

Vehicle Exemptions

New Jersey provides sales tax exemptions for specific types of vehicles, including:

- Electric Vehicles (EVs): Purchases of new or used electric vehicles are exempt from sales tax, encouraging the adoption of environmentally friendly transportation options.

- Hybrid Vehicles: Hybrid vehicles that meet certain fuel economy standards may also be eligible for sales tax exemptions, promoting energy-efficient choices.

- Leased Vehicles: Vehicles leased for business purposes are exempt from sales tax, making leasing an attractive option for businesses.

- Disabled Persons' Vehicles: Vehicles specifically modified for individuals with disabilities are exempt from sales tax, ensuring equal access to transportation.

Special Considerations

In addition to exemptions, New Jersey offers special considerations for certain car purchases. These include:

- Trade-Ins: When trading in an old vehicle as part of a new car purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle.

- Military Personnel: Active-duty military personnel and their spouses may be eligible for tax exemptions or reduced tax rates when purchasing a vehicle.

- First-Time Buyers: First-time car buyers in New Jersey may be entitled to certain tax incentives or rebates, making the overall cost of purchasing a vehicle more affordable.

Registration and Title Fees

In addition to sales tax, there are other fees associated with registering and titling your vehicle in New Jersey. These fees are separate from the sales tax and are paid to the state's Motor Vehicle Commission (MVC).

Registration Fees

The registration fee for a passenger vehicle in New Jersey is typically $40.00. However, the fee can vary based on the type of vehicle and its weight class. For example, trucks and commercial vehicles may have higher registration fees.

Title Fees

The title fee for a new vehicle in New Jersey is $87.00, which covers the cost of issuing a new title certificate. If you're transferring an out-of-state title, the fee is $55.00 plus an additional $4.00 for each lien recorded on the title.

Sales Tax Payment and Documentation

When purchasing a car in New Jersey, the sales tax is typically paid at the time of sale. The seller will collect the tax and remit it to the state. As a buyer, you'll receive documentation confirming the sales tax payment, which is an important record to keep for your records.

The sales tax documentation will typically include the following information:

- Vehicle Identification Number (VIN)

- Purchase price of the vehicle

- Sales tax rate applied

- Total sales tax amount paid

- Date of purchase

- Seller's information

Frequently Asked Questions (FAQ)

Can I negotiate the sales tax on my car purchase in New Jersey?

+The sales tax rate in New Jersey is set by the state government and is non-negotiable. However, you can negotiate the purchase price of the vehicle, which can indirectly affect the sales tax amount.

Are there any additional taxes or fees I should be aware of when buying a car in New Jersey?

+In addition to sales tax, you'll need to consider registration and title fees. These fees are paid to the MVC and are separate from the sales tax. Ensure you budget for these additional costs.

How can I claim a sales tax exemption for an electric or hybrid vehicle in New Jersey?

+To claim the sales tax exemption for an electric or hybrid vehicle, you'll need to provide documentation proving the vehicle's eligibility. This may include proof of the vehicle's fuel economy ratings or electric range. Contact the New Jersey Division of Taxation for specific requirements.

What happens if I fail to pay the sales tax on my car purchase in New Jersey?

+Failing to pay the sales tax on your car purchase can result in penalties and interest charges. It's important to ensure that you pay the sales tax at the time of purchase to avoid any legal issues.

Can I get a refund if I overpay the sales tax on my car purchase in New Jersey?

+If you overpay the sales tax, you can request a refund from the New Jersey Division of Taxation. You'll need to provide documentation supporting your claim, such as the sales tax receipt and proof of the correct tax amount.

Understanding the sales tax regulations when purchasing a car in New Jersey is crucial for making an informed decision. By familiarizing yourself with the tax rates, exemptions, and additional fees, you can navigate the car-buying process more confidently and ensure compliance with the state’s tax laws.