Pay Personal Property Tax Online

Personal property tax is an essential aspect of the taxation system, and understanding how to pay it online is a valuable skill for property owners. This guide will delve into the process, shedding light on the steps, benefits, and considerations associated with paying personal property taxes digitally.

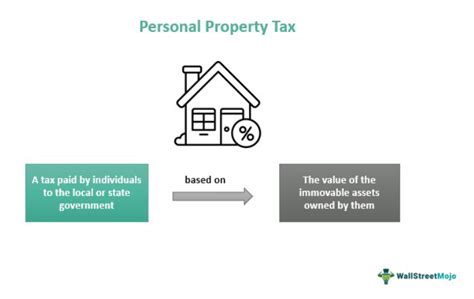

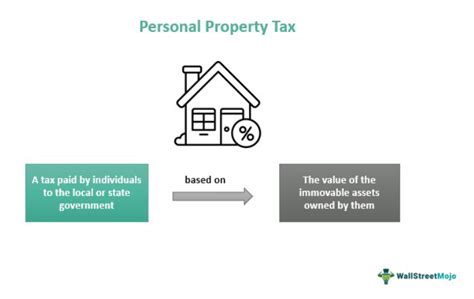

Understanding Personal Property Tax

Personal property tax, also known as ad valorem tax, is a levy imposed on the value of certain types of personal property owned by individuals or entities. This tax is distinct from real estate taxes, which are assessed on real property, such as land and buildings.

Personal property includes a wide range of assets, such as vehicles, boats, aircraft, business equipment, and sometimes even certain types of intangible assets. The specific items subject to personal property tax vary depending on the jurisdiction and local laws.

Tax rates for personal property can differ based on the type of property, its location, and the assessed value. The assessed value is typically determined by the local tax assessor's office, which evaluates the property's worth using various methods, including fair market value, replacement cost, or a predetermined percentage of the property's value.

The revenue generated from personal property taxes is often used to fund essential public services, including education, infrastructure maintenance, and local government operations. As such, paying personal property taxes is not only a legal obligation but also a contribution to the community's well-being.

The Benefits of Paying Personal Property Tax Online

In recent years, many tax authorities have embraced digital transformation, offering online platforms for taxpayers to fulfill their obligations. Paying personal property tax online provides several advantages, including:

- Convenience and Accessibility: Online payment platforms can be accessed from anywhere, at any time, providing flexibility for busy individuals and businesses. This eliminates the need for physical visits to tax offices during specific hours, reducing time and travel costs.

- Security and Data Protection: Reputable online payment systems employ robust security measures to protect taxpayers' sensitive information. Encryption protocols and secure payment gateways ensure that personal and financial details remain confidential.

- Real-Time Updates: Digital payment systems often provide immediate confirmation of payment, allowing taxpayers to track their transactions in real time. This instant feedback helps avoid potential issues and provides peace of mind.

- Paperless Process: Online payment eliminates the need for physical paperwork, reducing the risk of lost or misplaced documents. This not only streamlines the process but also contributes to environmental sustainability by minimizing paper waste.

- Payment Options: Online platforms typically offer a variety of payment methods, including credit and debit cards, e-wallets, and direct bank transfers. This flexibility accommodates different preferences and financial situations, making the payment process more inclusive.

Step-by-Step Guide: Paying Personal Property Tax Online

The process of paying personal property tax online may vary slightly depending on the jurisdiction and the specific online platform used. However, the general steps are outlined below:

Step 1: Gather Necessary Information

Before initiating the online payment process, ensure you have the following information at hand:

- Your personal or business identification number (usually a tax ID or account number)

- The assessed value of your personal property for the current tax year

- The tax rate applicable to your property type and location

- Your preferred payment method and relevant details (e.g., credit card number, bank account information)

Step 2: Access the Online Payment Portal

Visit the official website of your local tax authority or the designated online payment platform. Ensure you are using a secure connection and a trusted device to prevent potential security breaches.

Step 3: Register or Log In

If you are a first-time user, you will need to register an account. This typically involves providing basic personal or business details, creating a secure password, and accepting the terms and conditions of the platform. For returning users, simply log in using your credentials.

Step 4: Navigate to the Personal Property Tax Section

Once logged in, locate the section dedicated to personal property tax payments. This may be labeled as "Property Taxes," "Tax Payments," or a similar term. Click on the appropriate link to access the payment portal.

Step 5: Input Property and Payment Details

Follow the prompts to enter the necessary information, including your identification number, the assessed value of your property, and the amount you owe. Select your preferred payment method and provide the required details, such as card information or bank account details.

Step 6: Review and Confirm Payment

Carefully review all the information you have entered to ensure accuracy. Double-check the payment amount, property details, and payment method. Once you are satisfied, click the "Confirm" or "Submit" button to finalize the transaction.

Step 7: Receive Confirmation and Recordkeeping

After submitting your payment, you should receive an immediate confirmation message or email. This confirmation will typically include a transaction reference number and a detailed receipt. Save this information for your records and future reference.

Considerations and Best Practices

While paying personal property tax online offers numerous advantages, it is essential to consider the following:

- Security: Always use secure and trusted devices and networks when accessing online payment platforms. Avoid public Wi-Fi networks, as they may expose your data to potential risks.

- Recordkeeping: Maintain a digital or physical record of your payment receipts and confirmations. These records can be valuable for future reference, especially during tax audits or if you need to dispute any issues.

- Payment Due Dates: Be mindful of the payment deadlines set by your local tax authority. Late payments may incur penalties and interest charges, which can add unnecessary financial burden.

- Online Payment Limits: Some jurisdictions may have limitations on the maximum amount that can be paid online. If you owe a substantial sum, you may need to make multiple payments or consider alternative payment methods.

- Communication: Stay informed about any changes or updates to the online payment system by subscribing to notifications or checking the tax authority's website regularly. This ensures you are aware of any modifications to the process or new features.

Frequently Asked Questions

Can I pay my personal property tax online if I owe a substantial amount?

+Yes, most online payment platforms allow for larger payments. However, it's advisable to check the maximum limit allowed per transaction. If you owe a substantial amount, you may need to make multiple payments or explore alternative payment methods.

Are there any fees associated with online personal property tax payments?

+Some online payment platforms may charge a small convenience fee for using their service. These fees vary depending on the platform and payment method. It's recommended to review the fee structure before initiating the payment process.

Can I pay personal property tax online if I have multiple properties under my name?

+Yes, online payment platforms often allow you to manage multiple properties and make payments for each. You will need to enter the details for each property separately and ensure you have the necessary information for all of them.

What happens if I encounter technical issues while paying personal property tax online?

+If you experience technical difficulties, contact the customer support team of the online payment platform or the tax authority directly. They can provide guidance and assistance to resolve any issues you may encounter during the payment process.

Is it safe to provide my credit card information on online personal property tax payment platforms?

+Reputable online payment platforms employ robust security measures to protect your sensitive information. However, it's essential to verify the platform's security protocols and only provide your credit card details on secure and trusted websites. Look for indicators like "https" in the URL and a padlock icon in the browser's address bar.

Paying personal property tax online is a convenient and secure method that offers numerous benefits. By following the outlined steps and considering the provided tips, taxpayers can navigate the digital payment process with ease and contribute to their community’s development efficiently.