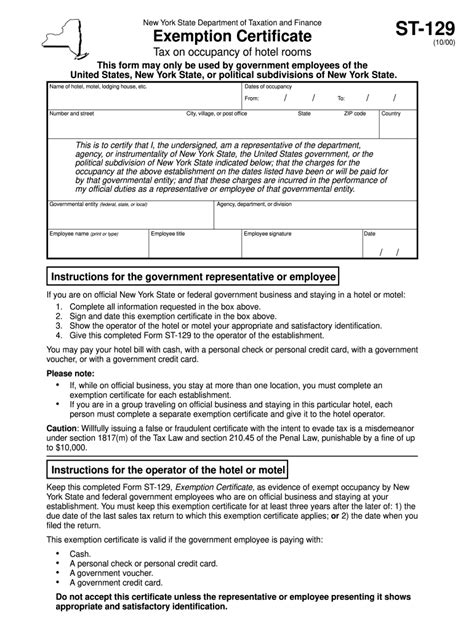

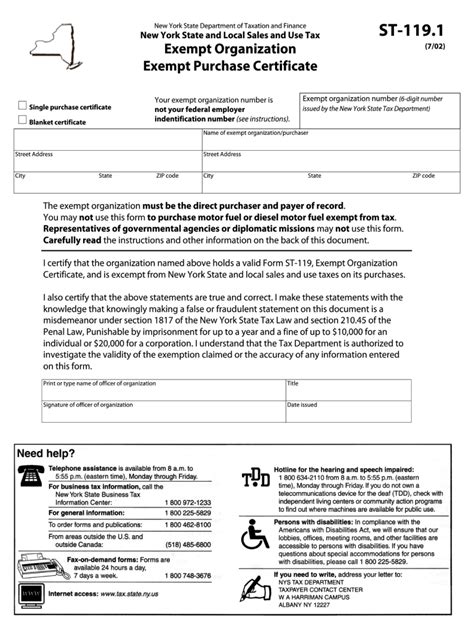

New York State Tax Exempt Form

For businesses and individuals operating within New York State, understanding the tax exemption process is crucial. The New York State Tax Exempt Form, also known as Form ST-120, plays a vital role in determining whether certain purchases are eligible for tax exemption. This article will delve into the intricacies of the tax exemption process, providing a comprehensive guide to help navigate this complex topic.

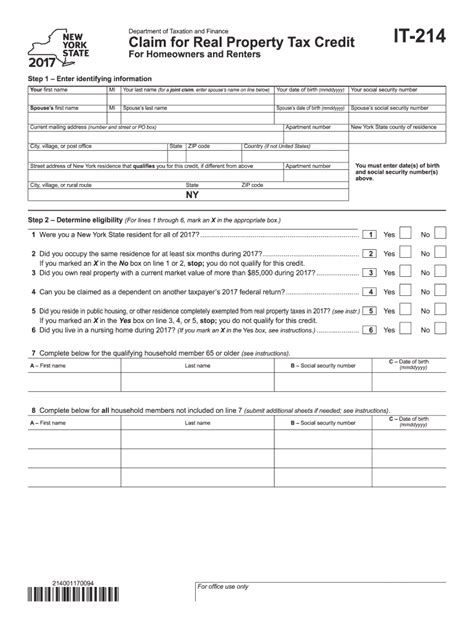

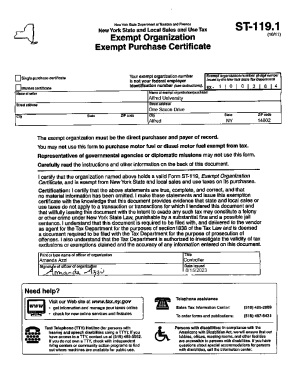

Understanding the New York State Tax Exempt Form

The New York State Tax Exempt Form, or Form ST-120, is a legal document that certifies an entity’s eligibility for tax exemption on certain purchases. This form is a crucial tool for businesses and individuals to ensure they are compliant with state tax regulations while also taking advantage of any applicable tax exemptions.

The form itself is a straightforward document, but the process of determining tax exemption can be complex. It involves a thorough understanding of New York State's tax laws, the specific exemptions available, and the requirements for qualification. This guide aims to break down these complexities and provide a clear roadmap for navigating the tax exemption landscape.

Eligibility and Qualifications

Not all entities are eligible for tax exemption, and the qualifications vary depending on the nature of the purchase and the entity’s status. Generally, tax exemptions are granted to certain types of organizations, such as:

- Nonprofit organizations

- Educational institutions

- Government entities

- Charitable organizations

- Certain religious organizations

Additionally, specific purchases may be exempt from taxation, such as:

- Sales to out-of-state customers

- Certain wholesale transactions

- Resale items

- Materials used for manufacturing or production

- Sales to diplomatic missions

The Tax Exempt Form Process

Obtaining a tax exemption in New York State requires a systematic approach. Here’s a step-by-step guide to the process:

- Determine Eligibility: Start by assessing whether your entity and the intended purchase meet the criteria for tax exemption. Refer to the official guidelines provided by the New York State Department of Taxation and Finance.

- Gather Required Documentation: Collect all necessary documentation to support your claim for tax exemption. This may include articles of incorporation, tax-exempt status letters, or other relevant certificates.

- Complete the Form ST-120: Download and fill out the New York State Tax Exempt Form accurately. Provide all required information, including the entity’s details, the purpose of the exemption, and the supporting documentation.

- Submit the Form: Submit the completed form to the appropriate tax authority, typically the New York State Department of Taxation and Finance. Ensure that you meet the submission deadline to avoid penalties.

- Await Approval: The tax authority will review your application and, if approved, issue a tax exemption certificate. This certificate should be retained and presented to vendors or suppliers to claim the exemption.

- Maintain Compliance: Keep accurate records of your tax-exempt purchases and ensure that you meet all ongoing compliance requirements. Regularly review your tax obligations and stay updated with any changes in tax laws.

Benefits and Implications of Tax Exemption

Securing tax exemption can provide significant financial benefits to eligible entities. By reducing or eliminating sales tax on eligible purchases, organizations can save a substantial amount of money, which can be redirected towards their core operations or other strategic initiatives.

Financial Benefits

The financial advantages of tax exemption are clear. For instance, consider a nonprofit organization that frequently purchases office supplies and equipment. With tax exemption, they can save a considerable amount on these purchases, which could otherwise be a significant expense. This saved money can be allocated to support their mission and programs, making tax exemption a crucial financial tool for many entities.

Compliance and Legal Implications

While tax exemption offers financial benefits, it also comes with a set of responsibilities. Entities must ensure strict compliance with tax laws and regulations to maintain their tax-exempt status. Non-compliance can lead to penalties, revocation of tax exemption, and legal consequences. It is essential to stay informed about any changes in tax laws and to maintain accurate records of all tax-exempt transactions.

Long-Term Planning

Tax exemption is not a one-time benefit but a long-term strategy. Entities should incorporate tax exemption into their financial planning and budgeting processes. By doing so, they can forecast their financial obligations more accurately and plan their expenditures accordingly. This proactive approach ensures that entities make the most of their tax-exempt status while also meeting their financial goals.

| Entity Type | Tax Exemption Impact |

|---|---|

| Nonprofit Organizations | Significant savings on office supplies and equipment, allowing for more efficient resource allocation. |

| Educational Institutions | Reduced costs for technology and educational materials, benefiting students and faculty. |

| Government Entities | Financial relief on large-scale purchases, leading to better budget management. |

Challenges and Considerations

While tax exemption offers clear advantages, there are also challenges and considerations to keep in mind.

Complex Eligibility Criteria

The eligibility criteria for tax exemption can be intricate and may vary based on the type of purchase and the entity’s status. Understanding these criteria and determining eligibility can be a complex process, especially for entities new to the tax exemption landscape.

Ongoing Compliance

Tax exemption is not a one-time process. Entities must continuously comply with tax laws and regulations to maintain their tax-exempt status. This includes staying updated with any changes in tax laws, accurately recording tax-exempt transactions, and ensuring that all supporting documentation is up-to-date.

Vendor Management

Entities must effectively communicate their tax-exempt status to vendors and suppliers. This requires a clear understanding of the exemption process and the ability to provide the necessary documentation to vendors. Effective vendor management is crucial to ensure that tax exemptions are applied correctly and consistently.

Best Practices for Tax Exemption

To navigate the complexities of tax exemption successfully, entities should consider the following best practices:

- Stay Informed: Regularly review and stay updated with the latest tax laws and regulations. The tax landscape can change, and entities must adapt to these changes to maintain compliance.

- Accurate Record-Keeping: Maintain detailed and organized records of all tax-exempt transactions. This ensures compliance and provides a clear audit trail if needed.

- Vendor Communication: Establish clear communication channels with vendors and suppliers to ensure they understand your tax-exempt status and apply the exemption correctly.

- Professional Guidance: Consider seeking professional advice from tax experts or consultants who specialize in tax exemption. They can provide tailored guidance and support based on your specific needs.

- Internal Training: Provide training to relevant staff members on tax exemption processes and requirements. This ensures that your team understands the importance of compliance and can effectively manage tax-exempt transactions.

Conclusion

The New York State Tax Exempt Form is a powerful tool for entities to manage their tax obligations and take advantage of eligible exemptions. By understanding the eligibility criteria, navigating the application process, and maintaining strict compliance, entities can benefit from significant financial savings. However, it is essential to approach tax exemption with a strategic mindset, staying informed, and ensuring ongoing compliance.

Frequently Asked Questions

How often do I need to renew my tax exemption certificate?

+Tax exemption certificates typically do not expire in New York State. However, it is crucial to keep your documentation up-to-date and accurate. Review your certificate annually to ensure it reflects any changes in your organization’s status or operations.

Can I apply for tax exemption online?

+Yes, New York State offers an online application process for tax exemption. You can access the online form and submission portal through the Department of Taxation and Finance’s website. This streamlines the application process and provides a convenient option for entities.

What happens if I make a mistake on my tax exemption application?

+If you discover a mistake on your tax exemption application, it is crucial to take immediate action. Contact the New York State Department of Taxation and Finance to inform them of the error. They will guide you on the necessary steps to correct the mistake and ensure your application remains valid.

Are there any penalties for non-compliance with tax exemption regulations?

+Yes, non-compliance with tax exemption regulations can result in penalties. These penalties may include fines, interest charges, or even the revocation of your tax-exempt status. It is essential to understand and adhere to the rules to avoid these consequences.

Can I apply for tax exemption retroactively?

+Retroactive tax exemption is generally not possible in New York State. It is important to apply for tax exemption before making eligible purchases to ensure compliance and avoid any potential issues. Plan your tax exemption strategy in advance to make the most of this benefit.