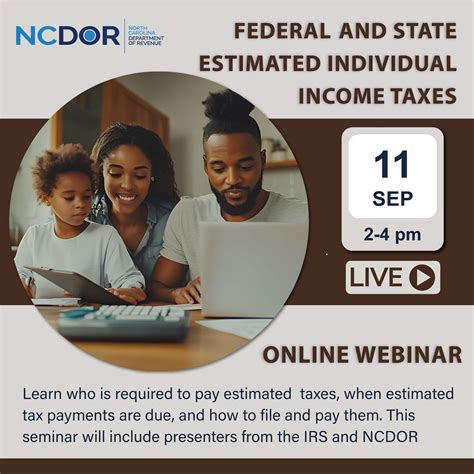

Ncdor Pay Taxes

In the world of tax administration, the North Carolina Department of Revenue (NCDOR) plays a pivotal role in ensuring compliance and facilitating the collection of taxes within the state. For individuals and businesses alike, understanding the processes and options available through the NCDOR is essential for meeting their tax obligations efficiently and accurately.

Unraveling the NCDOR: A Comprehensive Guide to Paying Taxes in North Carolina

The NCDOR serves as the guardian of tax compliance in North Carolina, providing a comprehensive suite of services to assist taxpayers in navigating the complex landscape of state taxes. From individual income taxes to corporate franchise taxes, the NCDOR offers resources and tools to ensure timely and accurate filing.

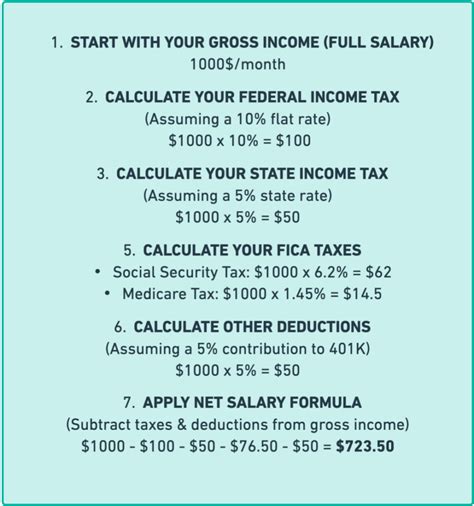

Individual Taxpayers: Navigating Personal Income Taxes

For North Carolina residents, understanding the state’s income tax structure is crucial. The NCDOR provides detailed guidelines and resources to help individuals calculate their taxable income, deductions, and credits accurately. The department offers online tools and tax forms to facilitate the filing process, ensuring a seamless experience for taxpayers.

Key considerations for individual taxpayers include:

- Tax Rates and Brackets: North Carolina has a progressive tax system with multiple tax brackets. Understanding the applicable tax rate based on income level is essential for accurate filing.

- Deductions and Credits: The state offers various deductions and credits, such as the standard deduction, itemized deductions, and tax credits for specific circumstances. These can significantly impact an individual’s tax liability.

- Filing Status: The NCDOR recognizes different filing statuses, including single, married filing jointly, and head of household. The chosen status can affect the applicable tax rates and deductions.

Business Taxes: Corporate and Business Entity Compliance

Businesses operating in North Carolina are subject to a range of tax obligations, including corporate income taxes, sales and use taxes, and various other business-related taxes. The NCDOR provides dedicated resources and guidance to assist businesses in meeting these requirements.

Key aspects of business taxes include:

- Corporate Income Tax: Corporations doing business in North Carolina are subject to corporate income tax. The NCDOR offers guidance on calculating taxable income, deductions, and tax credits specific to corporate entities.

- Sales and Use Tax: Businesses involved in the sale of goods or services must register for and collect sales tax. The NCDOR provides resources to help businesses understand their sales tax obligations and the proper collection and remittance procedures.

- Other Business Taxes: Depending on the nature of the business, entities may be subject to additional taxes such as franchise taxes, privilege taxes, or specific industry-related taxes. The NCDOR offers detailed information and resources to assist businesses in complying with these requirements.

Payment Options and Taxpayer Assistance

The NCDOR recognizes that taxpayers may face challenges in meeting their tax obligations. As such, the department offers a range of payment options and taxpayer assistance programs to help individuals and businesses navigate financial difficulties.

Available resources include:

- Payment Plans: Taxpayers unable to pay their tax liabilities in full can apply for payment plans, allowing them to make installment payments over an extended period. The NCDOR offers guidance on eligibility and the application process.

- Taxpayer Assistance Programs: The department provides dedicated assistance to taxpayers facing financial hardships or complex tax situations. These programs offer personalized guidance and support to ensure compliance and minimize penalties.

- Online Payment Options: For convenience, the NCDOR offers online payment portals, allowing taxpayers to make secure payments using credit or debit cards, electronic checks, or direct bank transfers.

Tax Filing Deadlines and Extensions

Timely filing is a critical aspect of tax compliance. The NCDOR sets specific deadlines for tax filings, and taxpayers must adhere to these timelines to avoid penalties and interest charges.

Key considerations regarding filing deadlines include:

- Income Tax Filing Deadline: The standard deadline for filing North Carolina income tax returns is typically aligned with the federal tax filing deadline. Taxpayers should be aware of any changes or extensions to this deadline.

- Extension Requests: In cases where taxpayers are unable to meet the filing deadline, the NCDOR allows for extension requests. Filing an extension provides additional time to prepare and file tax returns but does not extend the deadline for paying any taxes owed.

Staying Informed: Tax Updates and News

Tax laws and regulations are subject to change, and taxpayers must stay informed to ensure compliance with the latest requirements. The NCDOR provides regular updates and news through its website and official communications channels.

Staying informed involves:

- Monitoring Tax Updates: The NCDOR website provides a dedicated section for tax news and updates, including any changes to tax laws, regulations, or procedures. Taxpayers should regularly check this section to stay abreast of the latest developments.

- Subscribing to Newsletters: The department offers newsletter subscriptions, providing periodic updates on tax-related matters directly to taxpayers’ inboxes. This ensures that taxpayers receive timely information without having to actively search for updates.

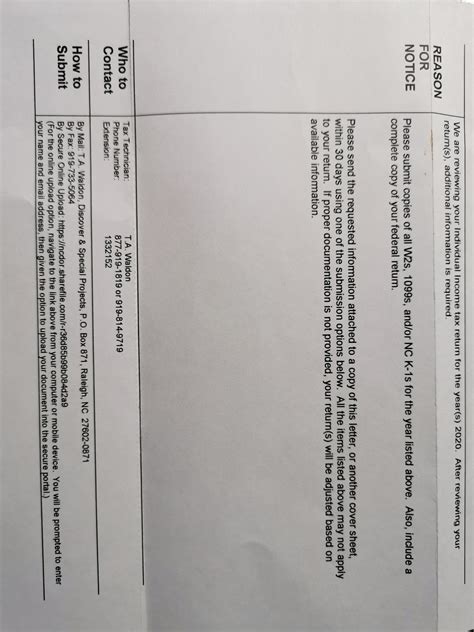

NCDOR’s Role in Tax Enforcement and Compliance

While the NCDOR primarily focuses on assisting taxpayers in meeting their obligations, it also plays a critical role in enforcing tax laws and ensuring compliance. The department has the authority to audit tax returns, investigate non-compliance, and impose penalties for violations.

Key aspects of the NCDOR’s enforcement role include:

- Audits: The NCDOR conducts audits to verify the accuracy of tax returns and ensure compliance with tax laws. Taxpayers selected for an audit should cooperate fully and provide the necessary documentation to facilitate the process.

- Penalty and Interest Charges: Failure to meet tax obligations on time or accurately can result in penalty and interest charges. The NCDOR assesses these charges based on the nature and severity of the violation.

- Appeals and Dispute Resolution: Taxpayers who disagree with the NCDOR’s assessments or enforcement actions have the right to appeal. The department provides a structured appeals process, allowing taxpayers to present their case and seek a resolution.

| Tax Type | Filing Deadline |

|---|---|

| Individual Income Tax | Typically aligned with federal deadline (April 15th) |

| Corporate Income Tax | Typically 3 months after the fiscal year-end |

| Sales and Use Tax | Monthly, quarterly, or annually, depending on registration status |

Conclusion: Empowering Taxpayers with Knowledge and Resources

Navigating the world of taxes can be complex, but the NCDOR strives to provide the necessary tools and resources to empower taxpayers in North Carolina. By understanding the state’s tax landscape, taxpayers can make informed decisions, comply with their obligations, and take advantage of the assistance programs available to them.

As taxpayers navigate the ever-changing tax environment, staying informed and seeking professional advice when needed is essential. The NCDOR’s commitment to taxpayer education and assistance ensures that individuals and businesses can thrive while meeting their tax responsibilities.

What is the North Carolina Department of Revenue (NCDOR)?

+The NCDOR is the state agency responsible for administering and enforcing tax laws in North Carolina. It collects various taxes, including income tax, sales tax, and corporate taxes, to fund state programs and services.

How can I pay my taxes to the NCDOR?

+The NCDOR offers multiple payment options, including online payments through their website, payments by phone, and traditional mail-in payments. Taxpayers can choose the method that best suits their preferences and circumstances.

Are there any payment plans available for taxpayers struggling to pay their taxes in full?

+Yes, the NCDOR recognizes that taxpayers may face financial challenges. It offers payment plans to allow taxpayers to pay their tax liabilities in installments. Eligibility and application details can be found on the NCDOR website.

What happens if I miss the tax filing deadline?

+Missing tax filing deadlines can result in penalties and interest charges. It’s crucial to stay informed about the specific deadlines for your tax type and consider requesting an extension if you cannot meet the original deadline.

Where can I find more information and resources to help me understand my tax obligations in North Carolina?

+The NCDOR website is an excellent resource, providing detailed information on various taxes, filing requirements, and payment options. Additionally, taxpayers can seek professional tax advice or consult reputable online tax resources for further guidance.