Sales Tax In Virginia

Virginia's sales tax system is a crucial component of the state's revenue generation, contributing significantly to its overall economy. Understanding the intricacies of this tax is essential for both residents and businesses operating within the state. This comprehensive guide aims to provide an in-depth analysis of Virginia's sales tax, offering valuable insights into its rates, applicability, and implications.

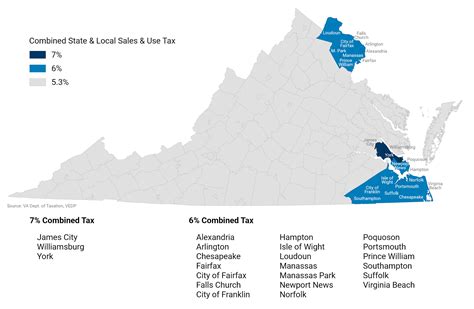

Sales Tax Rates in Virginia

The sales tax in Virginia operates on a state and local level, with a combined tax rate applied to most retail sales. As of my last update in January 2023, the statewide sales and use tax rate stands at 4.3%, while locality-specific taxes can vary from 0% to 4%, resulting in a combined rate that can range from 4.3% to 8.3%.

It's important to note that these local taxes are determined by the specific locality where the transaction takes place. For instance, Arlington County levies an additional 0.7% tax, while Alexandria applies a 2.7% surcharge, bringing their respective total sales tax rates to 5% and 7%.

| Locality | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Arlington County | 0.7% | 5% |

| Alexandria | 2.7% | 7% |

| Richmond | 2% | 6.3% |

Exemptions and Special Rates

Virginia’s sales tax system also includes various exemptions and special rates for specific goods and services. For instance, certain groceries, prescription drugs, and agricultural products are exempt from the state sales tax. Additionally, lodging tax rates can vary depending on the locality, with rates as high as 12% in some areas.

Applicability and Collection

The sales tax in Virginia is applicable to a wide range of transactions, including the sale of tangible personal property, certain services, and rentals. Businesses operating within the state are generally responsible for collecting and remitting sales tax to the Virginia Department of Taxation.

Registration and Remittance

Businesses must register with the Department of Taxation to obtain a Sales and Use Tax Certificate of Registration. This certificate allows them to collect and remit sales tax accurately. The frequency of remittance depends on the business’s sales volume, with options ranging from monthly to annually.

Remote Sellers and Nexus

The concept of economic nexus has been a significant development in Virginia’s sales tax landscape. Remote sellers who exceed a certain sales threshold in the state are now required to register, collect, and remit sales tax. This threshold is based on the number of transactions or the total sales revenue generated in Virginia.

Compliance and Penalties

Compliance with Virginia’s sales tax regulations is crucial to avoid penalties and maintain a positive relationship with the Department of Taxation. Failure to collect and remit sales tax accurately can result in significant fines and interest charges.

Audit Process

The Department of Taxation conducts audits to ensure compliance. These audits can cover a range of aspects, including sales tax collection, remittance, and reporting. It’s essential for businesses to maintain accurate records and be prepared for potential audits.

Penalties and Interest

Penalties for non-compliance can be severe, with the state imposing a 5% penalty on the amount of tax due for each month the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 0.75% per month, compounding daily.

Future Implications and Potential Changes

Virginia’s sales tax landscape is dynamic and subject to change. As the state’s economy evolves, so too might its tax policies. Here are some potential future developments to watch for:

-

Tax Rate Adjustments: While the current rates remain stable, Virginia has periodically adjusted its sales tax rates in the past. These adjustments could be influenced by economic factors, budget requirements, or legislative decisions.

-

Online Sales Tax: With the continued growth of e-commerce, Virginia might explore ways to streamline the collection of sales tax for online transactions. This could involve implementing a centralized collection system or further defining economic nexus thresholds.

-

Tax Exemptions: The state might consider expanding or reducing tax exemptions for specific goods or services, particularly in response to changing economic conditions or policy priorities.

-

Simplification of Tax Structure: To improve compliance and reduce administrative burdens, Virginia could look into simplifying its sales tax system, potentially by reducing the number of local tax jurisdictions or standardizing rates across localities.

Staying informed about these potential changes is crucial for both consumers and businesses to ensure they remain compliant and can adapt to any new tax regulations.

Conclusion

Understanding Virginia’s sales tax is essential for anyone conducting business within the state. From the varying rates across localities to the specific exemptions and collection responsibilities, this guide has provided an in-depth look at the key aspects of Virginia’s sales tax system. By staying informed and compliant, businesses can contribute to the state’s economy while avoiding potential penalties.

Frequently Asked Questions

What is the current sales tax rate in Virginia?

+

As of my last update, the statewide sales and use tax rate is 4.3%. However, local taxes can vary, resulting in a combined rate that ranges from 4.3% to 8.3%.

Are there any goods or services exempt from sales tax in Virginia?

+

Yes, certain groceries, prescription drugs, and agricultural products are exempt from the state sales tax. Additionally, lodging tax rates can vary, with some localities charging up to 12%.

How often do businesses need to remit sales tax in Virginia?

+

The frequency of remittance depends on the business’s sales volume. Options range from monthly to annually, with businesses required to register with the Virginia Department of Taxation to obtain a Sales and Use Tax Certificate of Registration.

What happens if a business fails to collect and remit sales tax accurately in Virginia?

+

Failure to comply with sales tax regulations can result in significant fines and interest charges. The state imposes a 5% penalty on the amount of tax due for each month the tax remains unpaid, up to a maximum of 25%. Interest accrues at a rate of 0.75% per month, compounding daily.

Are there any potential changes to Virginia’s sales tax system in the future?

+

Yes, potential future developments include tax rate adjustments, online sales tax collection, changes to tax exemptions, and potential simplifications to the tax structure. It’s important to stay informed about these potential changes to ensure compliance.