Nc Property Tax Lookup

Discover the intricacies of property taxes in North Carolina with our comprehensive guide. Understanding property taxes is essential for homeowners and investors alike, as they significantly impact financial planning and decision-making. In this article, we will delve into the details of the Nc Property Tax Lookup system, exploring how it works, its key features, and its implications for property owners.

Unraveling the Nc Property Tax Lookup System

The Nc Property Tax Lookup is a vital tool for property owners and stakeholders in North Carolina. It provides a transparent and accessible platform for understanding property tax assessments, rates, and payments. By utilizing this system, individuals can gain insights into the financial obligations associated with their real estate holdings.

Key Features and Benefits

The Nc Property Tax Lookup system offers a range of features designed to enhance the property tax experience for North Carolina residents:

- Property Search: Users can easily locate their property by address, parcel number, or owner name. This search functionality ensures quick and accurate access to relevant tax information.

- Assessment Details: The system provides comprehensive details about property assessments, including land value, improvements, and total assessed value. Property owners can review these assessments to ensure accuracy and fairness.

- Tax Rates and Calculations: Nc Property Tax Lookup calculates tax liabilities based on the assessed value and applicable tax rates. This feature offers transparency and helps property owners understand the factors influencing their tax obligations.

- Payment Options: The system outlines various payment methods, including online payments, e-check, credit card, and traditional mail-in options. Property owners can choose the most convenient and cost-effective payment method for their circumstances.

- Payment History: A detailed payment history is available, allowing property owners to track past payments, due dates, and any penalties or interest incurred. This feature promotes financial accountability and helps individuals stay on top of their tax obligations.

- Tax Exemptions and Discounts: The system provides information on available tax exemptions and discounts, such as homestead exemptions, military discounts, and senior citizen reductions. Property owners can explore these options to potentially reduce their tax liabilities.

- Appeal Process: In cases where property owners disagree with their assessment or tax calculation, the Nc Property Tax Lookup system outlines the appeal process. It provides step-by-step guidance on how to initiate and navigate the appeal, ensuring a fair and transparent resolution.

These features collectively empower property owners in North Carolina to take control of their property tax obligations, make informed decisions, and ensure compliance with local regulations.

Real-World Example: A Case Study

Let’s consider the scenario of a homeowner, Mr. Johnson, who recently purchased a property in Raleigh, North Carolina. Using the Nc Property Tax Lookup system, he discovers the following details about his property:

| Property Address | Assessment Value | Tax Rate | Estimated Annual Taxes |

|---|---|---|---|

| 123 Main Street, Raleigh, NC | $300,000 | 0.75% | $2,250 |

Based on this information, Mr. Johnson can calculate his estimated annual property taxes and plan his financial strategy accordingly. The system's transparency and accessibility empower him to make informed decisions and stay on top of his tax obligations.

Understanding Property Tax Assessments in North Carolina

Property tax assessments are a critical component of the Nc Property Tax Lookup system. These assessments determine the value of a property for tax purposes and are conducted by local tax assessors. Understanding how assessments are made and their implications is crucial for property owners.

Assessment Process

The assessment process in North Carolina involves the following key steps:

- Data Collection: Tax assessors gather information about properties, including size, location, improvements, and recent sales data. This data is used as a basis for valuation.

- Valuation Methods: Assessors employ various valuation methods, such as the sales comparison approach, cost approach, and income approach, to estimate the fair market value of a property.

- Adjustment and Equalization: Assessors adjust property values to ensure uniformity and fairness across similar properties. They also apply equalization rates to ensure that tax burdens are distributed equitably among taxpayers.

- Notice of Assessment: Property owners receive a notice of assessment, which includes the assessed value and any changes from the previous year. This notice provides an opportunity for property owners to review and dispute the assessment if they believe it is inaccurate.

Factors Affecting Property Tax Assessments

Several factors influence property tax assessments in North Carolina. These factors include:

- Property Type: Different property types, such as residential, commercial, or agricultural, may have different assessment methods and tax rates.

- Location: Property values can vary significantly based on factors like neighborhood, school district, and proximity to amenities or natural resources.

- Recent Sales: Assessors consider recent sales of comparable properties to determine the fair market value of a given property.

- Improvements and Renovations: Any improvements or renovations made to a property can impact its assessed value, as these additions increase the property's overall value.

- Economic Conditions: Local economic factors, such as employment rates, population growth, and market trends, can influence property values and, consequently, tax assessments.

Navigating Property Tax Payments and Due Dates

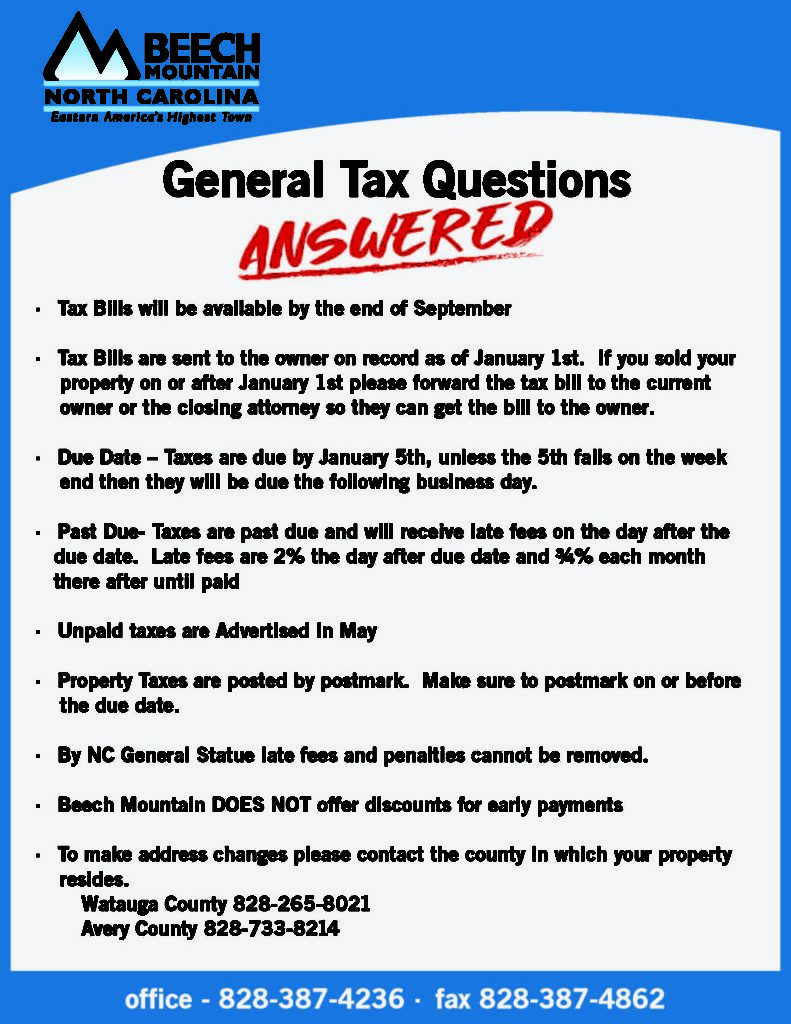

Understanding the payment process and due dates for property taxes is essential to avoid late fees and penalties. The Nc Property Tax Lookup system provides clear guidance on payment options and deadlines.

Payment Options

North Carolina offers a variety of payment methods to accommodate different preferences and circumstances:

- Online Payments: Property owners can make secure online payments through the Nc Property Tax Lookup system. This option provides real-time confirmation and convenience.

- E-Check: Electronic check payments are an alternative to online payments, allowing property owners to pay directly from their bank account.

- Credit Card Payments: For those who prefer credit card payments, the system accepts major credit cards, offering a quick and secure payment method.

- Mail-In Payments: Traditional mail-in payments are also accepted, providing flexibility for property owners who prefer this method.

Payment Due Dates

Property tax payments in North Carolina typically have two due dates per year, with the specific dates varying by county. It is essential for property owners to stay informed about their respective due dates to ensure timely payments.

For example, in Wake County, the first half of property taxes is due on September 1st, while the second half is due on January 5th of the following year. Other counties may have different due dates, so property owners should refer to their local tax office for accurate information.

Late Payment Penalties

Late payment of property taxes can result in penalties and additional fees. It is crucial for property owners to be aware of these consequences and plan their payments accordingly.

In North Carolina, late payment penalties typically start accruing after the due date. The specific penalty rate may vary by county, but it is commonly set at a percentage of the unpaid tax amount. Property owners should check with their local tax office to understand the exact penalty structure and avoid any unnecessary financial burdens.

Appealing Property Tax Assessments

In cases where property owners believe their tax assessment is inaccurate or unfair, they have the right to appeal. The Nc Property Tax Lookup system provides a clear process for initiating and navigating the appeal process.

Reasons for Appeal

Property owners may consider appealing their assessment for various reasons, including:

- Overvaluation: If the assessed value of the property is significantly higher than its fair market value, property owners may have grounds for an appeal.

- Unequal Assessment: In cases where similar properties have significantly lower assessments, property owners may argue for equal treatment and a reduction in their assessment.

- Mistakes in Property Characteristics: If the assessment includes incorrect information about the property's size, improvements, or other characteristics, an appeal may be warranted.

- Change in Property Value: If the property's value has decreased due to factors such as damage, obsolescence, or market conditions, an appeal can be made to reflect the current value.

Appeal Process

The appeal process in North Carolina typically involves the following steps:

- Preliminary Review: Property owners should carefully review their assessment notice and compare it with their understanding of the property's value and characteristics. This step helps identify any discrepancies or errors.

- Notice of Appeal: If a property owner decides to appeal, they must submit a notice of appeal within a specified timeframe. This notice should include the reasons for the appeal and any supporting documentation.

- Informal Hearing: In most cases, an informal hearing is scheduled to discuss the appeal with the local tax assessor or their representative. This provides an opportunity for property owners to present their case and provide additional evidence.

- Formal Appeal: If the informal hearing does not result in a satisfactory resolution, property owners can proceed to a formal appeal process. This typically involves a hearing before a board of review or an independent assessment review board.

- Decision and Notification: The board of review or assessment review board will make a decision based on the evidence presented. Property owners will receive a written notification of the decision, which may include a reduction in assessment or a denial of the appeal.

It is important for property owners to carefully follow the appeal process guidelines and gather relevant evidence to support their case. Consulting with a tax professional or legal advisor can be beneficial during this process.

Future Implications and Potential Reforms

The property tax system in North Carolina is subject to ongoing discussions and potential reforms. While the current system provides transparency and accessibility, there are areas where improvements can be made to enhance fairness and efficiency.

Potential Reforms

Some potential reforms that have been proposed or considered include:

- Reassessment Frequency: Currently, property reassessments are conducted at varying intervals across different counties. A potential reform could involve implementing a uniform reassessment cycle, ensuring that all properties are assessed regularly and accurately.

- Assessment Accuracy: Efforts to improve assessment accuracy and consistency are ongoing. This may involve investing in advanced technology and training for tax assessors to enhance their valuation methods and reduce errors.

- Tax Relief Programs: Expanding or creating new tax relief programs can provide additional support to low-income homeowners or those facing financial hardship. These programs can help alleviate the burden of property taxes and promote homeownership.

- Online Services and Transparency: Further enhancements to the Nc Property Tax Lookup system can improve accessibility and transparency. This may include adding features such as real-time tax rate comparisons, interactive maps, and personalized tax estimate calculators.

- Appeal Process Streamlining: Simplifying the appeal process and providing clearer guidelines can make it more accessible and efficient for property owners. This may involve consolidating appeal procedures or offering online appeal submission options.

Community Engagement and Advocacy

Engaging with local government and community organizations is essential for driving positive change in the property tax system. Property owners and stakeholders can participate in public hearings, join advocacy groups, or attend town hall meetings to voice their concerns and suggestions.

By actively participating in the democratic process, individuals can influence policy decisions and contribute to the development of a fair and equitable property tax system in North Carolina.

Conclusion

The Nc Property Tax Lookup system serves as a valuable resource for property owners in North Carolina, offering transparency, accessibility, and a platform for understanding and managing property tax obligations. By leveraging this system and staying informed about property tax assessments, payments, and appeal processes, property owners can make informed decisions and actively participate in shaping a fair and efficient tax system.

As the property tax landscape continues to evolve, staying updated on potential reforms and engaging in community discussions will ensure that property owners can navigate the system effectively and advocate for their interests.

How often are property tax assessments conducted in North Carolina?

+Property tax assessments in North Carolina are conducted at varying intervals depending on the county. Some counties reassess properties annually, while others reassess every two to four years. It is important for property owners to be aware of their county’s reassessment schedule to ensure they stay informed about any changes.

Can property owners request a reassessment of their property?

+Yes, property owners have the right to request a reassessment if they believe their property’s value has changed significantly. However, it is important to note that reassessments are typically conducted based on specific criteria and timelines set by the local tax assessor’s office. Property owners should contact their local tax office to inquire about the process and eligibility for a reassessment.

Are there any tax exemptions available for property owners in North Carolina?

+Yes, North Carolina offers several tax exemptions to eligible property owners. These include homestead exemptions for primary residences, military exemptions for active-duty military personnel, and senior citizen exemptions for homeowners aged 65 and older. It is advisable for property owners to research and understand the eligibility criteria for these exemptions to potentially reduce their tax liabilities.

What happens if property taxes are not paid on time in North Carolina?

+If property taxes are not paid by the due date, late payment penalties and interest may accrue. Additionally, failure to pay property taxes can result in tax liens being placed on the property, which can impact its ownership and resale value. Property owners should prioritize timely payments to avoid these consequences and maintain good standing with the local tax office.

How can property owners stay informed about changes in property tax rates and assessments?

+Property owners can stay informed by regularly checking the Nc Property Tax Lookup system, which provides up-to-date information on tax rates, assessments, and any changes or updates. Additionally, local tax offices often publish news and updates on their websites or through newsletters. Subscribing to these sources and staying engaged with local government communications can help property owners stay informed.