Pennsylvania Estate Tax

Estate taxes are an important aspect of financial planning, especially for individuals and families with substantial assets and properties. In the state of Pennsylvania, the estate tax landscape is unique and often subject to various rules and regulations. Understanding the intricacies of Pennsylvania's estate tax system is crucial for effective estate planning and ensuring that your loved ones receive the maximum benefit from your assets.

In this comprehensive guide, we will delve into the world of Pennsylvania estate tax, exploring its history, current regulations, and the strategies that can help mitigate its impact on your legacy. By the end of this article, you'll have a thorough understanding of how Pennsylvania's estate tax works and the steps you can take to navigate this complex financial terrain.

A Historical Perspective on Pennsylvania Estate Tax

The history of estate tax in Pennsylvania is a fascinating journey through the state’s economic and social development. Pennsylvania was one of the first states in the nation to impose an estate tax, dating back to the early 20th century. The purpose of this tax was twofold: to generate revenue for the state and to redistribute wealth more equitably.

The Pennsylvania Transfer Inheritance Tax, often referred to as the Inheritance Tax, was introduced in 1919. This tax was levied on the transfer of property, including real estate, personal belongings, and financial assets, upon an individual's death. The tax rate varied depending on the relationship of the beneficiary to the deceased and the value of the estate.

Over the years, the estate tax landscape in Pennsylvania has undergone significant changes. The state witnessed a major reform in 2005 when the Pennsylvania Inheritance Tax and the Pennsylvania Intangible Recording Tax were repealed. This reform was a part of a broader strategy to encourage economic growth and simplify the tax system.

However, the repeal of these taxes did not completely eliminate estate tax responsibilities for Pennsylvanians. The state still imposes an estate tax, albeit with a higher exemption threshold, which we will explore in the following sections.

Pennsylvania Estate Tax: The Current Scenario

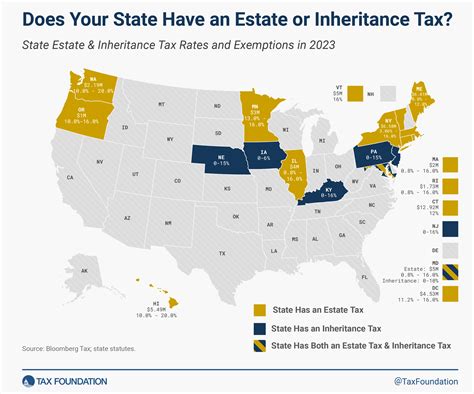

As of 2023, Pennsylvania has an estate tax that applies to estates valued above a certain threshold. The current estate tax exemption in Pennsylvania is 4,065,000, which is significantly higher than the federal estate tax exemption of 12,920,000 (for 2024). This means that estates with a value below $4,065,000 are not subject to Pennsylvania estate tax.

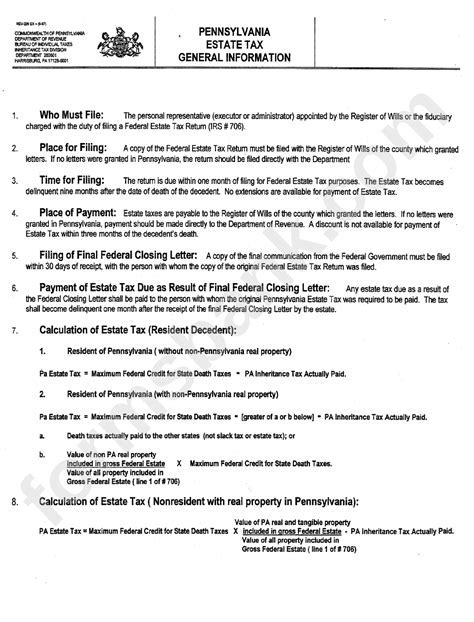

The Pennsylvania estate tax is a "pick-up" tax, which means that it complements the federal estate tax. In simple terms, if an estate is subject to federal estate tax, Pennsylvania will also impose its own estate tax, effectively "picking up" a portion of the federal tax liability. This pick-up tax is calculated as 15.6% of the amount of the federal credit allowed for state death taxes.

The estate tax is applied to the value of the entire estate, including real estate, personal property, cash, stocks, bonds, and other financial assets. It is important to note that the tax is not imposed on the heirs or beneficiaries; rather, it is a tax on the transfer of the estate itself.

Pennsylvania also imposes an inheritance tax, which is separate from the estate tax. The inheritance tax is a tax on the value of property received by beneficiaries, and the tax rate varies based on the beneficiary's relationship to the deceased. For example, spouses and charitable organizations are exempt from the inheritance tax, while other beneficiaries may face a tax rate of up to 15%.

Calculating Pennsylvania Estate Tax

Calculating the Pennsylvania estate tax can be a complex process, especially for larger estates. The tax is calculated based on the federal estate tax liability, taking into account the applicable credits and deductions. Here’s a simplified breakdown of the calculation process:

- Step 1: Determine the gross value of the estate, including all assets and properties.

- Step 2: Subtract applicable deductions, such as funeral expenses, administration costs, and charitable contributions.

- Step 3: Calculate the federal estate tax liability using the applicable tax rates and exemptions.

- Step 4: Determine the state pick-up tax by multiplying the federal credit for state death taxes by 15.6%.

- Step 5: Add the state pick-up tax to the federal estate tax liability to calculate the total Pennsylvania estate tax.

It's crucial to consult with a tax professional or an estate planning attorney to ensure an accurate calculation and to explore potential strategies for minimizing the estate tax liability.

Strategies for Minimizing Pennsylvania Estate Tax

While the Pennsylvania estate tax is a significant consideration for estate planning, there are strategies that can help reduce its impact on your legacy. Here are some effective strategies to consider:

Gifting During Lifetime

One of the most straightforward ways to reduce the value of your estate and, consequently, your estate tax liability is by making gifts during your lifetime. Pennsylvania, like many other states, allows individuals to make annual gifts of up to $16,000 (for 2023) to as many people as they choose without incurring gift tax. By strategically gifting assets to family members or charitable organizations, you can gradually reduce the value of your estate and potentially eliminate it from estate tax considerations.

Establishing Trusts

Trusts are powerful estate planning tools that can help manage and protect your assets while also minimizing tax liabilities. There are various types of trusts that can be utilized, including revocable living trusts, irrevocable trusts, and charitable trusts. Each type of trust serves a specific purpose and can be tailored to your unique financial situation and goals.

Utilizing Life Insurance

Life insurance is often an essential component of estate planning, as it can provide a substantial sum to your beneficiaries upon your death. By purchasing a life insurance policy and naming a trust or beneficiary other than your estate, you can ensure that the death benefit is not subject to estate tax. Additionally, life insurance can provide liquidity to your estate, helping to cover any tax liabilities and other expenses.

Charitable Giving

Making charitable contributions can not only support causes that are close to your heart but also provide tax benefits. Donations to qualified charitable organizations are typically deductible from your taxable estate. Moreover, establishing a charitable remainder trust or a charitable lead trust can offer tax advantages while allowing you to support your favorite charities.

Asset Ownership

The way you own your assets can have a significant impact on your estate tax liability. For instance, holding assets jointly with your spouse can reduce the value of your estate, as assets owned jointly pass to the surviving spouse without incurring estate tax. Additionally, owning assets in the name of a trust or a business entity can provide certain tax advantages and asset protection.

Pennsylvania Estate Tax: Future Implications

The future of estate tax in Pennsylvania is subject to ongoing legislative changes and economic shifts. While the state currently has a relatively high exemption threshold, there is no guarantee that this will remain the same in the future. Estate planning is a dynamic process, and staying informed about potential changes is crucial for effective planning.

One notable trend is the increasing focus on state-level estate taxes across the nation. As federal estate tax exemptions rise, more states are considering or implementing their own estate taxes to generate revenue and address budget concerns. Pennsylvania, with its robust economy and diverse population, is likely to continue its estate tax program, potentially with adjustments to exemption thresholds or tax rates.

Additionally, the ongoing debate surrounding estate tax fairness and its impact on wealth inequality is likely to influence future estate tax policies. Advocates for estate tax reform argue that it is a necessary tool for addressing income inequality and promoting economic mobility. On the other hand, critics argue that estate taxes hinder economic growth and interfere with the free market.

For Pennsylvanians, staying abreast of these discussions and legislative changes is essential. Regularly reviewing and updating your estate plan, in consultation with legal and financial professionals, is the best way to ensure that your legacy is protected and your assets are transferred according to your wishes.

Frequently Asked Questions (FAQ)

How often are Pennsylvania estate tax laws reviewed and updated?

+Pennsylvania estate tax laws are typically reviewed and updated on an annual basis to align with federal tax changes and address budgetary needs. However, significant reforms may occur less frequently, such as the 2005 repeal of certain taxes.

Are there any exceptions to the Pennsylvania estate tax exemption?

+Yes, there are certain exceptions to the estate tax exemption. For example, if an estate includes assets that were previously transferred from another state that had a lower exemption threshold, those assets may be subject to Pennsylvania estate tax.

Can I reduce my Pennsylvania estate tax liability through charitable giving?

+Absolutely! Charitable giving is an effective strategy for reducing your estate tax liability. Donations to qualified charitable organizations are deductible from your taxable estate, and you can further maximize this benefit by establishing a charitable remainder trust.

What is the difference between the Pennsylvania estate tax and inheritance tax?

+The Pennsylvania estate tax is a tax on the transfer of the entire estate, while the inheritance tax is levied on the value of property received by individual beneficiaries. The estate tax is calculated based on the total value of the estate, whereas the inheritance tax rates vary depending on the beneficiary’s relationship to the deceased.

Are there any tax benefits for leaving assets to a spouse or a charitable organization in Pennsylvania?

+Yes, leaving assets to a spouse or a charitable organization can offer significant tax benefits. Spouses are exempt from the Pennsylvania inheritance tax, and charitable organizations are exempt from both the estate and inheritance taxes. This makes these options attractive for estate planning.