New Hampshire Real Estate Taxes

Welcome to an in-depth exploration of New Hampshire's real estate taxes, a complex yet critical aspect of the Granite State's property ownership landscape. Understanding the intricacies of this tax system is essential for anyone considering investing in New Hampshire's diverse real estate market, ranging from picturesque coastal properties to mountain retreats and vibrant urban developments.

New Hampshire's real estate tax system, though relatively straightforward, boasts unique characteristics that set it apart from other states. This system is integral to the state's fiscal health and plays a pivotal role in funding vital services like education, infrastructure, and public safety. As such, it's a key consideration for both new and seasoned property investors in the state.

Understanding the Basics of New Hampshire’s Real Estate Taxes

In New Hampshire, real estate taxes are levied annually on the assessed value of real property, including land and improvements such as buildings and other structures. This assessment is conducted by local assessors, who are responsible for determining the fair market value of each property within their jurisdiction.

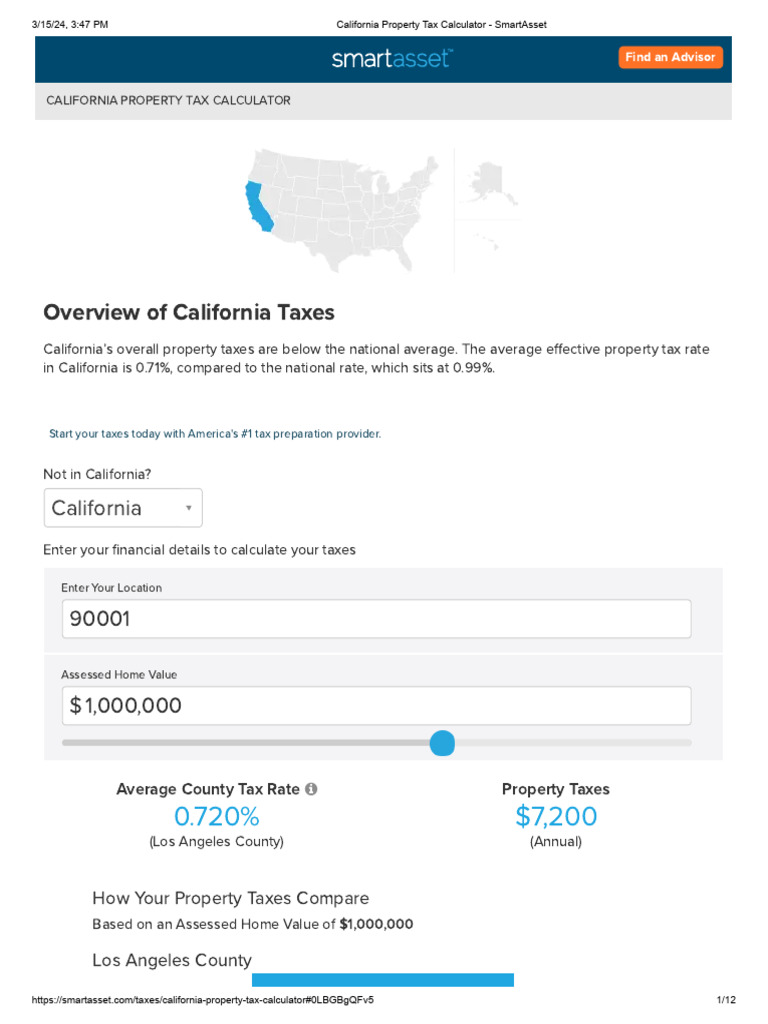

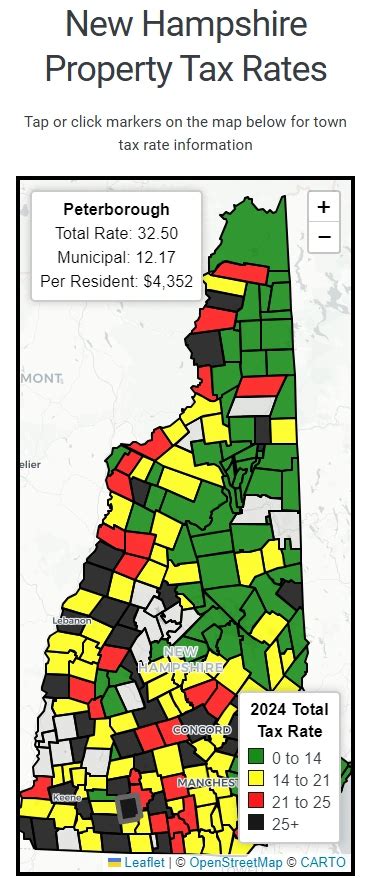

The tax rate, which is expressed as a percentage, is set by the local government and can vary significantly from one municipality to another. This variation reflects the differing needs and priorities of each community, influenced by factors such as the cost of providing local services, the local economy, and the overall property values within the area.

The formula for calculating real estate taxes in New Hampshire is straightforward: the assessed value of the property is multiplied by the tax rate, which yields the annual tax bill. For instance, if a property is assessed at $300,000 and the tax rate is 2%, the annual tax bill would be $6,000.

The Assessment Process

Property assessments in New Hampshire are conducted on a cyclical basis, typically every three to five years. During this process, local assessors physically inspect properties and review relevant data to determine their fair market value. This value is then used as the basis for calculating the property taxes.

It's important to note that property owners have the right to appeal their property assessments if they believe the value assigned is inaccurate. The appeals process varies by municipality, but it generally involves a review by an independent board or a formal hearing before a local court.

Exemptions and Abatements

New Hampshire offers various exemptions and abatements to reduce the tax burden on certain property owners. These include exemptions for senior citizens, veterans, and individuals with disabilities, as well as abatements for new construction or substantial improvements to existing properties.

For instance, the Elderly Tax Relief program provides a credit against property taxes for homeowners aged 65 and older with limited income. Similarly, the Disabled Veterans' Tax Abatement program offers a reduction in property taxes for certain disabled veterans.

| Exemption/Abatement | Description |

|---|---|

| Elderly Tax Relief | Provides a credit against property taxes for eligible seniors. |

| Disabled Veterans' Tax Abatement | Reduces property taxes for certain disabled veterans. |

| New Construction Abatement | Offers a temporary reduction in taxes for new construction. |

| Open Space Abatement | Reduces taxes for properties dedicated to open space preservation. |

The Impact of Real Estate Taxes on Property Ownership

Real estate taxes in New Hampshire significantly influence property ownership and investment decisions. While they represent a significant expense for homeowners, these taxes are also a vital source of revenue for local governments, funding essential services and infrastructure projects.

For prospective homebuyers, understanding the real estate tax landscape is crucial. It can impact the affordability of a property, especially over the long term. Additionally, fluctuations in tax rates or property assessments can significantly affect a homeowner's financial planning and budget.

From an investment perspective, real estate taxes are a key consideration. They can influence the return on investment, especially for rental properties or real estate investment trusts (REITs). Understanding the tax implications can help investors make more informed decisions and potentially optimize their strategies.

Strategies for Managing Real Estate Taxes

There are several strategies that property owners can employ to manage their real estate tax obligations effectively. These include:

- Understanding the Assessment Process: By familiarizing themselves with the assessment process, property owners can ensure their property is assessed fairly and accurately. This includes understanding the factors that influence property values and being aware of any improvements or changes that could impact the assessment.

- Exploring Exemptions and Abatements: Property owners should research and take advantage of any applicable exemptions or abatements. This can help reduce their tax burden and make property ownership more affordable.

- Appealing Assessments: If a property owner believes their assessment is inaccurate, they can appeal to have it reviewed. This process can be complex, but it can result in a reduced assessment and lower taxes.

- Consider Long-Term Financial Planning: Real estate taxes are a recurring expense, so it's important for property owners to incorporate them into their long-term financial planning. This can involve budgeting for annual tax payments and exploring strategies to reduce their tax liability, such as tax-efficient investments or retirement planning.

The Future of Real Estate Taxes in New Hampshire

The future of real estate taxes in New Hampshire is intertwined with the state’s economic growth, demographic changes, and evolving needs for public services. As the state’s population continues to grow and diversify, the demand for public services is likely to increase, potentially leading to higher tax rates to fund these services.

Additionally, changes in the national and global economic landscape can impact New Hampshire's real estate market, which in turn can influence property values and tax assessments. For instance, a thriving economy could lead to higher property values and increased tax revenue, while a downturn could result in lower assessments and reduced tax income.

Furthermore, the state's commitment to maintaining a balanced budget and its unique tax structure, which lacks a broad-based income tax, mean that real estate taxes will likely continue to play a significant role in funding public services. This makes it essential for property owners and investors to stay informed about tax policies and changes that could impact their financial obligations.

Conclusion

In conclusion, New Hampshire’s real estate tax system is a critical component of the state’s fiscal framework, impacting property ownership, investment decisions, and the provision of public services. Understanding this system, its nuances, and its potential future directions is essential for anyone with an interest in New Hampshire’s real estate market.

As we've explored, the system is influenced by a variety of factors, from local government policies to economic trends and demographic shifts. By staying informed and proactive, property owners and investors can navigate this landscape effectively, ensuring their financial obligations are managed efficiently and their long-term goals are supported.

Frequently Asked Questions

What is the average real estate tax rate in New Hampshire?

+

The average tax rate in New Hampshire varies significantly depending on the municipality. It typically ranges from 1% to 3%, but some areas may have higher or lower rates. It’s important to check with the local assessor’s office for specific tax rates in a particular town or city.

Are there any tax incentives or abatements for new construction in New Hampshire?

+

Yes, New Hampshire offers a temporary tax abatement for new construction or substantial improvements to existing properties. This abatement is designed to encourage economic development and can provide significant savings for property owners. The specific terms and eligibility criteria can vary by municipality, so it’s advisable to consult with the local assessor’s office for detailed information.

How often are properties reassessed for tax purposes in New Hampshire?

+

Property reassessments in New Hampshire typically occur on a cyclical basis, generally every three to five years. However, this can vary by municipality, and some towns may conduct reassessments more frequently. It’s important for property owners to stay informed about the assessment schedule in their area and to ensure that any changes to their property, such as additions or renovations, are reported to the local assessor’s office.

Can I appeal my property assessment if I believe it’s inaccurate?

+

Yes, property owners in New Hampshire have the right to appeal their property assessments if they believe the assessed value is incorrect. The appeals process can vary by municipality, but it typically involves a review by an independent board or a formal hearing before a local court. It’s advisable to consult with a real estate attorney or tax professional for guidance on the appeals process.

Are there any exemptions or abatements for senior citizens in New Hampshire?

+

Yes, New Hampshire offers various exemptions and abatements for senior citizens. The Elderly Tax Relief program provides a credit against property taxes for homeowners aged 65 and older with limited income. Additionally, there are other programs such as the Disabled Veterans’ Tax Abatement and the Open Space Abatement, which offer tax reductions for specific groups. It’s recommended to consult with the local assessor’s office to understand the eligibility criteria and application process for these exemptions.