Nh State Income Tax

The state of New Hampshire, often known as the Granite State, boasts a unique tax landscape, as it is one of only seven states that do not impose a broad-based personal income tax on its residents. This distinctive approach to taxation has significant implications for individuals and businesses alike, offering both advantages and considerations that shape the state's economic and financial environment.

Understanding New Hampshire’s Tax Structure

New Hampshire’s tax system is characterized by its simplicity and specificity. Unlike many other states, it does not levy income tax on wages, salaries, or investment income earned by individuals. This absence of a personal income tax is a key differentiator and has contributed to the state’s reputation for being business-friendly and attractive to those seeking tax efficiency.

However, it's important to note that New Hampshire does impose taxes on certain types of income. For instance, it taxes interest and dividends from investments, with rates varying based on the source and nature of the income. This selective taxation approach ensures that certain income streams are not entirely exempt from the state's revenue system.

Income Tax Exemptions: A Closer Look

The absence of a personal income tax in New Hampshire is particularly advantageous for high-income earners, retirees, and those with significant investment portfolios. This tax exemption allows individuals to retain a larger portion of their earnings, which can be particularly beneficial for those with substantial incomes or those seeking to minimize their tax burden during retirement.

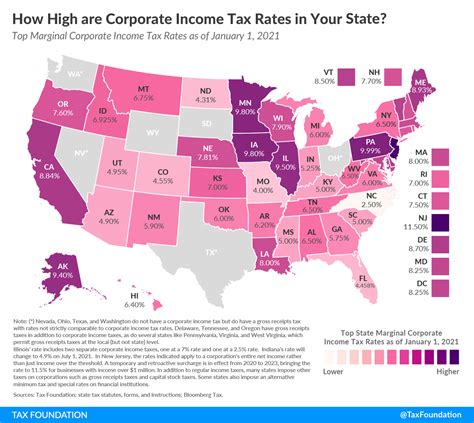

For businesses, the lack of a corporate income tax can be a significant incentive. New Hampshire's tax structure encourages business growth and investment, as companies can retain more of their profits to reinvest in their operations or expand their activities. This business-centric approach has contributed to the state's vibrant economic climate, attracting a diverse range of industries and fostering a competitive business environment.

Dividends and Interest Taxation

While New Hampshire does not tax most forms of personal income, it does levy taxes on dividends and interest income. These taxes are calculated at different rates depending on the source of the income and the tax classification of the individual or entity receiving the income. For instance, dividends from certain types of entities, such as S corporations, are taxed at a flat rate, while interest income from various sources is subject to varying tax rates.

| Income Type | Tax Rate |

|---|---|

| Interest Income | 5% |

| Dividends from S Corporations | 5% |

| Dividends from Other Sources | Varies |

The Impact on Individuals and Businesses

For individuals, the absence of a personal income tax in New Hampshire can result in significant tax savings, especially for those in higher tax brackets. This tax advantage can make the state an attractive destination for retirees or those seeking to minimize their tax liability. Additionally, the state’s tax structure encourages wealth accumulation and investment, as individuals can retain more of their earnings for savings and investment purposes.

Businesses, too, benefit from New Hampshire's tax environment. The lack of a corporate income tax means that businesses can retain more of their profits, which can be reinvested in the business, leading to potential expansion, job creation, and economic growth. This business-friendly approach has contributed to the state's reputation as a desirable location for startups and established companies alike.

Comparative Analysis: New Hampshire vs. Neighboring States

When compared to neighboring states, New Hampshire’s tax structure stands out for its lack of a personal income tax. While states like Massachusetts, Vermont, and Maine impose personal income taxes, New Hampshire’s approach is more akin to that of New Hampshire, which also does not have a personal income tax. This comparative analysis highlights the unique position New Hampshire holds in the region’s tax landscape, offering a distinct advantage to both individuals and businesses.

| State | Personal Income Tax | Corporate Income Tax |

|---|---|---|

| New Hampshire | No | No |

| Massachusetts | Yes | Yes |

| Vermont | Yes | Yes |

| Maine | Yes | Yes |

Future Implications and Considerations

As New Hampshire continues to thrive economically, the state’s unique tax structure will likely remain a key factor in its growth and development. However, it’s important to consider the potential implications of this tax approach in the long term. The absence of a personal income tax may limit the state’s revenue streams, potentially impacting its ability to fund public services and infrastructure projects. Balancing tax efficiency with the need for sustainable revenue sources will be a critical consideration for policymakers and residents alike.

Additionally, the state's tax structure may need to adapt to changing economic conditions and evolving business landscapes. As industries evolve and new technologies emerge, New Hampshire's tax system will need to remain flexible and responsive to ensure it continues to support economic growth and competitiveness. This may involve periodic reviews and adjustments to ensure the tax system remains fair, equitable, and aligned with the state's economic goals.

Conclusion: A Tax-Efficient Haven

In conclusion, New Hampshire’s tax structure, characterized by its lack of a personal income tax, offers a unique and advantageous environment for individuals and businesses. This tax-efficient approach has contributed to the state’s economic vitality and attractiveness, particularly for those seeking to minimize their tax burden. However, it’s important to consider the broader implications of this tax system and ensure that it remains sustainable and adaptable to future economic realities.

As New Hampshire continues to navigate the complex landscape of taxation, its unique approach will undoubtedly shape its economic trajectory, influencing the decisions of residents and businesses alike. The state's ability to balance tax efficiency with the need for robust public services and infrastructure will be a key factor in its long-term economic success and sustainability.

What are the main types of income taxed in New Hampshire?

+

New Hampshire taxes interest and dividend income, with varying rates depending on the source and nature of the income.

Are there any personal income tax exemptions in New Hampshire?

+

Yes, New Hampshire does not tax personal income, including wages, salaries, and investment income, making it a tax-efficient state for individuals.

How does New Hampshire’s tax structure compare to neighboring states?

+

New Hampshire’s tax structure is unique compared to neighboring states like Massachusetts, Vermont, and Maine, which impose personal income taxes.

What are the potential implications of New Hampshire’s tax structure for the state’s long-term economic sustainability?

+

While the tax structure provides short-term advantages, the lack of a personal income tax may limit long-term revenue streams, potentially impacting the funding of public services and infrastructure.