Philly Sales Tax

Welcome to the comprehensive guide on the Philadelphia Sales Tax, a crucial aspect of the city's fiscal landscape. Understanding sales tax is essential for businesses and consumers alike, as it directly impacts transactions and revenue generation. In this article, we delve into the intricacies of Philadelphia's sales tax system, exploring its rates, applicability, and implications for the local economy.

The Philadelphia Sales Tax Landscape

Philadelphia, the vibrant city of brotherly love, boasts a unique sales tax structure that sets it apart from many other municipalities. The city’s sales tax system is a critical component of its revenue generation strategy, contributing significantly to the overall economic development and funding of essential public services.

The Philadelphia Sales Tax is an additional tax levied on the purchase of goods and services within the city limits. This tax is applied on top of the standard Pennsylvania state sales tax, creating a composite tax rate that consumers encounter during their shopping experiences. The city's tax system is designed to ensure a fair and efficient revenue collection process, supporting the diverse needs of its residents and businesses.

Sales Tax Rates in Philadelphia

Philadelphia’s sales tax rates are subject to periodic adjustments to meet the evolving fiscal requirements of the city. As of our last update, the city’s sales tax rate stands at 8%. This rate is inclusive of both the state and local sales taxes, making Philadelphia’s tax rate among the higher end of the spectrum when compared to other major cities in the United States.

However, it's important to note that sales tax rates can vary based on the type of product or service being purchased. Certain categories, such as groceries and prescription drugs, often enjoy reduced tax rates or exemptions. These variations are designed to provide relief to essential consumer goods and encourage spending on vital items.

| Tax Rate Type | Rate |

|---|---|

| Philadelphia Sales Tax | 8% |

| Pennsylvania State Sales Tax | 6% |

| Composite Tax Rate | 14% |

Applicability and Exemptions

The Philadelphia Sales Tax applies to a wide range of goods and services, covering most transactions that occur within the city’s boundaries. From retail purchases to restaurant meals and entertainment services, the tax is a consistent presence in the daily lives of Philadelphia residents and visitors.

However, certain items are exempt from sales tax to promote specific economic and social objectives. These exemptions often extend to necessities like groceries, medications, and select services. By exempting these essential items, the city aims to reduce the tax burden on low-income households and encourage accessibility to basic needs.

Additionally, there are provisions for tax-exempt purchases by specific entities, such as government agencies, charitable organizations, and educational institutions. These exemptions are designed to support the critical operations of these entities without undue financial strain.

Impact on Businesses and Consumers

Philadelphia’s sales tax system has a profound impact on both businesses and consumers within the city. For businesses, the tax is a significant consideration in their pricing strategies and overall profitability. The higher tax rate can influence consumer behavior, prompting businesses to adjust their marketing and sales approaches to remain competitive.

From a consumer perspective, the sales tax directly affects purchasing power and budget allocation. The tax adds an additional cost to every transaction, impacting the affordability of goods and services. Consumers often factor in the tax when making purchasing decisions, seeking out deals and discounts to mitigate the tax's impact on their wallets.

Furthermore, the sales tax system plays a pivotal role in shaping consumer behavior and preferences. Higher tax rates can incentivize consumers to explore tax-free alternatives, such as online shopping or traveling to nearby tax-free jurisdictions, impacting local businesses and the overall economy.

Analyzing the Performance and Future of Philadelphia’s Sales Tax

Philadelphia’s sales tax system has been a critical revenue stream for the city, generating substantial funds for essential public services and infrastructure development. However, the system’s performance and future prospects are subject to ongoing analysis and scrutiny.

Revenue Generation and Allocation

The Philadelphia Sales Tax is a major contributor to the city’s annual revenue, accounting for a significant portion of its fiscal resources. The tax revenue is utilized to fund a wide range of public services, including education, public safety, healthcare, and transportation infrastructure. This allocation ensures that the tax directly benefits the city’s residents and businesses.

The revenue generated from sales tax is often a key factor in the city's budget planning and financial stability. It provides a predictable and consistent income stream, enabling the city to invest in long-term projects and initiatives that enhance the quality of life for its citizens.

Performance Analysis and Future Implications

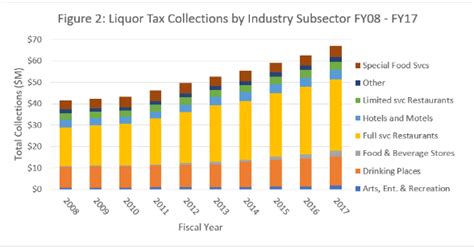

Analyzing the performance of Philadelphia’s sales tax system is essential for understanding its effectiveness and potential areas for improvement. The city conducts regular assessments to evaluate the tax’s impact on various sectors, including retail, hospitality, and entertainment.

Performance metrics such as tax collection rates, compliance levels, and consumer spending trends are closely monitored to gauge the tax's overall success. These insights help policymakers make informed decisions regarding tax rates, exemptions, and potential adjustments to optimize revenue generation without unduly burdening taxpayers.

The future of Philadelphia's sales tax system is closely tied to the city's economic growth and fiscal stability. As the city continues to evolve and adapt to changing economic landscapes, the sales tax may undergo revisions to remain competitive and responsive to the needs of its residents and businesses.

One potential future implication is the exploration of tax incentives and reforms to attract and retain businesses. By offering competitive tax rates and incentives, Philadelphia can enhance its appeal as a business hub, fostering economic growth and job creation. Additionally, the city may consider further streamlining tax processes and compliance requirements to reduce administrative burdens on businesses.

Furthermore, as consumer preferences and spending habits evolve, particularly with the rise of e-commerce, Philadelphia may need to adapt its sales tax system to address challenges such as online sales tax collection and ensuring a level playing field for local businesses.

Conclusion: Navigating Philadelphia’s Sales Tax Landscape

Philadelphia’s sales tax system is a complex yet vital component of the city’s fiscal framework. From its higher-than-average tax rates to its impact on businesses and consumers, understanding the nuances of this system is essential for navigating the city’s economic landscape.

As we've explored, the sales tax plays a crucial role in revenue generation, public service funding, and economic development. However, its performance and future prospects are subject to ongoing analysis and adaptation to meet the evolving needs of Philadelphia's residents and businesses.

For businesses, staying informed about sales tax rates, exemptions, and compliance requirements is crucial for effective financial planning and strategic decision-making. Consumers, too, benefit from understanding the tax's impact on their purchasing power and making informed choices when shopping in Philadelphia.

In conclusion, Philadelphia's sales tax system is a dynamic and evolving aspect of the city's economic fabric. By staying engaged and informed, businesses and consumers can actively contribute to the city's fiscal health and overall prosperity.

How often are Philadelphia’s sales tax rates reviewed and adjusted?

+

Philadelphia’s sales tax rates are subject to periodic reviews and adjustments based on the city’s fiscal needs and economic conditions. The timing of these reviews varies, but they typically occur every few years or when significant changes in the city’s financial landscape warrant a reassessment.

Are there any efforts to simplify the sales tax system in Philadelphia?

+

Yes, there have been ongoing discussions and initiatives aimed at simplifying Philadelphia’s sales tax system. The complexity of the current system, with its various rates and exemptions, can be a challenge for businesses and consumers alike. Simplification efforts focus on streamlining processes, reducing administrative burdens, and enhancing transparency to make the tax system more user-friendly.

How does Philadelphia’s sales tax compare to other major cities in the region?

+

Philadelphia’s sales tax rate of 8% is relatively higher compared to some neighboring cities in the region. For instance, New York City has a sales tax rate of 8.875%, while Baltimore’s rate is 6%. This disparity in tax rates can influence consumer behavior, with shoppers potentially seeking out lower-tax jurisdictions for certain purchases.