Nj Property Tax Relief

Property taxes are a significant concern for homeowners across the United States, and New Jersey is no exception. With one of the highest property tax burdens in the nation, many residents seek relief to ease the financial strain. Understanding the various forms of property tax relief available in New Jersey is crucial for homeowners looking to manage their expenses effectively. This comprehensive guide aims to provide an in-depth analysis of the property tax relief programs in the Garden State, offering a valuable resource for residents seeking to reduce their tax liabilities.

The Landscape of Property Taxes in New Jersey

New Jersey’s property tax system is renowned for its complexity and high rates. The state’s local governments, including counties, municipalities, school districts, and special taxing districts, heavily rely on property taxes to fund their operations and public services. This reliance has led to some of the highest property tax rates in the country, with the average homeowner in New Jersey paying approximately $8,767 in property taxes annually.

The property tax burden is not distributed evenly across the state. It varies significantly based on the location, with some municipalities boasting lower rates while others have some of the highest property taxes in the nation. This disparity often stems from the unique needs and costs of each locality, which can range from educational requirements to infrastructure maintenance.

| County | Average Property Tax |

|---|---|

| Union County | $11,975 |

| Essex County | $10,884 |

| Bergen County | $10,773 |

| Monmouth County | $9,346 |

| Morris County | $9,268 |

Understanding this landscape is the first step for homeowners seeking property tax relief. It highlights the need for comprehensive strategies to reduce the burden, which is where New Jersey's tax relief programs come into play.

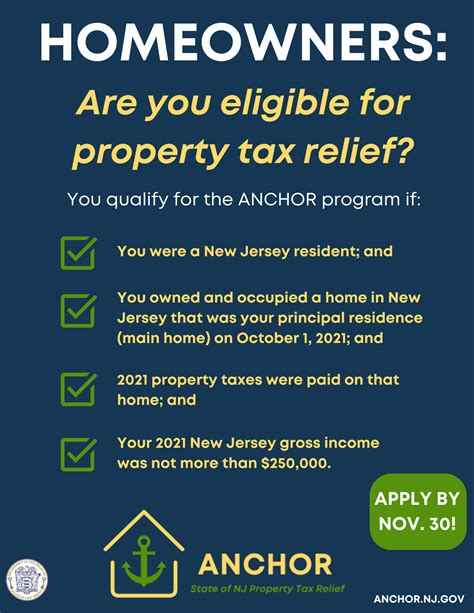

Exploring Property Tax Relief Programs in New Jersey

New Jersey offers a range of property tax relief programs designed to assist homeowners in managing their tax liabilities. These programs aim to provide financial support to specific groups of homeowners, reduce the overall tax burden, and promote homeownership.

Homestead Rebate Program

One of the most well-known relief programs in the state is the Homestead Rebate Program. This program provides eligible homeowners with a rebate, which is essentially a refund of a portion of their property taxes. The rebate amount is determined based on various factors, including the homeowner’s income, the assessed value of their property, and the total amount of property taxes paid.

To be eligible for the Homestead Rebate, homeowners must meet certain criteria. First, they must be New Jersey residents who own and occupy their primary residence. The property must be a one- or two-family dwelling, a condominium, or a cooperative unit. Additionally, homeowners must have a gross household income below a specified limit, which varies based on the number of dependents and the municipality.

| Household Size | Maximum Income |

|---|---|

| One Person | $106,000 |

| Two Persons | $140,000 |

| Three Persons | $174,000 |

| Four Persons | $208,000 |

The rebate amount is calculated based on a formula that takes into account the property's assessed value and the homeowner's income. For example, a homeowner with an assessed property value of $200,000 and an income of $80,000 might receive a rebate of approximately $600. This rebate is intended to offset a portion of the property taxes paid, providing some financial relief to eligible homeowners.

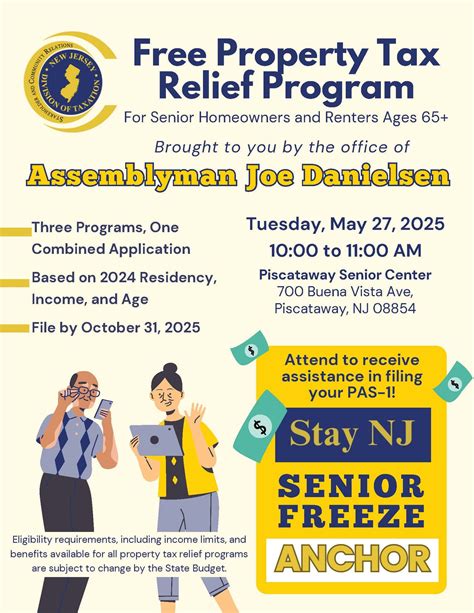

Senior Freeze Program

Another notable relief program in New Jersey is the Senior Freeze Program, officially known as the Property Tax Reimbursement Program. This program is designed specifically for senior citizens, offering them a reimbursement for property tax increases. The purpose is to help seniors maintain their financial stability and continue living in their homes as they age.

To be eligible for the Senior Freeze Program, homeowners must be at least 65 years old, have lived in their home for at least three consecutive years, and have a gross household income below a specified limit. The income limit is adjusted annually and takes into account the homeowner's income from the previous year.

The reimbursement amount is based on the difference between the current year's property taxes and the base year's property taxes. The base year is typically the year the homeowner first enrolled in the program. This ensures that seniors are not burdened with significant property tax increases as they age. For instance, if a senior's property taxes increased by $500 from the base year to the current year, they would be eligible for a reimbursement of $500.

The Senior Freeze Program is a vital safety net for many senior citizens in New Jersey, providing them with financial stability and peace of mind. It ensures that they can continue to live in their homes without facing unaffordable property tax increases.

Veterans Deduction and Exemption

New Jersey also offers tax relief specifically for veterans. The Veterans Deduction and Veterans Exemption programs provide eligible veterans with a reduction in their property taxes. These programs aim to honor and support the service and sacrifices made by veterans, making homeownership more affordable.

The Veterans Deduction allows eligible veterans to deduct a certain percentage of their property's assessed value from their taxable value. This deduction can significantly reduce the property taxes owed. To be eligible, veterans must have served during a recognized period of war or conflict and have been honorably discharged. The deduction amount depends on the veteran's length of service and disability status.

Additionally, the Veterans Exemption program offers a complete exemption from property taxes for certain veterans. This exemption is available to veterans who are permanently and totally disabled as a result of their military service. The exemption applies to the veteran's primary residence, providing a substantial financial benefit.

Both the Veterans Deduction and Exemption programs are testament to New Jersey's commitment to supporting its veterans. They recognize the unique challenges veterans face when transitioning to civilian life and aim to make homeownership a more realistic option.

Maximizing Property Tax Relief: Strategies and Considerations

While New Jersey’s property tax relief programs offer valuable assistance, it’s important for homeowners to understand how to maximize their benefits. Here are some strategies and considerations to keep in mind:

- Income Eligibility: Many relief programs, such as the Homestead Rebate and Senior Freeze, have income eligibility requirements. It's crucial to stay informed about these limits and ensure your income remains within the specified range to continue benefiting from these programs.

- Property Value Assessment: Property values can fluctuate, and an accurate assessment is essential for determining eligibility and benefit amounts. Regularly review your property's assessed value and ensure it reflects the current market conditions.

- Application Deadlines: Most relief programs have specific application deadlines. Missing these deadlines can result in forfeited benefits. Mark your calendar and ensure you submit your applications on time.

- Documentation: Keep all relevant documents, such as tax bills, income statements, and proof of residency, organized and readily accessible. These documents are often required for application and eligibility verification.

- Professional Assistance: Navigating property tax relief programs can be complex. Consider seeking assistance from tax professionals or local community organizations that specialize in these programs. They can provide valuable guidance and ensure you receive the benefits you're entitled to.

By staying informed, organized, and proactive, homeowners can maximize their benefits from New Jersey's property tax relief programs. These programs offer a valuable safety net, reducing the financial burden of property taxes and promoting long-term homeownership.

The Future of Property Tax Relief in New Jersey

As New Jersey continues to grapple with its high property tax burden, the future of property tax relief is a topic of ongoing discussion and debate. While the current programs provide valuable assistance, there are ongoing efforts to enhance and expand these initiatives to better serve the needs of homeowners.

One potential area of focus is expanding the income eligibility criteria for relief programs. As property taxes continue to rise, more homeowners may find themselves struggling to afford their tax liabilities. Widening the income brackets for programs like the Homestead Rebate and Senior Freeze could provide relief to a larger portion of the population.

Additionally, there are discussions around implementing new relief measures, such as tax credits or deductions for specific groups of homeowners. For instance, proposals have been made to offer tax credits for homeowners who install energy-efficient improvements or for those who live in areas with high property taxes but lower incomes. These initiatives aim to provide targeted relief to homeowners who may be disproportionately affected by the property tax burden.

Another aspect that is being considered is the potential for property tax reform. New Jersey's complex tax system has led to calls for simplification and modernization. Some proposals suggest shifting the tax burden away from property taxes and towards other forms of taxation, such as a higher income tax or a sales tax. While these reforms may take time to implement, they could ultimately provide long-term relief for homeowners.

As the state works towards these potential changes, it's crucial for homeowners to stay informed and engaged. By understanding the current relief programs and advocating for their own interests, homeowners can ensure that their voices are heard in the development of future tax policies. This active participation is essential for shaping a tax system that is fair, equitable, and supportive of homeownership in New Jersey.

How often can I apply for the Homestead Rebate Program?

+You can apply for the Homestead Rebate Program annually. The application period typically opens in the spring and closes in the summer. It’s important to note that the rebate amount may vary from year to year based on your income and property value.

Are there any income limits for the Senior Freeze Program?

+Yes, the Senior Freeze Program has income limits that are adjusted annually. The limits are based on your gross household income from the previous year. It’s crucial to stay informed about these limits to ensure your eligibility.

Can I apply for both the Veterans Deduction and Exemption programs?

+Yes, you can apply for both programs if you meet the eligibility criteria for each. The Veterans Deduction reduces your taxable property value, while the Veterans Exemption provides a complete exemption from property taxes for certain eligible veterans.

What happens if I move during the Senior Freeze Program?

+If you move within the state of New Jersey, you can continue to receive the Senior Freeze benefit for your new home. However, if you move out of state, you will no longer be eligible for the program. It’s important to notify the program administrators of your change of address to ensure continuity of benefits.