Philadelphia Wage Tax Refund

The Philadelphia Wage Tax is a significant consideration for individuals earning an income within the city limits. This tax, levied on wages, salaries, and other forms of compensation, can amount to a substantial portion of one's earnings. However, there is a silver lining for eligible taxpayers in the form of the Philadelphia Wage Tax Refund, which offers a potential reprieve from the full tax burden. In this comprehensive guide, we delve into the intricacies of the Wage Tax Refund, exploring its applicability, eligibility criteria, and the process of claiming it.

Understanding the Philadelphia Wage Tax Refund

The Philadelphia Wage Tax Refund is a refund mechanism designed to provide relief to taxpayers who have overpaid their Wage Tax obligations. This refund is not automatic and requires a deliberate application process. It is a critical component of the city’s tax system, ensuring that taxpayers are not subjected to undue financial strain.

The Wage Tax, which varies depending on the taxpayer's residential status, is imposed on individuals working within the city. Residents of Philadelphia are subject to a higher tax rate compared to non-residents. The tax is calculated based on the taxpayer's earnings and is typically withheld from their paychecks by their employers.

Eligibility and Qualifications

Not all taxpayers are eligible for the Wage Tax Refund. To qualify, individuals must meet specific criteria, which primarily revolve around their income level and tax liability. Here are the key eligibility factors:

- Income Thresholds: The Wage Tax Refund is geared towards taxpayers with lower to moderate incomes. The exact income thresholds vary annually and are determined by the City of Philadelphia. These thresholds ensure that the refund benefits those who need it most.

- Tax Liability: To be eligible, taxpayers must have overpaid their Wage Tax obligations. This overpayment can occur due to various reasons, including changes in employment status, multiple jobs, or incorrect withholding by employers.

- Residency Status: The eligibility criteria also take into account the taxpayer's residency status. Non-residents of Philadelphia may have different qualifications compared to residents.

It is essential to note that the eligibility requirements are subject to change each year, so taxpayers must stay informed about the latest guidelines.

Calculating the Wage Tax Refund

The amount of the Wage Tax Refund is determined by the degree of overpayment and the taxpayer’s specific circumstances. The City of Philadelphia provides guidelines and tools to assist taxpayers in calculating their potential refund. These calculations can be complex, often involving adjustments for deductions, credits, and other factors.

| Taxpayer Category | Potential Refund |

|---|---|

| Philadelphia Residents | Up to $150 per individual, with additional amounts for each dependent |

| Non-Residents | Up to $100 per individual |

These figures are subject to change and should be used as a general guide. Taxpayers are encouraged to refer to official sources for the most accurate and up-to-date information.

The Application Process

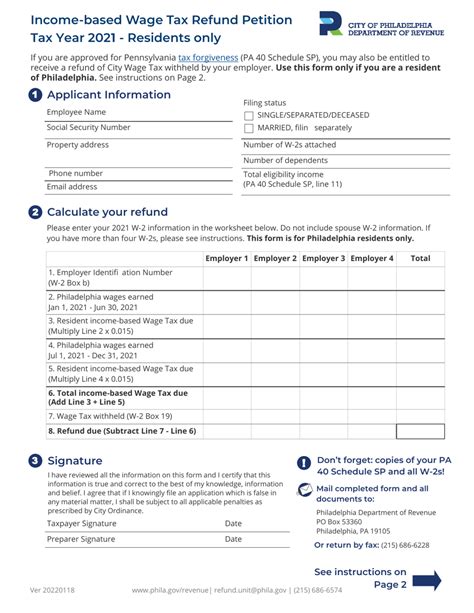

Claiming the Philadelphia Wage Tax Refund requires a well-defined process. Here’s a step-by-step guide to assist taxpayers in navigating this procedure:

- Gather Documentation: Before initiating the application, taxpayers should assemble the necessary documents. This includes W-2 forms, 1099 forms, and any other records related to their earnings and tax payments.

- Determine Eligibility: Review the eligibility criteria and income thresholds for the current tax year. Ensure that your income and tax liability meet the requirements.

- Calculate Refund: Utilize the provided calculators or guidelines to estimate your potential refund. This step is crucial to understand the financial benefit you may receive.

- Complete the Application: Access the official application form, either online or from the Philadelphia Department of Revenue. Fill out the form accurately, providing all required details.

- Submit Supporting Documents: Along with the application, attach supporting documents such as tax returns, proof of residency, and any other relevant paperwork.

- Review and Verify: Carefully review your application and ensure its accuracy. Errors or omissions can lead to delays or denials.

- Submit Application: Submit your application and supporting documents to the Philadelphia Department of Revenue by the designated deadline.

- Wait for Processing: The processing time can vary, so be patient. The Department of Revenue will review your application and, if approved, issue your refund.

- Follow Up: If you haven't received a response within a reasonable timeframe, consider contacting the Department of Revenue to inquire about the status of your application.

Important Considerations

- The application process may evolve over time, so taxpayers should stay informed about any changes or updates.

- It is advisable to consult with tax professionals or utilize online resources to ensure a smooth and accurate application process.

- Keep in mind that refunds are subject to availability of funds and may be prorated in some cases.

Maximizing Your Refund

To ensure you receive the maximum Wage Tax Refund possible, consider the following strategies:

- Review Withholdings: Regularly review your tax withholdings to ensure they align with your expected tax liability. Adjustments can be made throughout the year to avoid overpayment.

- Claim All Deductions and Credits: Take advantage of all applicable deductions and credits. These can reduce your taxable income and, consequently, your Wage Tax liability.

- Stay Informed: Keep abreast of any changes to tax laws and regulations. Stay updated on eligibility criteria, income thresholds, and any new developments that may impact your refund.

- Seek Professional Advice: Consult with tax professionals or utilize reputable online resources to maximize your refund. They can provide tailored advice based on your specific circumstances.

Future Implications

The Philadelphia Wage Tax Refund is an evolving aspect of the city’s tax system. As the city’s economy and population dynamics change, so too may the refund program. Here are some potential future implications:

- Income Threshold Adjustments: The income thresholds for eligibility may be revised to accommodate changes in the cost of living or economic conditions.

- Expanded Eligibility: The city may consider expanding the eligibility criteria to include a broader range of taxpayers, particularly those with unique circumstances or specific needs.

- Online Application Enhancements: With the increasing reliance on digital services, the application process could become more streamlined and user-friendly, potentially reducing processing times.

- Community Outreach: The city may intensify efforts to raise awareness about the Wage Tax Refund among eligible taxpayers, ensuring that those who qualify are informed and able to claim their refunds.

Conclusion

The Philadelphia Wage Tax Refund is a critical component of the city’s tax system, offering much-needed relief to eligible taxpayers. By understanding the eligibility criteria, calculating potential refunds, and following the application process diligently, taxpayers can maximize their benefits. Staying informed about tax laws and seeking professional advice can further enhance the refund process. As the city’s tax landscape evolves, the Wage Tax Refund program is likely to adapt, providing ongoing support to Philadelphia’s residents and workers.

When is the deadline for applying for the Philadelphia Wage Tax Refund?

+The deadline for applying for the Philadelphia Wage Tax Refund typically falls in early spring. However, it is crucial to check the official sources for the exact deadline each year, as it can vary slightly.

Can I apply for the Wage Tax Refund if I’m a non-resident of Philadelphia?

+Yes, non-residents of Philadelphia can also apply for the Wage Tax Refund, but the eligibility criteria and potential refund amounts may differ from residents.

What if I don’t receive my Wage Tax Refund within the expected timeframe?

+If you have not received your Wage Tax Refund within a reasonable period, it is advisable to contact the Philadelphia Department of Revenue to inquire about the status of your application. They can provide updates and assist with any issues.