Pay Ct State Taxes Online

Are you a Connecticut resident or business owner seeking a convenient way to fulfill your tax obligations? Look no further than the online platform provided by the Connecticut Department of Revenue Services (CT DRS). This user-friendly system allows taxpayers to manage their accounts, file returns, and make payments efficiently and securely. In this comprehensive guide, we will walk you through the process of paying your Connecticut state taxes online, offering step-by-step instructions and valuable insights to ensure a smooth and hassle-free experience.

The Benefits of Paying CT State Taxes Online

The online payment system offered by the CT DRS brings a multitude of advantages to taxpayers. Here’s why you should consider this digital approach:

- Convenience and Accessibility: You can access your account and make payments from the comfort of your home or office at any time, eliminating the need for physical visits to tax offices.

- Time Efficiency: Online payments save you time by automating the process, reducing the need for manual calculations and paperwork.

- Secure Transactions: The CT DRS employs robust security measures to protect your financial information, ensuring that your transactions are safe and confidential.

- Error Reduction: With online payment systems, the risk of errors is minimized, as the platform guides you through the process, reducing the likelihood of mistakes that could lead to penalties.

- Payment Flexibility: You have the option to pay your taxes in full or set up a payment plan, accommodating various financial situations.

Step-by-Step Guide to Paying CT State Taxes Online

Follow these simple steps to navigate the CT DRS online payment system successfully:

Step 1: Access the CT DRS Website

Begin by visiting the official website of the Connecticut Department of Revenue Services: https://www.ct.gov/drs. This is the secure portal where you’ll manage your tax obligations.

Step 2: Create an Account (if you don’t have one)

If you’re a new user, you’ll need to create an account. Click on the “Register” or “Create Account” button, typically found in the top-right corner of the homepage. Follow the on-screen instructions to provide your personal or business details, including your name, address, and tax identification number.

Step 3: Log In to Your Account

Once you’ve registered, log in to your account using your credentials. This will give you access to your personalized dashboard, where you can manage your tax payments and other related activities.

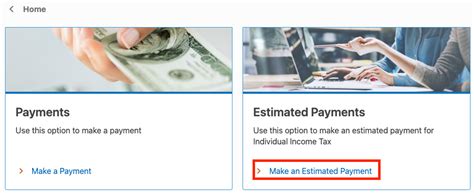

Step 4: Navigate to the Online Payment Section

On your dashboard, look for the “Online Payments” or “Make a Payment” section. This is where you’ll initiate the payment process.

Step 5: Select Your Tax Type

Choose the type of tax you wish to pay from the provided options. Common tax types include income tax, sales tax, property tax, and more. Select the relevant tax to proceed.

Step 6: Enter Payment Details

Provide the necessary payment information, such as the amount you owe, your billing address, and your preferred payment method. The CT DRS accepts various payment methods, including credit cards, debit cards, and electronic checks (eChecks). Ensure you have the required details handy, such as your card number and expiration date.

Step 7: Review and Confirm Your Payment

Carefully review the payment details you’ve entered, ensuring accuracy. Once you’re satisfied, confirm your payment. The CT DRS will provide you with a confirmation number and a receipt for your records.

Step 8: Receive Your Payment Confirmation

After successfully completing the payment process, you’ll receive a confirmation email or a downloadable receipt. Keep this confirmation for your records and for any future reference.

Frequently Asked Questions (FAQs)

Can I pay my CT state taxes online if I’m not a resident of Connecticut?

+Yes, the online payment system is accessible to non-residents as well. Whether you’re a business owner with operations in Connecticut or an individual with tax obligations in the state, you can utilize the online platform to manage your payments.

What payment methods are accepted for online CT state tax payments?

+The CT DRS accepts a range of payment methods, including major credit cards (Visa, MasterCard, American Express, and Discover), debit cards, and electronic checks (eChecks). Each payment method may have its own processing fees, so be sure to review the terms before proceeding.

How long does it take for my online payment to be processed and reflected on my account?

+Online payments are typically processed instantly. However, it may take some time for the payment to be reflected on your account, especially if you’re paying for a specific tax type or period. Allow for a reasonable processing time, and if you have concerns, contact the CT DRS for assistance.

Can I set up automatic payments for my CT state taxes online?

+Yes, the CT DRS offers an automatic payment option. You can set up recurring payments for specific tax types, ensuring that your payments are made on time without the need for manual intervention. This feature is particularly useful for businesses and individuals with regular tax obligations.

What happens if I encounter technical issues while paying my CT state taxes online?

+If you experience any technical difficulties during the online payment process, contact the CT DRS technical support team. They can assist with troubleshooting and guide you through any issues you may encounter. Their contact information is typically available on the website or through a help desk phone number.

Conclusion: A Streamlined Approach to Tax Payments

Paying your CT state taxes online is a convenient, secure, and efficient way to fulfill your tax obligations. By following the step-by-step guide provided, you can navigate the CT DRS online payment system with ease. Remember to keep your payment confirmations and receipts for future reference, and don’t hesitate to reach out to the CT DRS for assistance if needed. Stay on top of your tax payments, and let the online platform simplify your financial responsibilities.