Pay New York City Real Estate Taxes

Paying real estate taxes in New York City can be a complex process, especially for those unfamiliar with the city's unique tax system and property assessment procedures. The Big Apple, with its diverse neighborhoods and ever-evolving real estate market, presents a unique challenge for property owners and investors alike. In this comprehensive guide, we will navigate the intricacies of real estate taxes in NYC, offering expert insights and practical advice to ensure a seamless tax-paying experience.

Understanding the NYC Real Estate Tax Landscape

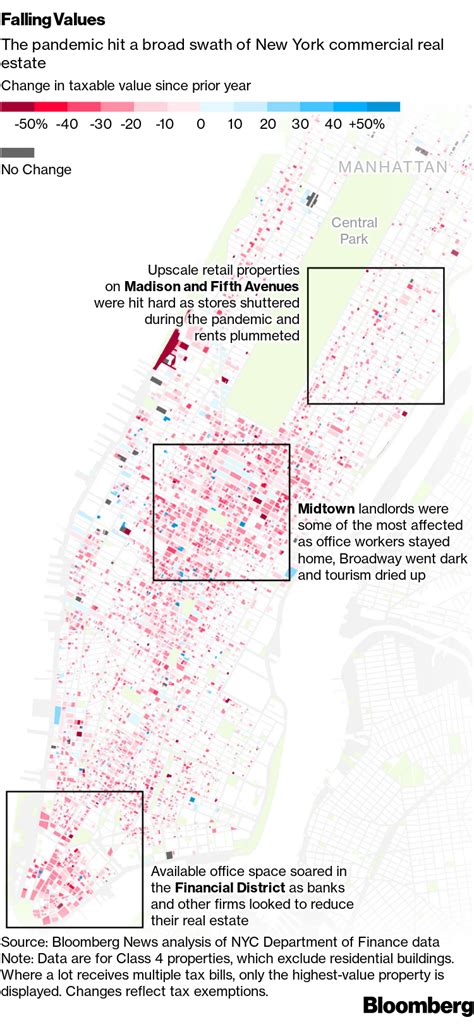

New York City’s real estate tax system is renowned for its complexity, influenced by factors such as property value, location, and the unique assessment process. The city’s real estate market, characterized by high demand and diverse property types, presents a unique set of challenges when it comes to tax obligations.

The tax rate in NYC is determined by the City Council and can vary depending on the property's location and usage. The current tax rate for residential properties is approximately $24.00 per $1,000 of assessed value, while commercial properties face a slightly higher rate of around $26.00 per $1,000. These rates are subject to change, so it's essential to stay updated with the latest information from the NYC Department of Finance.

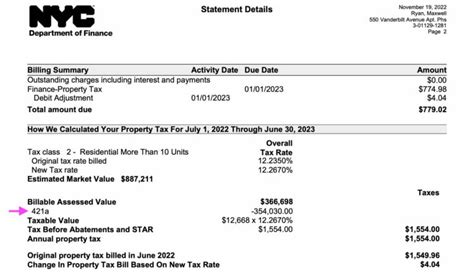

The property assessment process is a critical aspect of real estate taxes in NYC. The Department of Finance conducts regular assessments to determine the market value of each property. These assessments are based on various factors, including recent sales data, property improvements, and market trends. Property owners receive a Notice of Property Value (NOPV) annually, which outlines the assessed value and the corresponding tax liability.

The Impact of Property Value on Taxes

In NYC, property value plays a significant role in determining tax obligations. The higher the assessed value, the higher the tax liability. For instance, a residential property valued at 1 million would have a tax bill of approximately 24,000 per year, assuming the standard tax rate. This makes accurate property assessments crucial for both property owners and the city’s revenue collection.

| Property Value | Estimated Tax |

|---|---|

| $500,000 | $12,000 |

| $1,000,000 | $24,000 |

| $1,500,000 | $36,000 |

Tax Exemptions and Abatements

NYC recognizes the importance of encouraging affordable housing and supporting certain types of real estate development. As such, the city offers a range of tax exemptions and abatements to eligible property owners. These include:

- Senior Citizen Rent and Property Tax Exemption: Seniors aged 65 and older with limited income may be eligible for a partial or full exemption from rent and property taxes.

- Star Exemption Program: This program provides a significant tax break for residential and commercial property owners who occupy their properties. It offers a 17% reduction in assessed value, resulting in lower tax bills.

- Affordable Housing Incentives : The city offers tax abatement programs for developers who build or convert properties into affordable housing units. These incentives can provide substantial savings over the long term.

Navigating the Payment Process

Paying real estate taxes in NYC involves several steps, and it’s crucial to stay organized and adhere to deadlines to avoid penalties. Here’s a step-by-step guide to ensure a smooth payment process:

Step 1: Receive Your Tax Bill

Property owners in NYC receive a tax bill, officially known as a “Notice of Property Value and Taxes,” from the Department of Finance. This notice details the assessed value of the property, the applicable tax rate, and the total tax due. It’s essential to review this bill carefully and ensure that the information is accurate.

Step 2: Understand the Payment Schedule

NYC real estate taxes are typically due in two installments. The first installment is due in January, and the second installment is due in July. It’s crucial to mark these dates on your calendar to ensure timely payment.

Step 3: Choose Your Payment Method

The NYC Department of Finance offers various payment methods to accommodate different preferences and circumstances. These include:

- Online Payment: The most convenient and secure method, allowing property owners to pay their taxes through the Department of Finance's website using a credit card or electronic check.

- Mail-in Payment: Property owners can mail a check or money order along with the payment stub from their tax bill to the address provided on the bill.

- In-Person Payment: For those who prefer a more traditional approach, in-person payments can be made at designated Department of Finance offices or authorized payment centers.

- Automatic Payment Plan: This option allows property owners to set up automatic payments, ensuring timely payment without the need for manual reminders.

Step 4: Verify Payment and Receive Receipt

After making a payment, it’s crucial to verify that the payment has been processed successfully. The Department of Finance provides online tools to check payment status and download receipts. Property owners should retain these receipts for their records and to address any potential disputes.

Staying Informed and Managing Tax Obligations

Navigating the NYC real estate tax landscape requires staying informed about changes in tax rates, assessment procedures, and eligible exemptions. Here are some additional tips to ensure you stay on top of your tax obligations:

Stay Updated with Tax Rate Changes

Tax rates in NYC can fluctuate, influenced by various factors such as the city’s budget and economic conditions. It’s essential to stay updated with any changes in tax rates to accurately calculate your tax liability. The Department of Finance provides regular updates on its website, so make sure to check for any announcements.

Understand Assessment Appeals

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The assessment review process in NYC is detailed and involves specific deadlines. It’s crucial to understand the appeal process and gather the necessary documentation to support your case. Consider seeking professional advice from tax consultants or attorneys who specialize in real estate tax matters.

Explore Tax Deductions and Credits

In addition to exemptions and abatements, NYC offers various tax deductions and credits that can reduce your overall tax liability. These include deductions for mortgage interest, property taxes, and certain home improvements. It’s beneficial to consult a tax professional to explore all eligible deductions and maximize your tax savings.

Conclusion

Paying real estate taxes in New York City may be a complex process, but with the right knowledge and preparation, it can be efficiently managed. By understanding the unique tax landscape, staying informed about changes, and taking advantage of available exemptions and deductions, property owners can navigate the system with confidence. Remember, staying organized, adhering to deadlines, and seeking professional advice when needed are key to ensuring a smooth tax-paying experience in the Big Apple.

What happens if I miss a tax payment deadline in NYC?

+Missing a tax payment deadline in NYC can result in late fees and penalties. The city imposes a 5% late payment penalty for each month the payment is overdue. It’s crucial to stay organized and make payments on time to avoid these additional costs.

Can I pay my NYC real estate taxes in installments?

+Yes, NYC offers the option to pay real estate taxes in two installments. The first installment is due in January, and the second installment is due in July. This provides property owners with more flexibility in managing their cash flow.

How can I appeal my property’s assessed value in NYC?

+To appeal your property’s assessed value in NYC, you must file a formal grievance with the New York City Tax Commission. The process involves submitting documentation to support your claim and attending a hearing. It’s recommended to consult a tax professional for guidance.