Pay Nys State Taxes Online

Paying Your NYS State Taxes: A Comprehensive Guide to Online Payment

Navigating the process of paying your New York State taxes can be a straightforward and efficient task when done online. This comprehensive guide will walk you through the steps, ensuring a smooth and secure experience. Whether you're a resident, business owner, or tax professional, understanding the online payment system is crucial for timely and accurate tax settlement.

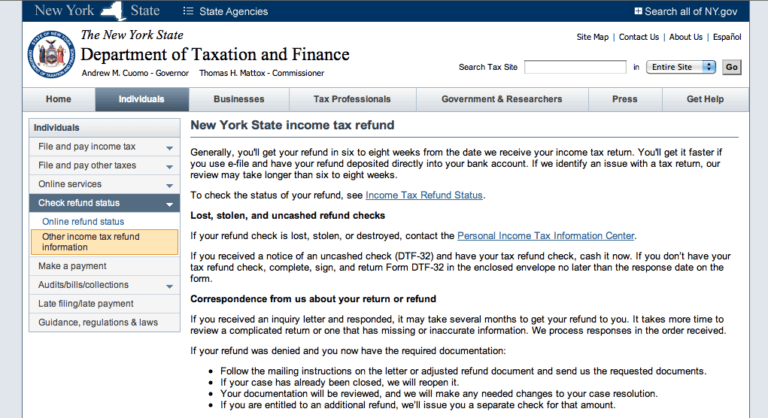

The New York State Department of Taxation and Finance has implemented a user-friendly platform to facilitate online tax payments. This guide will delve into the specifics, providing you with the necessary knowledge to utilize this system effectively.

The Online Payment Portal: A Secure and Efficient Solution

The NYS tax payment portal offers a convenient and secure method to remit your state taxes. Designed with user experience in mind, the portal ensures a seamless journey from registration to payment confirmation. Let's explore the key features and benefits:

-

Secure Payment Options: The portal supports a range of payment methods, including credit cards, debit cards, and electronic funds transfer (EFT). This flexibility caters to diverse preferences and ensures a secure transaction environment.

-

User-Friendly Interface: The platform is designed with simplicity, allowing taxpayers to navigate easily. Clear instructions and intuitive forms guide users through the process, minimizing the risk of errors.

-

Real-Time Payment Tracking: One of the key advantages is the ability to track your payment status in real-time. This feature provides instant feedback, ensuring transparency and peace of mind.

-

Automatic Record-Keeping: The system generates detailed payment receipts, which can be downloaded and stored for future reference. This automated record-keeping simplifies tax filing and audit processes.

Step-by-Step Guide to Online Tax Payment

-

Access the NYS Tax Payment Portal: Begin by visiting the official New York State Department of Taxation and Finance website. Navigate to the "Online Services" section and select the "Tax Payment" option.

-

Register or Log In: If you're a new user, register an account by providing basic information. Existing users can log in with their credentials. This step ensures a personalized and secure experience.

-

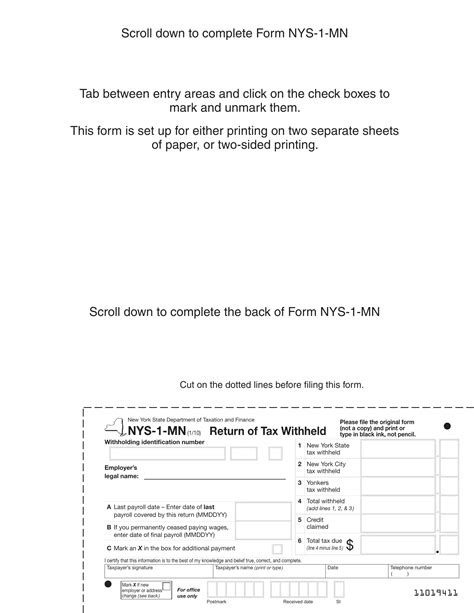

Select Your Tax Type: Choose the type of tax you wish to pay, such as income tax, sales tax, or corporate tax. The portal will guide you through the specific requirements for each tax category.

-

Enter Tax Details: Provide the necessary tax information, including the tax period, filing status, and amount due. Ensure accuracy to avoid delays or penalties.

-

Choose Payment Method: Select your preferred payment option from the available choices. Credit/debit card payments may incur convenience fees, while EFT is typically free of additional charges.

-

Review and Confirm: Carefully review the payment details, including the amount, payment method, and associated fees (if applicable). Once satisfied, confirm the payment.

-

Receive Payment Confirmation: After successful payment, you will receive an instant confirmation on the screen. Additionally, an email confirmation will be sent to your registered email address.

-

Download Payment Receipt: Access and download the detailed payment receipt, which includes all relevant transaction information. This receipt serves as a legal record of your tax payment.

Benefits of Online Tax Payment for NYS Taxpayers

Adopting online tax payment offers a range of advantages to New York State taxpayers. Here's a closer look at some of the key benefits:

-

Convenience and Flexibility: Online payment eliminates the need for in-person visits to tax offices or mailing checks. You can access the portal 24/7, allowing you to manage your taxes at your convenience.

-

Reduced Errors: The structured and guided nature of the online platform minimizes the risk of errors in tax calculations and payment details. This ensures compliance and reduces the likelihood of audits.

-

Real-Time Updates: With online payment, you receive instant feedback on your payment status. This transparency helps you stay on top of your tax obligations and facilitates better financial planning.

-

Secure Transactions: The NYS tax payment portal employs robust security measures to protect your financial information. Encryption protocols and secure servers ensure that your data remains confidential.

-

Efficient Record-Keeping: The automated record-keeping feature simplifies tax management. You can easily access and download payment receipts, making tax filing and audits more streamlined.

Tips for a Smooth Online Payment Experience

To ensure a seamless online tax payment process, consider the following tips:

-

Have all the necessary tax information ready before starting the process. This includes tax identification numbers, filing status, and the amount due.

-

If paying by credit/debit card, be aware of the associated convenience fees. Compare the fees with the convenience of using your preferred card.

-

Consider using EFT for larger payments or if you prefer a fee-free option. Ensure you have the necessary banking details ready.

-

Review the payment details carefully before confirming. Double-checking ensures accuracy and prevents potential errors.

-

Save the payment confirmation and download the receipt for future reference. These documents are essential for tax records and audits.

FAQs: Addressing Common Concerns

Can I pay my NYS taxes online if I don't have an account?

+Absolutely! You can pay your NYS taxes online as a guest without registering an account. However, registering provides additional benefits, such as access to your payment history and the ability to set up recurring payments.

Are there any penalties for late online tax payments?

+Yes, late payments may incur penalties and interest. It's important to make timely payments to avoid additional charges. The NYS tax portal provides due dates and reminders to help you stay on track.

Can I pay my NYS taxes in installments online?

+Yes, the NYS tax payment portal offers an installment payment option for certain tax types. You can set up a payment plan to pay your taxes in multiple installments. Contact the NYS Department of Taxation and Finance for eligibility and details.

Is my financial information secure during online tax payment?

+Yes, the NYS tax payment portal utilizes advanced security measures to protect your financial information. Encryption protocols and secure servers ensure that your data remains confidential and safe during the transaction.

Can I access my payment history online?

+Yes, registered users can access their payment history online. This feature allows you to review past payments, track payment status, and download payment receipts for record-keeping purposes.

Conclusion: Embracing Efficiency in Tax Management

Paying your New York State taxes online offers a modern, secure, and efficient approach to tax management. The NYS tax payment portal simplifies the process, providing a user-friendly platform for taxpayers to meet their obligations. By following the step-by-step guide and leveraging the benefits of online payment, you can navigate the tax landscape with ease and confidence.

Remember, staying informed and utilizing the available resources can make tax season less daunting. Embrace the convenience and security of online tax payment, and rest assured that your New York State tax obligations are handled with precision and efficiency.