New Jersey Income Tax Calculator

When it comes to managing your finances and understanding your tax obligations, having a reliable income tax calculator is invaluable. For residents of New Jersey, a state known for its diverse economy and vibrant communities, a comprehensive income tax calculator can provide clarity and help individuals and businesses make informed financial decisions. In this article, we will delve into the world of the New Jersey Income Tax Calculator, exploring its features, benefits, and how it can assist taxpayers in navigating the state's tax landscape.

Unveiling the New Jersey Income Tax Calculator

The New Jersey Income Tax Calculator is a sophisticated online tool designed to assist taxpayers in calculating their state income tax liabilities accurately. Developed by tax experts and financial professionals, this calculator is a user-friendly platform that simplifies the complex process of tax computation, making it accessible to a wide range of users.

With its intuitive interface, the calculator guides users through a series of straightforward steps, gathering essential information about their income, deductions, and tax status. By inputting relevant data, individuals and businesses can obtain an accurate estimate of their taxable income and the corresponding tax liability for the current tax year.

Key Features and Benefits

The New Jersey Income Tax Calculator offers a multitude of features and advantages that set it apart as a valuable resource for taxpayers:

- Accuracy and Precision: Built upon the latest tax laws and regulations, the calculator ensures precise calculations, providing taxpayers with reliable estimates of their tax obligations.

- User-Friendly Interface: The calculator's interface is designed with simplicity in mind, allowing users of all technical backgrounds to navigate it effortlessly. Clear instructions and intuitive data entry fields make the process smooth and efficient.

- Real-Time Updates: Tax laws and rates are subject to change, and the calculator stays up-to-date with the latest amendments. Regular updates ensure that users receive accurate information based on the current tax year's regulations.

- Detailed Breakdown: Beyond providing a final tax estimate, the calculator offers a comprehensive breakdown of the calculation process. Users can understand how their income, deductions, and tax credits impact their overall tax liability, fostering a deeper understanding of their financial position.

- Scenario Analysis: A unique feature of the calculator is its ability to perform scenario analysis. Users can input different income levels, deductions, or tax scenarios to explore the potential impact on their tax obligations. This feature is particularly useful for financial planning and decision-making.

- Secure and Confidential: The calculator prioritizes user privacy and security. All data entered is encrypted and protected, ensuring that sensitive financial information remains confidential.

Applications and Use Cases

The New Jersey Income Tax Calculator finds applications in various scenarios, benefiting individuals, families, and businesses alike:

- Individual Taxpayers: For residents of New Jersey, the calculator serves as a handy tool to estimate their personal income tax liability. Whether it's for annual tax planning or assessing the impact of a new job offer, the calculator provides valuable insights.

- Business Owners: Small business owners and entrepreneurs can utilize the calculator to understand their business income tax obligations. By inputting business income, expenses, and deductions, they can make informed decisions regarding tax strategies and financial planning.

- Financial Planners and Advisors: Financial professionals can leverage the calculator to provide accurate tax estimates to their clients. This tool enhances their ability to offer comprehensive financial advice and ensures that their clients are well-prepared for tax season.

- Students and Recent Graduates: Students and recent graduates, especially those entering the workforce, can benefit from the calculator's simplicity. It helps them understand their tax obligations as they navigate their first jobs and financial independence.

- Retirees and Pensioners: Retirees and individuals receiving pension income can use the calculator to assess their tax liability on retirement income. This ensures they can plan their retirement finances effectively.

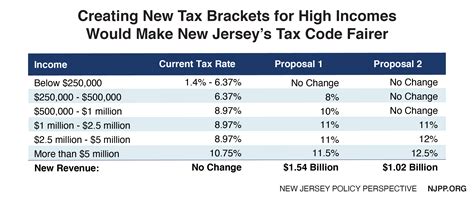

| Income Level | Tax Bracket | Tax Rate |

|---|---|---|

| Up to $20,000 | 1.4% | 2.9% |

| $20,001 - $35,000 | 3.5% | 4.0% |

| $35,001 - $40,000 | 5.5% | 5.9% |

| $40,001 and above | 6.5% | 10.75% |

Maximizing the Potential of the Calculator

To make the most of the New Jersey Income Tax Calculator, here are some tips and best practices:

- Gather all necessary documents and information before using the calculator. Having income statements, deduction records, and tax-related documents at hand ensures accurate input.

- Explore the calculator's features and options. Take advantage of the scenario analysis to understand the impact of different financial decisions on your tax liability.

- Stay updated with tax law changes. While the calculator provides real-time updates, it's beneficial to stay informed about any significant tax reforms that may impact your calculations.

- Seek professional advice if needed. For complex financial situations or specific tax queries, consulting a tax professional or financial advisor can provide personalized guidance.

The Future of Tax Calculation in New Jersey

As technology advances and tax regulations evolve, the New Jersey Income Tax Calculator is poised to play an even more significant role in the state's tax landscape. With ongoing enhancements and improvements, the calculator is expected to offer even greater accuracy and expanded features, catering to the diverse needs of taxpayers.

In the future, we can anticipate the integration of machine learning algorithms, further streamlining the tax calculation process. Additionally, the calculator may incorporate more interactive elements, allowing users to visualize their tax obligations and explore various financial scenarios with ease.

Conclusion

The New Jersey Income Tax Calculator is a powerful tool that empowers taxpayers to take control of their financial well-being. By providing accurate estimates and offering valuable insights, the calculator simplifies the often complex world of income tax calculation. As New Jersey residents and businesses continue to navigate the state's tax system, this calculator serves as a reliable companion, ensuring compliance and financial peace of mind.

Is the New Jersey Income Tax Calculator free to use?

+Yes, the New Jersey Income Tax Calculator is a free online tool accessible to all taxpayers. It is designed to provide a convenient and cost-effective solution for tax estimation.

Can I use the calculator for previous tax years?

+While the calculator primarily focuses on the current tax year, some versions may offer the ability to input historical data for estimation purposes. However, for official tax filings, it’s essential to refer to the relevant tax year’s guidelines.

How often is the calculator updated with new tax laws and rates?

+The calculator is regularly updated to reflect the latest tax laws and rates. Updates are made promptly whenever there are significant changes to ensure users receive accurate and up-to-date information.

Can the calculator handle complex tax scenarios, such as multiple streams of income or business expenses?

+Absolutely! The calculator is designed to accommodate various income sources and expenses. It provides a comprehensive platform to input and calculate taxes for different income streams, making it suitable for complex tax scenarios.