Pre Tax Or Roth 401K

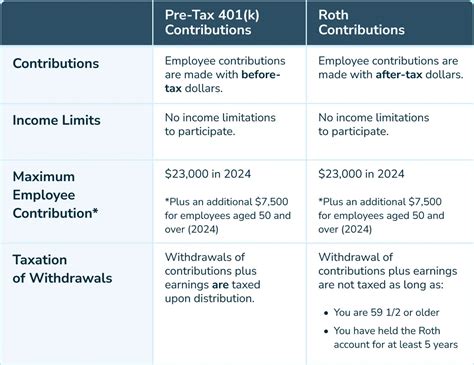

When it comes to planning for retirement, one of the most important decisions you'll make is choosing the right type of retirement account. Two popular options are the pre-tax, or traditional, 401(k) and the Roth 401(k). Both have their advantages and considerations, and understanding the differences is crucial for maximizing your retirement savings.

Unraveling the Benefits of Pre-Tax and Roth 401(k) Contributions

The decision between a pre-tax and Roth 401(k) hinges on your financial situation, tax bracket, and long-term retirement goals. Each option offers unique benefits and considerations that can significantly impact your retirement savings and overall financial strategy.

Pre-Tax (Traditional) 401(k): Lowering Your Taxable Income

A pre-tax, or traditional, 401(k) allows you to contribute a portion of your pre-tax income directly into your retirement account. This means that the money you contribute is deducted from your taxable income, effectively lowering your tax liability in the year you make the contribution. The primary advantage here is the immediate tax savings, especially beneficial if you’re in a higher tax bracket.

For instance, if you earn 80,000 annually and contribute 6,000 to your pre-tax 401(k), your taxable income drops to $74,000. This reduction in taxable income can result in significant tax savings, especially when considering federal and state income taxes.

Additionally, the earnings on your pre-tax contributions grow tax-deferred, meaning you won’t pay taxes on these gains until you withdraw the funds during retirement. This tax-deferred growth can lead to substantial savings over time, especially if you have a long-term investment horizon.

| Pre-Tax 401(k) Benefits | Considerations |

|---|---|

| Immediate tax savings on contributions | Taxes due upon withdrawal in retirement |

| Tax-deferred growth on earnings | Potential higher tax bracket in retirement |

| Suitability for high-income earners | May require more complex tax planning |

Roth 401(k): Investing with After-Tax Dollars

In contrast, a Roth 401(k) operates on the principle of investing with after-tax dollars. This means that the contributions you make are with money that has already been taxed. While this might seem less appealing initially, the advantage lies in the tax-free growth and withdrawal opportunities during retirement.

Consider a scenario where you earn 60,000 annually and contribute 5,000 to your Roth 401(k). Although you don’t receive an immediate tax benefit on your contribution, the earnings on this contribution grow tax-free. This means that when you withdraw funds during retirement, you won’t owe any taxes on the original contributions or the earnings, regardless of your retirement income.

This feature makes the Roth 401(k) particularly attractive for those who anticipate being in a higher tax bracket during retirement or for those who wish to leave a tax-free inheritance to their beneficiaries.

| Roth 401(k) Benefits | Considerations |

|---|---|

| Tax-free growth and withdrawal in retirement | No immediate tax savings on contributions |

| Potential for higher returns due to tax-free growth | Suitability for those expecting lower income in retirement |

| Flexibility for various financial goals | May not be ideal for high-income earners |

Weighing the Options: Pre-Tax vs. Roth 401(k)

The choice between a pre-tax and Roth 401(k) is highly personal and depends on various factors. Here are some key considerations to help you make an informed decision:

- Current Tax Bracket vs. Expected Retirement Tax Bracket: If you’re in a higher tax bracket now and expect to be in a lower bracket during retirement, a pre-tax 401(k) might be advantageous. Conversely, if you anticipate a higher tax bracket in retirement, a Roth 401(k) could be more beneficial.

- Investment Horizon: The longer your investment horizon, the more time your contributions have to grow, making both options appealing. However, the tax-free growth of a Roth 401(k) can be especially advantageous over the long term.

- Financial Goals and Inheritance Planning: If you’re looking to leave a tax-free inheritance or have specific financial goals beyond retirement, a Roth 401(k) can offer more flexibility.

Maximizing Your Retirement Savings: A Comprehensive Strategy

Choosing between a pre-tax and Roth 401(k) is just one aspect of your retirement planning strategy. Here are some additional tips to help you maximize your retirement savings:

- Start Early: The power of compound interest works best when you start saving early. Even small contributions made regularly can grow significantly over time.

- Take Advantage of Employer Matches: If your employer offers a 401(k) match, make sure you’re contributing enough to maximize this benefit. It’s essentially free money that can boost your retirement savings.

- Diversify Your Investments: Consider a mix of stocks, bonds, and other investment options within your 401(k) to mitigate risk and maximize returns.

- Regularly Review and Rebalance: As your financial situation and market conditions change, review your 401(k) portfolio and make adjustments to maintain your desired asset allocation.

- Explore Other Retirement Accounts: Depending on your financial situation, you might also consider IRAs or other retirement savings options to complement your 401(k) strategy.

Conclusion: Navigating Your Retirement Journey

The decision between a pre-tax and Roth 401(k) is a crucial step in your retirement planning journey. By understanding the benefits and considerations of each option, you can make an informed choice that aligns with your financial goals and circumstances. Remember, a well-rounded retirement strategy often involves a mix of savings accounts and a long-term investment horizon.

As you navigate the complexities of retirement planning, consider seeking professional advice to tailor a strategy that suits your unique needs. With careful planning and consistent contributions, you can look forward to a secure and comfortable retirement.

What is the maximum contribution limit for a pre-tax 401(k)?

+

The maximum contribution limit for a pre-tax 401(k) is set by the IRS and may change annually. For the 2023 tax year, the limit is 22,500. If you're aged 50 or older, you can make catch-up contributions of an additional 6,500, bringing the total to 29,000.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any income limits for contributing to a Roth 401(k)?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, there are income limits for contributing to a Roth 401(k). For the 2023 tax year, if you're single and your modified adjusted gross income (MAGI) is above 144,000, you can’t contribute to a Roth 401(k). If you’re married and filing jointly, the limit is $214,000. These limits are set by the IRS and may change annually.

Can I have both a pre-tax and Roth 401(k) at the same time?

+

Yes, many employers offer the option to contribute to both a pre-tax and Roth 401(k) simultaneously. This allows you to take advantage of the benefits of both types of accounts and provides greater flexibility in managing your tax liability.