Property Taxes Baltimore County

Property taxes are an essential aspect of any local government's revenue stream, and they play a significant role in funding public services and infrastructure. In Baltimore County, Maryland, property taxes contribute to the financial stability of the region and directly impact the residents and businesses that call this vibrant county home. This article aims to delve into the intricacies of property taxes in Baltimore County, exploring the assessment process, tax rates, exemptions, and the impact on the local community.

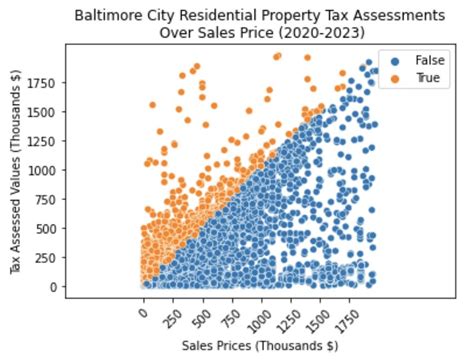

Understanding Property Tax Assessments in Baltimore County

The foundation of property tax assessments in Baltimore County lies in the meticulous evaluation process conducted by the Baltimore County Department of Finance, specifically the Office of Property Assessment. This office is responsible for determining the taxable value of each property within the county, which serves as the basis for calculating the property tax bill. The assessment process considers various factors, including:

- Property Type: Different types of properties, such as residential, commercial, and industrial, are assessed differently, taking into account their unique characteristics and market values.

- Market Conditions: The real estate market in Baltimore County is closely monitored to ensure assessments reflect current trends and values. This includes analyzing sales data, property improvements, and economic factors.

- Property Features: Assessors consider the physical attributes of each property, such as size, age, condition, number of rooms, and any unique features that may impact its value.

- Tax Maps and Records: The Office of Property Assessment maintains detailed tax maps and records, ensuring accurate boundaries and ownership information for each property.

Once the taxable value of a property is determined, it is subject to a tax rate, which is set by the Baltimore County government. The tax rate is expressed as a millage rate, representing the amount of tax owed per $1,000 of assessed value. For instance, a millage rate of 100 mills means that for every $1,000 of assessed value, the property owner owes $10 in taxes.

Assessment Appeal Process

Baltimore County recognizes the importance of a fair and transparent assessment process. If a property owner disagrees with their assessed value, they have the right to appeal the assessment. The appeal process typically involves submitting documentation to support the owner's claim and presenting their case to the Maryland State Department of Assessments and Taxation or the Baltimore County Board of Appeals, depending on the nature of the appeal.

| Assessment Appeal Statistics (2022) | Data |

|---|---|

| Total Appeals Filed | 3,215 |

| Appeals Granted | 1,275 |

| Percentage of Appeals Granted | 39.66% |

These statistics highlight the effectiveness of the appeal process, providing property owners with a pathway to ensure their assessments are accurate and fair.

Baltimore County Property Tax Rates

The property tax rates in Baltimore County are determined annually by the Baltimore County Council, taking into account the budgetary needs of the county and the impact on residents. The tax rates can vary depending on the homestead exemption status and the specific tax district in which the property is located.

Homestead Exemption

Baltimore County offers a homestead exemption program to provide relief to eligible homeowners. This exemption reduces the taxable value of a primary residence, effectively lowering the property tax burden. To qualify for the homestead exemption, a homeowner must meet certain criteria, such as:

- The property must be the owner's primary residence.

- The homeowner's total household income must not exceed a specified limit, which is adjusted annually.

- The homeowner must apply for the exemption and provide necessary documentation.

The homestead exemption can significantly reduce the property tax liability for eligible homeowners, making it an attractive incentive for those who wish to establish long-term roots in Baltimore County.

Tax Rates by District

Baltimore County is divided into multiple tax districts, each with its own unique characteristics and needs. As a result, property tax rates can vary slightly from one district to another. The following table provides an overview of the tax rates for the major tax districts in Baltimore County for the current fiscal year:

| Tax District | Millage Rate |

|---|---|

| District 1 | 105.70 mills |

| District 2 | 105.00 mills |

| District 3 | 105.00 mills |

| District 4 | 106.00 mills |

| District 5 | 105.00 mills |

| District 6 | 105.00 mills |

| District 7 | 105.00 mills |

It's important to note that these rates are subject to change annually, and property owners should refer to the official Baltimore County government website for the most up-to-date information.

Property Tax Exemptions and Relief Programs

In addition to the homestead exemption, Baltimore County offers various other property tax exemptions and relief programs to support specific groups of residents and businesses. These initiatives aim to foster economic growth, encourage homeownership, and provide assistance to those in need.

Senior Citizen Tax Credit

The Senior Citizen Tax Credit program provides a credit against property taxes for eligible senior citizens. To qualify, individuals must be at least 65 years old, own and occupy their property as their primary residence, and meet certain income and asset limits. The credit can significantly reduce the tax burden for seniors, allowing them to remain in their homes longer.

Veterans' Property Tax Exemption

Baltimore County extends a property tax exemption to honorably discharged veterans who meet specific criteria. This exemption can be claimed for both residential and commercial properties owned by qualifying veterans. The exemption amount varies based on the veteran's disability status and the property's assessed value.

Farmland Preservation Program

The Baltimore County Farmland Preservation Program aims to preserve agricultural land by offering a land-in-trust agreement to landowners. In exchange for placing their land under the program's protection, landowners receive a substantial property tax credit, ensuring the long-term viability of farming in the county.

Impact of Property Taxes on the Baltimore County Community

Property taxes are a vital source of revenue for Baltimore County, funding essential services and infrastructure projects that benefit the entire community. Here are some key ways in which property taxes impact the local community:

Public Education

A significant portion of property tax revenue is allocated to the Baltimore County Public School System, supporting the education of thousands of students. These funds contribute to teacher salaries, school maintenance, educational resources, and various programs aimed at enhancing student learning and development.

Public Safety and Emergency Services

Property taxes also fund critical public safety initiatives, including the Baltimore County Police Department, Fire Department, and Emergency Medical Services. These services ensure the safety and well-being of residents, providing swift responses to emergencies and maintaining a secure environment.

Infrastructure Development

Property taxes play a crucial role in infrastructure development within Baltimore County. They finance road improvements, bridge repairs, public transportation initiatives, and the maintenance of public spaces, ensuring a well-connected and thriving community.

Economic Growth and Development

The stability and predictability of property taxes attract businesses and investors to Baltimore County. A robust tax base supports economic growth, leading to job creation, increased tax revenue, and a thriving local economy. Additionally, the tax revenue generated from commercial properties helps fund public services, creating a positive feedback loop.

Frequently Asked Questions

How often are property assessments conducted in Baltimore County?

+Property assessments in Baltimore County are conducted every three years, with the next assessment cycle scheduled for 2024.

<div class="faq-item">

<div class="faq-question">

<h3>Can I appeal my property assessment if I disagree with the value assigned to my property?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Baltimore County provides a fair and transparent appeal process. You can appeal your assessment by filing a written request with the Maryland State Department of Assessments and Taxation or the Baltimore County Board of Appeals.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the deadline for paying property taxes in Baltimore County?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property taxes in Baltimore County are due in two installments. The first installment is due by July 31st, and the second installment is due by November 15th. Failure to pay on time may result in penalties and interest.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any online resources available to help me understand my property tax bill and assessment?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! The Baltimore County government website offers a comprehensive <a href="https://baltimorecountymd.gov/government/departments/finance/property-tax/pages/property-tax-rates.aspx">Property Tax Information Center</a> with detailed explanations, calculators, and guides to assist property owners in understanding their tax obligations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I receive my property tax bill electronically instead of through traditional mail?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Baltimore County offers an <strong>e-billing service</strong> for property taxes. By signing up for this service, you can receive your tax bill electronically, making it more convenient and environmentally friendly. Visit the <a href="https://baltimorecountymd.gov/government/departments/finance/property-tax/pages/ebilling.aspx">e-Billing webpage</a> for more information and to enroll.</p>

</div>

</div>