Nj County Property Tax Rates

Understanding property tax rates is crucial for homeowners and prospective buyers alike. In the state of New Jersey, these rates can vary significantly from one county to another, impacting the overall cost of homeownership. This article provides an in-depth exploration of the property tax landscape in New Jersey's counties, offering insights into rates, their implications, and how they are calculated.

The Complex Landscape of NJ County Property Tax Rates

New Jersey’s property tax system is renowned for its complexity, with rates that can differ substantially between counties, municipalities, and even within the same municipality. This diversity is influenced by a multitude of factors, including the cost of local government services, debt obligations, and the value of properties within a given area.

The average effective property tax rate in New Jersey is approximately 2.24%, which is among the highest in the nation. However, this average masks significant variations, with rates ranging from as low as 1.22% in one county to as high as 3.49% in another.

Factors Influencing County Property Tax Rates

Several key factors contribute to the variance in property tax rates across New Jersey’s counties:

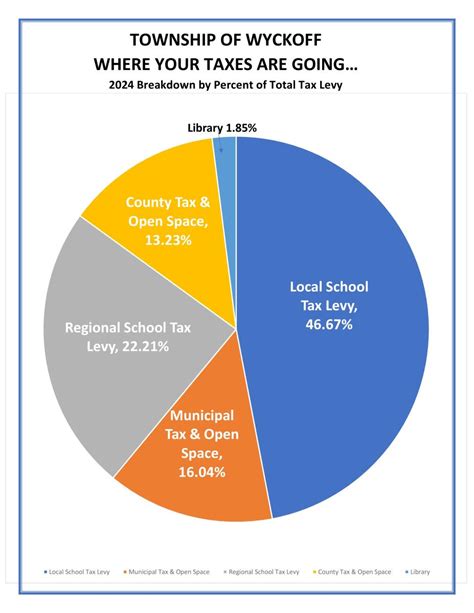

- Local Government Costs: The primary driver of property taxes is the cost of funding local government operations, including police and fire departments, schools, road maintenance, and other public services.

- Debt Obligations: Counties and municipalities may have outstanding debt, such as bonds issued for infrastructure projects. Repayment of this debt is often funded through property taxes.

- Property Values: The assessed value of properties within a county plays a significant role. Higher property values can result in higher tax collections, assuming a consistent tax rate.

- Local Budget Decisions: Elected officials at the county and municipal levels have discretion over budget allocations, which can impact property tax rates.

For instance, a county with a robust economy, high property values, and a relatively low cost of living might be able to maintain lower tax rates compared to a county with similar expenses but lower property values.

| County | Effective Property Tax Rate | Rank |

|---|---|---|

| Essex | 2.89% | 1 |

| Union | 2.79% | 2 |

| Hudson | 2.75% | 3 |

| Bergen | 2.59% | 4 |

| Passaic | 2.46% | 5 |

Understanding Property Tax Assessments and Calculations

Property taxes in New Jersey are calculated based on the assessed value of a property and the applicable tax rate. This process involves several steps:

- Property Assessment: Each municipality is responsible for assessing the value of properties within its borders. This value is often based on a property's fair market value, taking into account factors like location, size, condition, and recent sales of comparable properties.

- Equalization Rate: To ensure fairness across municipalities, the state determines an equalization rate for each municipality. This rate adjusts the assessed value to account for differences in assessment practices.

- Tax Rate Calculation: The tax rate is determined by the county and municipality. It is the amount of tax owed per $100 of assessed value. For instance, a tax rate of 3% would mean $3 is owed for every $100 of assessed value.

- Property Tax Bill: The property tax bill is calculated by multiplying the equalized assessed value by the tax rate. This results in the total amount of property tax owed for the year.

The Impact of Property Tax Rates on Homeowners

Property tax rates have a direct and significant impact on homeowners’ finances. For many, property taxes are the largest annual expense associated with homeownership, often exceeding mortgage payments. These taxes fund essential services, but they can also influence a homeowner’s decision to buy, sell, or rent.

Consider the case of two similar homes in different counties with varying tax rates. Even if the homes have the same assessed value, the homeowner in the county with the higher tax rate will pay significantly more in property taxes each year.

Comparative Analysis: NJ County Property Tax Rates

Let’s take a closer look at the property tax rates in some of New Jersey’s most populous counties, comparing them to the state average:

| County | Effective Property Tax Rate | State Average | Difference from State Average |

|---|---|---|---|

| Essex | 2.89% | 2.24% | +0.65% |

| Bergen | 2.59% | 2.24% | +0.35% |

| Hudson | 2.75% | 2.24% | +0.51% |

| Passaic | 2.46% | 2.24% | +0.22% |

As evident from the table, some counties, like Essex, have property tax rates that are significantly higher than the state average, while others, like Passaic, are relatively closer to the average. These differences can have a substantial impact on the cost of living for residents.

Future Implications and Trends

The future of property tax rates in New Jersey is influenced by a variety of economic, political, and social factors. Here are some key considerations:

- Economic Conditions: A robust economy can lead to higher property values, which may result in increased tax revenues for counties and municipalities, potentially stabilizing or reducing tax rates.

- Budgetary Constraints: Counties and municipalities with tight budgets may consider raising property tax rates to fund essential services and infrastructure projects.

- Population Shifts: Population growth or decline can impact property tax rates. A growing population might lead to increased demand for services, potentially driving up tax rates.

- Political Landscape: Changes in local or state leadership can influence budget decisions and, subsequently, property tax rates.

Conclusion

Navigating New Jersey’s property tax landscape can be challenging due to the wide range of rates across counties. Understanding these rates is essential for prospective homeowners, as they directly impact the overall cost of homeownership. By examining the factors that influence property tax rates and staying informed about local and state-level economic and political developments, individuals can make more informed decisions about where to buy or invest in real estate.

Frequently Asked Questions

What is the average property tax rate in New Jersey?

+

The average effective property tax rate in New Jersey is approximately 2.24%.

How often do property tax rates change in New Jersey?

+

Property tax rates can change annually, typically as a result of budget decisions made by county and municipal governments.

Are property taxes the same throughout a county?

+

No, property taxes can vary within a county, as municipalities within the county set their own tax rates.

How can I estimate my property taxes before buying a home in New Jersey?

+

You can estimate your property taxes by multiplying the assessed value of the property by the tax rate for the municipality in which the property is located.