Restaurant Tax

The restaurant industry is a vital part of many economies, providing a vibrant and essential service to communities. However, like any business, it operates within a complex web of regulations and taxes. Among these, the restaurant tax is a critical aspect that significantly impacts the financial health and operations of restaurants. This article aims to delve into the intricacies of restaurant taxes, exploring their implications, variations, and strategies to navigate this complex landscape.

Understanding Restaurant Taxes: A Complex Web

Restaurant taxes encompass a wide range of levies and fees that restaurants are required to pay, often varying by jurisdiction and the nature of the business. These taxes can significantly influence a restaurant’s financial performance and strategic decisions.

Sales and Value-Added Taxes

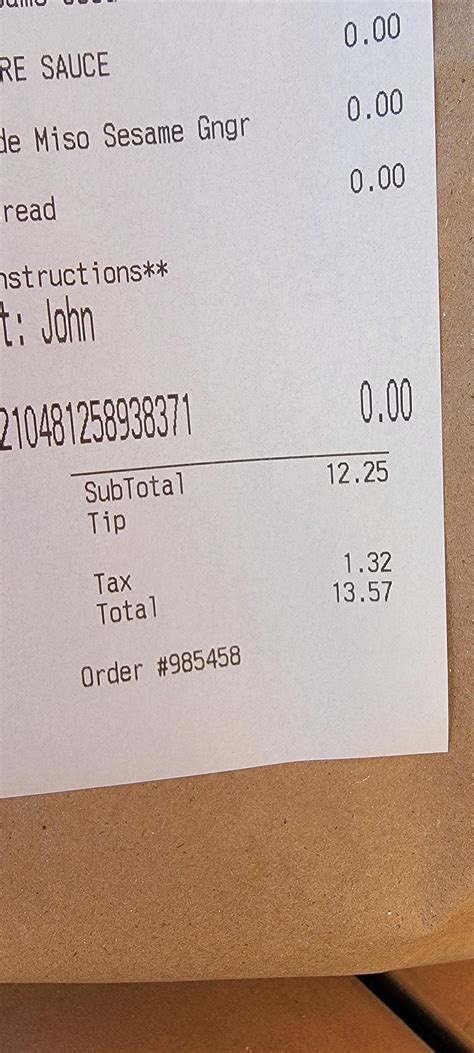

One of the most common taxes faced by restaurants is the sales tax or its equivalent, the value-added tax (VAT). This tax is applied to the sale of goods and services and is often a significant revenue source for governments. For restaurants, this means that every item sold, from meals to drinks, is subject to this tax, which can range from 5% to 20% or more, depending on the region.

| Region | Sales Tax Rate |

|---|---|

| California | 7.25% |

| New York City | 8.875% |

| Toronto | 13% |

| Paris | 20% |

Restaurants must carefully calculate and remit these taxes, often on a monthly or quarterly basis, to the appropriate tax authorities. The complexity increases for multi-jurisdictional restaurants, where different tax rates and rules may apply in each location.

Property Taxes

Another significant tax for restaurants is property tax, which is levied on the value of the restaurant’s real estate and any permanent fixtures. This tax can be substantial, especially for larger restaurants or those in high-value areas. For instance, a restaurant in a prime city location could face annual property taxes of tens or even hundreds of thousands of dollars.

Income and Payroll Taxes

Like any business, restaurants are subject to income tax on their profits. This tax varies by jurisdiction and the restaurant’s legal structure. Additionally, restaurants must also manage payroll taxes, which include social security, Medicare, and other employee-related deductions. Proper management of these taxes is crucial to avoid penalties and ensure compliance.

Other Levies and Fees

Restaurants may also face a myriad of other taxes and fees, such as hospitality taxes, license fees, food safety inspection fees, and alcohol taxes (if they serve alcohol). These additional charges can quickly add up and impact a restaurant’s bottom line.

Navigating the Restaurant Tax Landscape

Given the complexity and significance of restaurant taxes, effective tax management is essential for the success and longevity of a restaurant business. Here are some strategies and considerations to navigate this landscape:

Comprehensive Tax Planning

Restaurateurs should engage in thorough tax planning, considering all relevant taxes and their implications. This involves understanding the tax rules in the jurisdictions they operate in, and how these taxes may change over time. Regular reviews of tax strategies are crucial to adapt to changing regulations and business circumstances.

Accurate Record Keeping

Maintaining meticulous records is vital for tax compliance and planning. This includes keeping track of sales, expenses, inventory, and payroll. With accurate records, restaurants can efficiently calculate and remit their taxes, identify potential deductions, and plan for future tax obligations.

Leveraging Tax Deductions and Credits

Restaurants, like other businesses, can benefit from various tax deductions and credits. These may include deductions for business expenses, depreciation of assets, and employee benefits. Additionally, restaurants may qualify for specific industry-related credits, such as those for hiring and training new employees or investing in energy-efficient equipment.

Efficient Tax Filing and Remittance

Ensuring timely and accurate tax filing and remittance is crucial. Restaurants should establish efficient processes for collecting and remitting taxes, including integrating tax calculations into their point-of-sale (POS) systems and using tax compliance software. Regular reviews of tax obligations and payments can help identify and rectify any errors promptly.

Seeking Professional Advice

Given the complexity of restaurant taxes, seeking advice from tax professionals or accountants with restaurant industry expertise can be invaluable. These professionals can provide guidance on tax strategies, help with compliance, and identify opportunities to optimize tax obligations.

The Future of Restaurant Taxes

The restaurant tax landscape is dynamic and subject to change, influenced by economic, political, and social factors. While some jurisdictions may seek to increase tax revenues from restaurants to address budget deficits or invest in public services, others may introduce tax breaks or incentives to stimulate the industry and local economies.

Additionally, the growing trend of online ordering and delivery services introduces new complexities to restaurant taxes. For instance, taxes on these services may vary depending on the platform used and the location of the customer. As these services become more prevalent, restaurants will need to adapt their tax strategies accordingly.

Strategies for the Future

To navigate future tax challenges, restaurants can consider the following strategies:

- Stay informed about tax law changes and their implications.

- Explore technology solutions for efficient tax management, such as POS systems with integrated tax calculations and compliance software.

- Build relationships with local tax authorities to understand their priorities and potential opportunities.

- Engage in industry advocacy to influence tax policies and ensure they are fair and sustainable for the restaurant sector.

As the restaurant industry continues to evolve, effective tax management will remain a critical success factor. By understanding the complexities of restaurant taxes and implementing strategic tax planning, restaurateurs can ensure their businesses remain competitive and financially healthy.

How often do restaurants need to remit sales taxes?

+The frequency of sales tax remittance can vary by jurisdiction. Some require monthly remittances, while others may allow for quarterly or semi-annual payments. It’s crucial for restaurants to understand the specific requirements of their region to ensure timely and accurate tax payments.

Are there any tax benefits for restaurants that use sustainable or local ingredients?

+Yes, some jurisdictions offer tax incentives or credits for restaurants that promote sustainability or source locally. These can include deductions for energy-efficient equipment, tax credits for using renewable energy sources, or reduced tax rates for businesses that meet certain sustainability criteria.

What challenges do restaurants face with tax compliance when operating in multiple jurisdictions?

+Operating in multiple jurisdictions introduces a host of tax compliance challenges. Restaurants must navigate different tax rates, filing requirements, and deadlines for each location. This complexity can lead to errors and penalties if not managed properly. To address this, restaurants often employ specialized tax software or consult with tax professionals who can help streamline the process.