Orange County California Sales Tax

Welcome to a comprehensive guide exploring the intricacies of sales tax in Orange County, California. In this article, we delve into the essential details, rates, and regulations that govern sales tax in this vibrant region, providing valuable insights for both businesses and consumers.

Understanding Sales Tax in Orange County

Sales tax is a vital component of the economic landscape in Orange County, impacting businesses and consumers alike. It is a consumption tax levied on the sale of goods and services, contributing significantly to the county’s revenue and funding various public services and infrastructure projects.

Orange County, known for its vibrant cities, stunning beaches, and thriving economy, operates within a complex tax system that requires careful understanding. The sales tax rate in Orange County consists of a combination of state, county, and city-specific taxes, making it crucial for businesses and consumers to stay informed about the applicable rates and regulations.

The State Sales Tax Rate

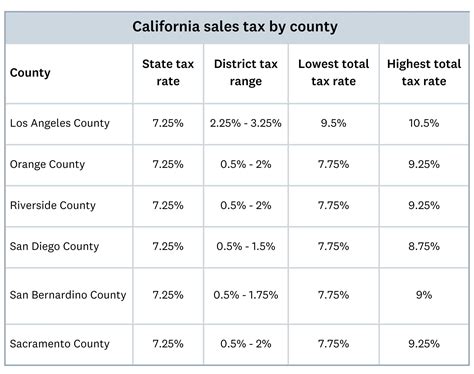

California, being the Golden State, imposes a uniform state sales tax rate across all counties. As of the latest updates, the state sales tax rate stands at 7.25%, which serves as the foundation for the total sales tax rate in Orange County.

County Add-On Taxes

In addition to the state sales tax, Orange County imposes its own county add-on tax, which is applied to most transactions within the county. This add-on tax is currently set at 1.00%, bringing the total sales tax rate in Orange County to 8.25%.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Add-On Tax | 1.00% |

| Total Sales Tax in Orange County | 8.25% |

City-Specific Sales Taxes

While the county-wide sales tax rate is a crucial component, it’s essential to note that individual cities within Orange County may have their own additional sales tax rates. These city-specific taxes are imposed to fund local projects and initiatives. Some notable cities with their respective sales tax rates include:

- Anaheim: With its world-famous theme parks and attractions, Anaheim imposes an additional sales tax of 0.50%, bringing the total sales tax rate to 8.75% within city limits.

- Newport Beach: This coastal gem, known for its luxurious lifestyle, applies an extra 0.75% sales tax, resulting in a total sales tax rate of 9.00% for residents and visitors.

- Santa Ana: As the county seat, Santa Ana has a vibrant downtown and diverse population. The city adds 0.50% to the county tax, making the total sales tax rate 8.75% for businesses and consumers.

Sales Tax Exemptions and Special Cases

While the standard sales tax rates apply to most goods and services, there are specific exemptions and special cases to consider. Understanding these exemptions is vital for both consumers and businesses to navigate the tax landscape effectively.

Exemptions for Certain Goods

California, and by extension, Orange County, offers exemptions for specific goods and services. These exemptions vary based on the nature of the item and its intended use. Some common exemptions include:

- Food and Groceries: Most unprepared food items and groceries are exempt from sales tax, providing a much-needed relief for households and businesses in the food industry.

- Prescription Drugs: Sales tax is not applicable to prescription medications, ensuring that healthcare remains accessible to all residents.

- Manufacturing Equipment: Businesses engaged in manufacturing often benefit from tax exemptions on the purchase of machinery and equipment, fostering economic growth.

Special Cases: Tourism and E-Commerce

Orange County, with its thriving tourism industry, has unique considerations for sales tax. When it comes to tourism-related transactions, such as hotel stays or rental car bookings, the sales tax rate may include additional tourism taxes, which can vary by city.

Additionally, with the rise of e-commerce, it's essential to understand the implications for online sales. Online retailers must comply with the sales tax regulations of the state and county where the customer resides, which can be complex given the diverse sales tax rates within Orange County.

Compliance and Filing Requirements

Ensuring compliance with sales tax regulations is a critical responsibility for businesses operating in Orange County. Here’s an overview of the key compliance and filing requirements:

Registering for a Seller’s Permit

Any business engaged in selling tangible goods or certain services must obtain a seller’s permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state and county.

Sales Tax Filing Frequency

The frequency of sales tax filings depends on the business’s sales volume. Most businesses file sales tax returns quarterly, but those with higher sales may be required to file monthly. It’s crucial to stay updated with the filing deadlines to avoid penalties.

Remitting Sales Tax

Businesses are responsible for calculating the sales tax on each transaction, ensuring accurate record-keeping, and remitting the collected tax to the appropriate tax authorities. The process involves a combination of manual calculations and the use of tax software for larger businesses.

The Impact of Sales Tax on Businesses and Consumers

Sales tax plays a significant role in shaping the economic landscape of Orange County, influencing both business strategies and consumer behavior.

Business Strategies

For businesses, understanding the sales tax landscape is crucial for pricing strategies and financial planning. The sales tax rate directly impacts the final cost of goods and services, influencing customer perception and purchasing decisions.

Additionally, businesses must consider the administrative burden of managing sales tax compliance. This includes implementing robust accounting systems, training staff, and staying updated with changing regulations to ensure accurate tax collection and remittance.

Consumer Behavior

Consumers, on the other hand, are directly impacted by sales tax rates when making purchases. The tax can significantly affect the overall cost of goods, especially for high-value items. This influence extends beyond the immediate transaction, as consumers may consider the sales tax rate when choosing where to shop or even where to live.

Future Outlook and Potential Changes

The sales tax landscape is dynamic, and Orange County, like many other regions, may experience changes in tax rates or regulations in the future. Here’s a glimpse into potential developments:

Proposed Tax Rate Increases

With the ever-evolving economic landscape, there is a possibility of proposed tax rate increases to fund specific initiatives or address budgetary concerns. These changes, if implemented, could impact the total sales tax rate in Orange County, requiring businesses and consumers to adapt to new rates.

Simplification of Tax Structure

Efforts to streamline and simplify the tax structure are ongoing. Simplification could involve consolidating or standardizing tax rates across cities, making it easier for businesses to comply with regulations and reducing the administrative burden.

Impact of Economic Shifts

Economic shifts, such as changes in consumer spending patterns or shifts in the local economy, can also influence the sales tax landscape. These shifts may prompt the county or state to reevaluate tax rates and exemptions to ensure they remain aligned with the needs of the community.

What happens if a business fails to collect or remit sales tax accurately?

+Businesses that fail to comply with sales tax regulations may face penalties, interest charges, and even legal consequences. It is crucial for businesses to understand their obligations and seek professional advice if needed.

Are there any online resources to help businesses navigate sales tax compliance in Orange County?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides comprehensive guides and resources specifically tailored for businesses operating in Orange County. These resources cover registration, filing, and compliance requirements.

How can consumers stay informed about sales tax rates when shopping online or in different cities within Orange County?

+Consumers can utilize online tools and resources provided by the CDTFA to calculate and understand the applicable sales tax rates for their specific location. Additionally, many e-commerce platforms display the sales tax rate during the checkout process.

Are there any upcoming changes to sales tax regulations in Orange County that businesses should be aware of?

+It is always advisable for businesses to stay updated with local news and official announcements from the county and state tax authorities. While specific changes cannot be predicted, staying informed ensures businesses are prepared for any regulatory updates.

In conclusion, understanding the sales tax landscape in Orange County is essential for both businesses and consumers. By staying informed about the applicable rates, exemptions, and compliance requirements, individuals and businesses can navigate the complex tax system with confidence. As the county continues to thrive and evolve, staying abreast of potential changes ensures a seamless and compliant experience for all stakeholders.