Sales Tax In Dc

Sales tax is an essential component of the revenue system for many jurisdictions worldwide, including the District of Columbia (DC). Understanding the intricacies of sales tax laws and regulations is crucial for both consumers and businesses operating within the district. This comprehensive guide aims to provide an in-depth analysis of sales tax in DC, covering its structure, rates, exemptions, and implications for various industries and consumers.

The Structure of Sales Tax in DC

The sales and use tax system in the District of Columbia is governed by the District of Columbia Office of Tax and Revenue (OTR), which administers and enforces the tax laws. Sales tax in DC is a consumption tax imposed on the sale of tangible personal property and certain services. It is a cumulative tax, meaning that the tax is calculated based on the selling price, and any prior taxes already included in the price are also subject to the tax.

The OTR has established a clear and straightforward structure for sales tax in DC, ensuring compliance and ease of understanding for taxpayers. Here are the key components of the sales tax system:

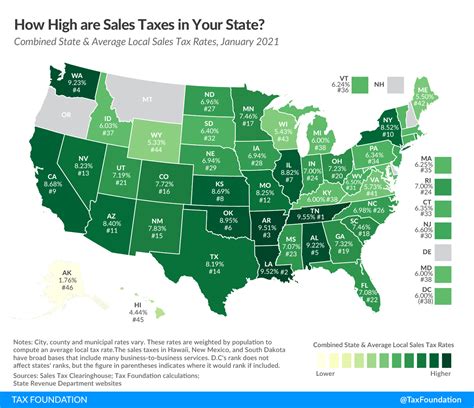

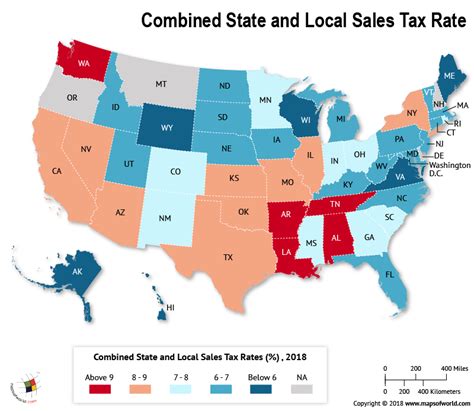

- Sales Tax Rate: The general sales tax rate in DC is 6%, which applies to most retail sales of tangible personal property and certain services. This rate is consistently applied across the district, providing a uniform tax environment for businesses and consumers.

- Use Tax: In addition to the sales tax, DC imposes a use tax on the storage, use, or consumption of tangible personal property and certain services purchased from out-of-state vendors. The use tax rate mirrors the sales tax rate at 6%, ensuring that all purchases are subject to tax, regardless of their origin.

- Special Tax Districts: DC has designated certain areas as special tax districts, where an additional sales tax rate is applied. These districts are established to support specific community projects or initiatives. For instance, the Anacostia Waterfront Corporation Tax Increment Financing District has an additional sales tax rate of 0.25%, bringing the total sales tax rate to 6.25% within this district.

- Taxable Items: Sales tax in DC applies to a wide range of goods and services, including clothing, electronics, furniture, and many other retail items. However, there are certain exemptions and exclusions, which we will explore in detail in the following sections.

Sales Tax Rates and Exemptions

While the general sales tax rate in DC is a straightforward 6%, there are specific categories of goods and services that are exempt from sales tax. These exemptions are designed to promote certain economic activities or provide relief to specific consumer groups. Here’s an overview of the key sales tax exemptions in DC:

Groceries and Food Products

One of the most notable exemptions in DC is the exclusion of groceries and certain food products from sales tax. This exemption aims to alleviate the tax burden on essential items that are fundamental to daily living. Here are the key points regarding this exemption:

- The sales tax does not apply to food intended for human consumption, including staple groceries, fruits, vegetables, meats, dairy products, and other basic food items.

- Prepared foods and meals, such as those sold in restaurants or delis, are subject to the standard 6% sales tax rate.

- Certain items that are considered "food" but have alternative uses, like flour, sugar, and baking ingredients, are also exempt from sales tax.

- However, if these items are sold as part of a meal or in a prepared form, they may be subject to tax.

Prescription Drugs and Medical Supplies

To support access to healthcare and essential medical needs, DC exempts prescription drugs and certain medical supplies from sales tax. This exemption covers a wide range of items, including:

- Prescription medications dispensed by licensed pharmacies or healthcare providers.

- Over-the-counter medications when purchased with a valid prescription.

- Durable medical equipment, such as wheelchairs, walkers, and oxygen equipment.

- Diabetic supplies, including insulin, test strips, and glucose meters.

- First aid items like bandages, gauze, and antiseptics.

Educational Materials and Supplies

DC promotes access to education and learning by exempting certain educational materials and supplies from sales tax. This exemption is particularly beneficial for students, educators, and institutions. Here’s what you need to know:

- Textbooks, workbooks, and other educational materials used in accredited educational institutions are exempt from sales tax.

- Writing instruments, paper, art supplies, and other classroom essentials are also excluded from the tax.

- However, if these items are sold in combination with taxable items (e.g., a textbook bundled with a CD), the entire package may be subject to tax.

Additional Exemptions

DC offers several other exemptions to support specific industries and consumer groups. These include:

- Clothing and footwear for children under 10 years old are exempt from sales tax.

- Sales of residential real estate are exempt from sales tax, as they are subject to a separate transfer tax.

- Certain non-profit organizations and government entities are exempt from sales tax on their purchases.

Registration and Compliance

Businesses operating within DC, or those making sales into the district, are required to register with the OTR and obtain a sales tax permit. This process ensures that businesses understand their tax obligations and comply with the sales tax regulations. Here are the key steps for registration and compliance:

Registering for Sales Tax

To register for sales tax in DC, businesses can follow these steps:

- Visit the OTR website and navigate to the "Register for Taxes" section.

- Complete the online application form, providing details about the business, its location, and the nature of its sales.

- Submit the application and any required supporting documentation.

- Once approved, the business will receive a unique sales tax permit number and a certificate of registration.

Collecting and Remitting Sales Tax

Once registered, businesses are responsible for collecting and remitting sales tax on behalf of the OTR. Here’s how the process works:

- Businesses must calculate the sales tax on each taxable transaction and add it to the selling price.

- The collected sales tax must be remitted to the OTR on a regular basis, typically monthly or quarterly, depending on the business's tax liability.

- Businesses can remit sales tax online through the OTR's secure payment portal or by mailing a check to the designated address.

- Accurate record-keeping is essential to ensure compliance and facilitate audits.

Compliance and Penalties

Compliance with sales tax regulations is crucial to avoid penalties and legal consequences. Here are some key points to keep in mind:

- Businesses must accurately calculate and collect sales tax on all taxable transactions.

- Failure to register, collect, or remit sales tax can result in penalties, interest, and even criminal charges in severe cases.

- The OTR conducts audits to ensure compliance, and businesses are required to provide access to their records upon request.

- It is important for businesses to stay informed about any changes to sales tax laws and regulations to avoid non-compliance.

Impact on Industries and Consumers

Sales tax has a significant impact on various industries and consumer behavior within DC. Understanding these implications can provide valuable insights into the economic landscape of the district.

Retail Industry

The retail industry in DC is directly influenced by sales tax. While the 6% sales tax rate is relatively moderate compared to some other jurisdictions, it still affects consumer spending and business profitability. Here’s how it impacts the retail sector:

- Pricing Strategy: Retailers must incorporate the sales tax into their pricing strategies to ensure competitiveness. They may choose to absorb the tax or pass it on to consumers, impacting their profit margins.

- Competitive Advantage: Businesses that can offer tax-free sales, such as those catering to tourists or providing specific exemptions, may have a competitive edge over others.

- Online Sales: The rise of e-commerce has made it crucial for retailers to understand the impact of sales tax on online transactions. Businesses must ensure compliance with the use tax for out-of-state purchases.

Hospitality and Tourism

The hospitality industry in DC, including hotels, restaurants, and attractions, is subject to sales tax on their services and goods. This tax has both positive and negative implications:

- Revenue Generation: Sales tax on hospitality services contributes significantly to DC's revenue stream, supporting infrastructure and community development.

- Competitive Pricing: Businesses in the hospitality sector must factor in the sales tax when setting their prices, impacting their ability to compete with neighboring jurisdictions.

- Tourist Spending: Sales tax can affect the spending habits of tourists, as they may choose to make larger purchases in tax-free areas or plan their expenditures strategically.

Consumer Behavior

Sales tax influences consumer behavior in DC, shaping purchasing decisions and spending patterns. Here are some key observations:

- Tax Awareness: Consumers in DC are generally aware of the sales tax rate and factor it into their budgeting and decision-making processes.

- Exemption Awareness: The exemptions for groceries, prescription drugs, and educational supplies are well-known among consumers, encouraging them to make tax-efficient choices.

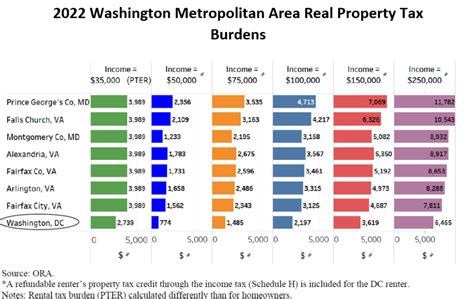

- Cross-Border Shopping: With neighboring jurisdictions having different sales tax rates, some consumers may engage in cross-border shopping to take advantage of lower tax rates.

- Online Shopping: The convenience of online shopping has made it easier for consumers to compare prices and tax rates, potentially impacting their purchasing decisions.

Sales Tax and Economic Development

Sales tax plays a vital role in DC’s economic development and community growth. The revenue generated from sales tax is a significant source of funding for various public projects and services. Here’s how sales tax contributes to economic development:

Infrastructure and Community Projects

The funds collected through sales tax are often allocated to support infrastructure development and community initiatives. These funds can be used for:

- Road construction and maintenance.

- Public transportation improvements.

- Park development and maintenance.

- Community centers and recreational facilities.

- Public safety initiatives.

Revenue Distribution

The revenue generated from sales tax is distributed among various government entities and agencies, ensuring a fair and balanced allocation of resources. Here’s an overview of the distribution process:

- A portion of the sales tax revenue is allocated to the general fund, which supports a wide range of government operations and services.

- Certain special tax districts, like the Anacostia Waterfront Corporation Tax Increment Financing District, receive a dedicated share of the sales tax revenue to support their specific community projects.

- The remaining revenue is distributed based on predetermined formulas, ensuring equitable distribution across different government departments and agencies.

Impact on Small Businesses

While sales tax provides revenue for community development, it can also pose challenges for small businesses. Here’s how sales tax affects small businesses in DC:

- Administrative Burden: Complying with sales tax regulations can be a significant administrative burden for small businesses, especially those with limited resources.

- Competitive Disadvantage: Small businesses may struggle to compete with larger enterprises that have more resources to absorb sales tax costs.

- Innovation and Growth: Sales tax obligations can divert resources away from innovation and business growth, potentially hindering the development of small businesses.

Future Implications and Trends

As DC’s economy and tax landscape continue to evolve, it is essential to consider the future implications and potential trends related to sales tax. Here are some key insights:

E-Commerce and Online Sales

The growth of e-commerce and online sales presents unique challenges and opportunities for sales tax collection. Here’s what to expect:

- Increased Online Transactions: With the rise of digital marketplaces, more transactions will occur online, impacting the collection of use tax on out-of-state purchases.

- Sales Tax Simplification: Efforts to simplify and streamline sales tax regulations for online sellers may become more prominent, ensuring compliance and fairness.

- Remote Seller Nexus: The concept of "remote seller nexus" may evolve, determining when out-of-state sellers are required to collect and remit sales tax based on their economic presence in DC.

Sales Tax Reform

As sales tax laws and regulations evolve, there may be calls for reform to address emerging challenges and promote fairness. Potential areas for reform include:

- Exemption Review: A comprehensive review of sales tax exemptions could ensure that they remain relevant and aligned with the district's economic priorities.

- Simplification: Simplifying the sales tax structure and reducing administrative burdens for businesses may be a focus to enhance compliance and efficiency.

- Tax Rate Adjustments: Depending on economic conditions and revenue needs, adjustments to the general sales tax rate or special tax districts may be considered.

Community Engagement

Sales tax revenue is a vital source of funding for community projects and initiatives. As such, engaging the community in discussions about sales tax allocation and priorities can lead to more transparent and accountable governance. Here are some potential avenues for community engagement:

- Public forums and town hall meetings to discuss sales tax revenue allocation and community development plans.

- Online platforms and surveys to gather feedback and ideas from residents on how sales tax revenue should be utilized.

- Collaborative efforts between government agencies and community organizations to ensure that sales tax revenue supports the needs and aspirations of the community.

Conclusion

Sales tax in DC is a critical component of the district’s revenue system, impacting businesses, consumers, and community development. With a clear structure, exemptions, and compliance requirements, the sales tax system in DC ensures a balanced approach to taxation. As the economy evolves, it is essential for businesses, consumers, and policymakers to stay informed about sales tax regulations and their implications to navigate the changing landscape effectively.

How often must businesses remit sales tax to the OTR?

+The frequency of sales tax remittance depends on the business’s tax liability. Generally, businesses with higher tax liabilities remit sales tax monthly, while those with lower liabilities remit quarterly. However, the OTR provides flexibility, allowing businesses to request changes to their remittance frequency based on their sales volume and tax obligations.

Are there any sales tax holidays in DC?

+Yes, DC observes sales tax holidays, which are specific periods when certain categories of items are exempt from sales tax. These holidays are typically announced by the OTR and provide consumers with tax-free shopping opportunities. Sales tax holidays in DC often coincide with back-to-school or holiday shopping seasons.

How does DC handle sales tax for online purchases?

+DC imposes a use tax on out-of-state purchases made online or through catalogs. Consumers are responsible for self-assessing and paying the use tax on these purchases. However, as e-commerce continues to grow, efforts to simplify and streamline the use tax collection process may be implemented to ensure compliance.