Oc Cpa For Trust Taxes

The complex world of trust taxes demands a dedicated approach, and that's where the expertise of an OC CPA (Orange County Certified Public Accountant) specializing in trust taxes becomes invaluable. These professionals play a pivotal role in ensuring the financial security and compliance of trusts, offering specialized knowledge and tailored strategies to navigate the intricate tax landscape.

Understanding the Role of OC CPAs in Trust Taxes

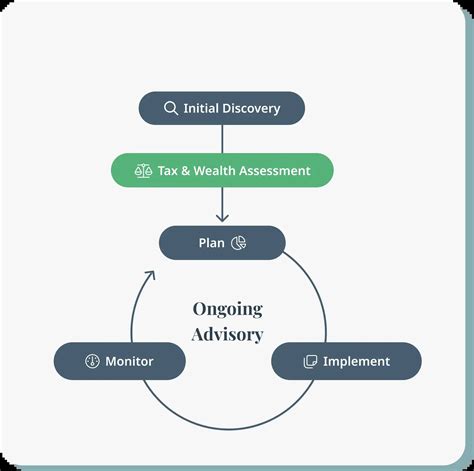

An OC CPA with a focus on trust taxes provides a comprehensive range of services, from initial trust setup to ongoing tax management and compliance. Their expertise ensures that trust beneficiaries receive the maximum financial benefits while adhering to the intricate rules and regulations governing trust taxation.

The Comprehensive Services of OC CPAs

These professionals offer a spectrum of services, including trust accounting, tax return preparation, and estate planning advice. They work closely with trustees and beneficiaries to ensure that all tax obligations are met accurately and efficiently, minimizing potential risks and maximizing financial advantages.

| OC CPA Services | Description |

|---|---|

| Trust Accounting | Expert management of trust finances, including income tracking, expense management, and record-keeping. |

| Tax Return Preparation | Preparation and filing of tax returns for trusts, ensuring compliance with all relevant tax laws and regulations. |

| Estate Planning | Advice and guidance on estate planning strategies to minimize taxes and maximize the value of the trust for beneficiaries. |

With their deep understanding of tax laws and regulations, OC CPAs specializing in trust taxes provide invaluable guidance, ensuring trusts are structured and managed optimally to benefit all stakeholders.

The Benefits of Engaging an OC CPA for Trust Taxes

Hiring an OC CPA for trust taxes brings numerous advantages, including:

- Expertise and Experience: These professionals have in-depth knowledge of tax laws and regulations, ensuring that trusts are managed and structured to optimize tax benefits.

- Compliance Assurance: They ensure that trusts adhere to all relevant tax laws, minimizing the risk of penalties and legal issues.

- Strategic Tax Planning: OC CPAs offer strategic advice to maximize the financial benefits for trust beneficiaries, including minimizing taxes and maximizing the value of the trust.

- Personalized Service: Each trust is unique, and OC CPAs provide tailored services to meet the specific needs and goals of each trust and its beneficiaries.

Case Study: Maximizing Trust Benefits with OC CPA Guidance

Consider the case of the Smith family trust, a complex structure with multiple beneficiaries and a diverse range of assets. The family engaged an OC CPA specializing in trust taxes to ensure optimal management and compliance. Through their expertise, the CPA:

- Structured the trust to minimize taxes on income and capital gains, ensuring maximum financial benefits for the beneficiaries.

- Implemented a strategic distribution plan to align with the beneficiaries’ financial goals and needs.

- Provided ongoing advice and support, ensuring the trust remained compliant and financially sound over the long term.

The Smith family's trust, with the guidance of their OC CPA, was able to thrive, providing significant financial benefits to the beneficiaries while ensuring full compliance with tax laws.

The Future of Trust Taxes: A Forward-Thinking Approach

As the tax landscape continues to evolve, the role of OC CPAs in trust taxes becomes increasingly crucial. With their forward-thinking approach and deep understanding of tax laws, these professionals are well-equipped to guide trusts through potential changes and challenges.

Navigating Future Tax Challenges

OC CPAs specializing in trust taxes are attuned to the latest tax law changes and potential future developments. They proactively advise clients on how to structure and manage their trusts to mitigate the impact of these changes, ensuring continued financial security and compliance.

For instance, with potential changes to estate tax laws on the horizon, OC CPAs are guiding clients on strategies to optimize their trusts, ensuring beneficiaries receive the maximum benefits while staying compliant with evolving regulations.

Embracing Technological Advancements

In addition to their legal expertise, OC CPAs are also leveraging technological advancements to enhance their services. From using specialized software for accurate trust accounting to employing secure online portals for easy client communication and document sharing, they are ensuring that trust management remains efficient and secure.

The future of trust taxes is bright, and with the guidance of OC CPAs, trusts can navigate this landscape with confidence, ensuring they remain a powerful tool for wealth management and preservation.

What is the role of an OC CPA in trust taxes?

+An OC CPA specializing in trust taxes provides expert guidance and services to ensure that trusts are optimally structured and managed to minimize taxes and maximize financial benefits for beneficiaries. They handle trust accounting, tax return preparation, and offer strategic estate planning advice.

How do OC CPAs ensure trust compliance with tax laws?

+OC CPAs stay up-to-date with the latest tax laws and regulations, ensuring that trusts are structured and managed to adhere to these rules. They provide ongoing advice and support to trustees and beneficiaries, helping them understand their tax obligations and ensuring compliance.

What are the benefits of engaging an OC CPA for trust taxes?

+Engaging an OC CPA brings several benefits, including their deep knowledge of tax laws, ensuring optimal trust management and compliance. They offer strategic tax planning advice, personalized services, and expertise in navigating the complex world of trust taxes.