Okaloosa County Tax Collector Fl

The Okaloosa County Tax Collector's office plays a vital role in the administration and collection of various taxes and fees within Okaloosa County, Florida. This department is responsible for ensuring the efficient and timely collection of taxes, which are crucial for the functioning and development of the county. In this comprehensive article, we will delve into the operations, services, and significance of the Okaloosa County Tax Collector's office, providing an in-depth analysis of its functions and impact on the local community.

Introduction to the Okaloosa County Tax Collector’s Office

The Okaloosa County Tax Collector’s office is an essential government entity that serves as a key revenue collection agency for the county. Located in the heart of Florida’s Panhandle, Okaloosa County boasts a vibrant community and a thriving economy. The tax collector’s office, headed by an elected official, is responsible for a wide range of tax-related services, including property taxes, vehicle registration, driver’s license issuance, and various other fee collections.

The tax collector's office is committed to providing efficient and accessible services to the residents and businesses of Okaloosa County. By utilizing modern technology and adopting innovative practices, the department strives to streamline the tax payment process, ensuring a seamless experience for taxpayers.

Core Services and Responsibilities

Property Tax Collection

One of the primary responsibilities of the Okaloosa County Tax Collector’s office is the collection of property taxes. Property owners within the county are required to pay annual taxes based on the assessed value of their properties. The tax collector’s office sends out tax notices, accepts payments, and ensures that the revenue generated is distributed to the appropriate local government entities, including schools, fire departments, and other essential services.

To facilitate timely payments, the tax collector's office offers various payment options, such as online payment portals, walk-in payments at their offices, and even payment plans for eligible taxpayers. This ensures that property owners have the flexibility to manage their tax obligations effectively.

Vehicle Registration and Titling

The tax collector’s office also plays a crucial role in vehicle registration and titling. Residents of Okaloosa County must register their vehicles and obtain titles through this office. This process involves verifying ownership, assessing applicable fees, and issuing registration certificates and license plates. The office ensures that vehicles are properly registered and taxed, contributing to the overall revenue stream of the county.

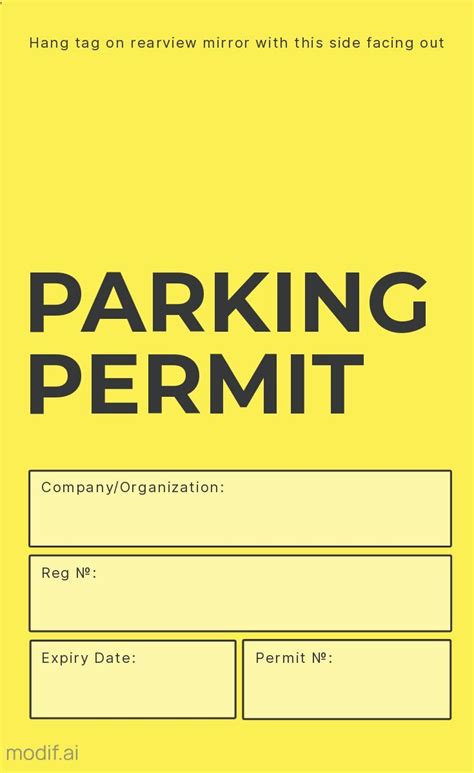

Additionally, the tax collector's office assists with title transfers, providing guidance and support to ensure a smooth transition of vehicle ownership. They also offer specialized services for disabled individuals, providing customized license plates and parking permits to enhance accessibility.

Driver’s License and Identification Services

The Okaloosa County Tax Collector’s office is authorized to issue driver’s licenses and state-issued identification cards. This service is essential for residents, as it provides them with the necessary documentation for driving privileges and personal identification. The office follows the guidelines set by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) to ensure accurate and secure issuance of these documents.

In addition to standard driver's licenses, the tax collector's office also offers specialized licenses, such as commercial driver's licenses (CDLs) and permits for motorcycle and moped operation. They provide testing and evaluation services to assess the driving skills and knowledge of applicants.

Other Fee Collections

Beyond property taxes, vehicle registration, and driver’s licenses, the Okaloosa County Tax Collector’s office handles a wide array of fee collections. These include business taxes, occupational licenses, hunting and fishing licenses, and various miscellaneous fees. The office ensures that these fees are collected accurately and promptly, contributing to the overall financial stability of the county.

| Service Category | Fee Type |

|---|---|

| Business Taxes | Occupational License Fees |

| Hunting & Fishing Licenses | Miscellaneous Fees (e.g., Boat Registration) |

Technology and Innovation

The Okaloosa County Tax Collector’s office embraces technology to enhance its operations and improve the taxpayer experience. They have implemented an online portal, allowing taxpayers to access their accounts, view tax records, and make payments conveniently from their homes or offices. This digital platform ensures efficiency and reduces the need for in-person visits.

Furthermore, the office utilizes advanced data management systems to streamline record-keeping and ensure accurate tax assessments. This technology enables them to provide timely and transparent information to taxpayers, fostering trust and confidence in the tax collection process.

Community Engagement and Outreach

The Okaloosa County Tax Collector’s office actively engages with the community to promote awareness and understanding of tax obligations. They organize outreach programs, attend community events, and provide educational resources to ensure that residents are well-informed about their tax responsibilities.

Additionally, the office offers assistance to senior citizens, veterans, and individuals with disabilities, ensuring that these vulnerable populations receive the support they need to navigate the tax system. This commitment to community engagement strengthens the relationship between the tax collector's office and the residents of Okaloosa County.

Performance Analysis and Impact

The Okaloosa County Tax Collector’s office has consistently demonstrated its efficiency and effectiveness in tax collection. Through its streamlined processes and adoption of modern technology, the office has achieved high collection rates, ensuring that the county receives the necessary revenue for its operations.

The impact of the tax collector's office extends beyond revenue generation. By providing accessible and efficient services, the office contributes to the overall economic health of the county. It supports local businesses, facilitates infrastructure development, and ensures that essential public services are adequately funded.

Economic Benefits

The tax collector’s office plays a crucial role in attracting and retaining businesses in Okaloosa County. By offering efficient registration and licensing services, the office simplifies the process for businesses to establish and operate within the county. This, in turn, stimulates economic growth and job creation, benefiting the entire community.

Infrastructure Development

The revenue collected by the tax collector’s office is directed towards crucial infrastructure projects, such as road improvements, bridge repairs, and the development of public facilities. These investments enhance the quality of life for residents and create a more attractive environment for businesses and visitors.

Community Services

A significant portion of the tax revenue is allocated to support community services, including education, healthcare, and public safety. The tax collector’s office ensures that these vital services receive the necessary funding to operate effectively, contributing to the overall well-being of the community.

Conclusion

The Okaloosa County Tax Collector’s office is a cornerstone of the county’s administrative and financial system. Through its commitment to efficient tax collection, innovative practices, and community engagement, the office ensures that Okaloosa County thrives. By understanding the vital role of the tax collector’s office, residents can appreciate the significance of their tax contributions and the impact it has on the overall development and prosperity of their community.

What are the office hours of the Okaloosa County Tax Collector’s office?

+The Okaloosa County Tax Collector’s office operates from Monday to Friday, typically from 8:00 AM to 5:00 PM. However, it is recommended to check their website or call their customer service for the most up-to-date information, as hours may vary.

How can I pay my property taxes online?

+To pay your property taxes online, visit the Okaloosa County Tax Collector’s official website. You can create an account and access the online payment portal. Follow the step-by-step instructions to make a secure payment using your credit or debit card.

What documents do I need to renew my driver’s license at the Tax Collector’s office?

+To renew your driver’s license, you will need a valid proof of identity, such as a passport or birth certificate. Additionally, you may need to provide proof of your Social Security number and two documents proving your residential address. Check the FLHSMV website for specific requirements.