Nashville Tax

Welcome to this comprehensive guide on Nashville Tax, an essential aspect of doing business in Nashville, Tennessee. Understanding the local tax landscape is crucial for entrepreneurs, investors, and professionals looking to navigate the city's economic ecosystem. In this article, we will delve into the intricacies of Nashville's tax system, providing you with the knowledge and insights to make informed financial decisions.

Understanding Nashville’s Tax Structure

Nashville, the vibrant capital of Tennessee, boasts a thriving economy and a unique tax structure that plays a significant role in its fiscal policies. The city’s tax system is designed to support its diverse business landscape, from startups to established corporations, while contributing to the overall economic growth and development.

Nashville's tax structure is a combination of local, state, and federal taxes, each with its own set of rules and regulations. Let's break down these components to gain a clearer understanding of how they work together.

Local Taxes

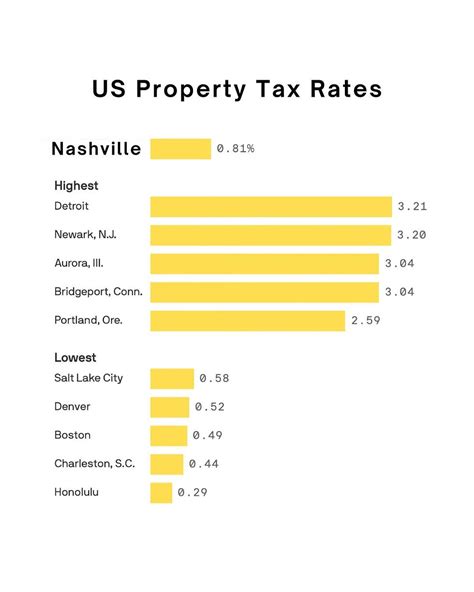

At the local level, Nashville imposes various taxes to fund city services and infrastructure projects. The city’s property tax rate is a notable component, with assessments based on the value of real estate properties. Additionally, Nashville levies a sales and use tax on goods and services purchased within the city limits. This tax contributes to the city’s revenue stream and is often a significant source of funding for local initiatives.

Another unique aspect of Nashville's local tax system is the Franchise Tax, applicable to businesses operating within the city. This tax is calculated based on a company's net worth and provides a steady stream of revenue for the city's operations. Nashville's Franchise Tax is an important consideration for businesses looking to establish a presence in the city.

Furthermore, Nashville imposes Business Privilege Taxes on certain business activities, such as wholesale and retail operations. These taxes vary depending on the nature of the business and are designed to support the city's business-friendly environment while generating essential revenue.

| Local Tax Category | Rate/Assessment |

|---|---|

| Property Tax | Varies based on property value |

| Sales and Use Tax | 9.25% (including state and local rates) |

| Franchise Tax | Varies based on net worth |

| Business Privilege Tax | Varies by business activity |

State Taxes

Tennessee, the state in which Nashville is located, has its own set of tax regulations that impact businesses and individuals alike. The state’s tax system is relatively business-friendly, with no personal income tax and a competitive corporate tax rate.

The Tennessee Sales and Use Tax is a significant source of revenue for the state. This tax applies to the sale or lease of tangible personal property and certain services. The state's sales tax rate is currently set at 7%, with additional local taxes bringing the total rate to 9.25% in Nashville.

In addition to sales tax, Tennessee imposes a Franchise and Excise Tax on businesses. This tax is calculated based on a company's net earnings or capital stock value, depending on the type of business entity. The rate for this tax varies, with a minimum payment required for certain entities.

Tennessee also has a Hall Income Tax, applicable to certain types of investment income, including dividends and interest. This tax is levied at a rate of 1% and is an important consideration for individuals and businesses with investment holdings.

| State Tax Category | Rate/Assessment |

|---|---|

| Sales and Use Tax | 7% (state rate) + Local Taxes |

| Franchise and Excise Tax | Varies based on net earnings or capital stock value |

| Hall Income Tax | 1% |

Federal Taxes

At the federal level, businesses and individuals in Nashville are subject to the comprehensive tax system administered by the Internal Revenue Service (IRS). This includes income taxes, payroll taxes, and various other federal levies.

The Federal Income Tax is a progressive tax system, meaning tax rates increase as income rises. Businesses and individuals in Nashville are required to file federal tax returns annually, with tax rates varying based on income brackets and filing status.

Payroll taxes, such as Social Security and Medicare taxes, are also a significant component of the federal tax system. These taxes fund social welfare programs and are typically split between employers and employees.

Additionally, Nashville businesses may be subject to federal excise taxes on specific goods and services, such as fuel, communications, and environmental taxes. These taxes are often passed on to consumers through increased prices.

| Federal Tax Category | Rate/Assessment |

|---|---|

| Federal Income Tax | Progressive tax rates based on income |

| Payroll Taxes | Social Security: 6.2% (employee), 6.2% (employer) Medicare: 1.45% (employee), 1.45% (employer) |

| Excise Taxes | Varies based on specific goods and services |

Tax Incentives and Benefits in Nashville

Nashville is renowned for its vibrant music scene, but it’s also a city that offers a range of tax incentives and benefits to attract and support businesses. These incentives are designed to encourage economic growth, job creation, and investment in the city.

Business Tax Credits

Nashville provides a variety of tax credits to eligible businesses, helping them offset their tax liabilities. These credits are often tied to specific economic development goals, such as job creation or investment in underserved areas.

One notable tax credit is the Nashville Music Business Incentive, which aims to support the city's iconic music industry. This credit provides a tax incentive for businesses that create new jobs in the music sector, contributing to Nashville's reputation as Music City.

Additionally, the Tennessee Jobs Act offers a range of tax credits for businesses that create new jobs and invest in capital improvements. This act is designed to encourage economic growth and make Tennessee an attractive location for businesses.

Enterprise Zones and Incentives

Nashville has designated specific Enterprise Zones within the city, offering enhanced tax incentives to businesses that operate in these areas. These zones are typically located in economically distressed areas and aim to stimulate growth and development.

Businesses operating in Nashville's Enterprise Zones may be eligible for tax credits, reduced tax rates, and other incentives. These incentives can significantly reduce a business's tax burden and make it more competitive in the local market.

Small Business Programs

Nashville is committed to supporting small businesses, which are the backbone of the city’s economy. As such, the city offers a range of programs and initiatives to assist small businesses with their tax obligations and overall financial health.

The Nashville Small Business Center provides resources and guidance to help small businesses navigate the tax landscape. This includes assistance with tax registration, compliance, and understanding tax incentives specific to small businesses.

Nashville also offers Small Business Tax Workshops, where experts provide in-depth training and advice on tax-related matters. These workshops cover topics such as tax planning, record-keeping, and maximizing tax benefits.

Tax Compliance and Filing in Nashville

Navigating Nashville’s tax landscape requires a solid understanding of the city’s tax compliance requirements and deadlines. Let’s explore the key aspects of tax compliance and filing in Nashville.

Registration and Licensing

Before conducting business in Nashville, it’s essential to register and obtain the necessary licenses and permits. The Nashville Business Licensing and Permits office is the primary resource for businesses to obtain the required documentation.

Businesses must register for local, state, and federal tax purposes, which includes obtaining an Employer Identification Number (EIN) from the IRS. This unique identifier is crucial for tax compliance and reporting.

Tax Deadlines and Filing Requirements

Nashville, like other jurisdictions, has specific tax deadlines and filing requirements. Understanding these deadlines is crucial to avoid penalties and maintain good standing with tax authorities.

For local taxes, such as the Nashville Business Tax, businesses must file returns and make payments by the specified due dates. Late filings may result in penalties and interest charges.

State tax deadlines in Tennessee vary depending on the type of tax. For example, the Tennessee Franchise and Excise Tax has a due date of the 15th day of the 3rd month after the close of the tax year. It's important for businesses to stay informed about these deadlines to ensure timely compliance.

Federal tax deadlines are also critical. Businesses must file their federal income tax returns and make payments by the 15th day of the 4th month after the close of their tax year. For calendar year filers, this deadline typically falls in April.

Tax Forms and Reporting

Nashville, Tennessee, and the federal government each have their own set of tax forms and reporting requirements. Businesses must use the appropriate forms to report their income, expenses, and other relevant information.

For local taxes, Nashville provides specific tax forms, such as the Nashville Business Tax Return, which businesses must complete and submit by the due date. These forms may vary depending on the type of business and its activities.

Tennessee also has its own set of tax forms, including the Tennessee Franchise and Excise Tax Return and the Tennessee Sales and Use Tax Return. These forms are available through the Tennessee Department of Revenue and must be completed accurately to avoid penalties.

At the federal level, businesses use IRS forms such as the Form 1120 (U.S. Corporation Income Tax Return) or Form 1065 (U.S. Return of Partnership Income), depending on their business structure. These forms are essential for reporting income, deductions, and credits to the IRS.

Nashville’s Tax Impact on Businesses

Understanding the impact of Nashville’s tax system on businesses is crucial for financial planning and strategic decision-making. Let’s explore how Nashville’s tax landscape affects businesses, both large and small.

Tax Burden on Businesses

Nashville’s tax structure, while designed to support the city’s economy, can also present a significant burden for businesses. The combination of local, state, and federal taxes can impact a business’s bottom line, especially for smaller enterprises with limited resources.

The Nashville Business Tax, for instance, can be a substantial expense for businesses, particularly those with a large physical presence in the city. This tax is based on a company's gross receipts, meaning it can quickly add up for businesses with high sales volumes.

Additionally, the Tennessee Franchise and Excise Tax, while providing revenue for the state, can be a challenge for businesses, especially those with high net earnings. This tax is often a significant consideration when planning a business's financial strategy.

Impact on Business Operations

Nashville’s tax system can influence various aspects of a business’s operations. For example, the Sales and Use Tax can impact a business’s pricing strategy, as businesses often pass this tax on to consumers. This can affect a business’s competitive position in the market.

The Franchise Tax, while a source of revenue for Nashville, can also impact a business's financial planning. Businesses must carefully consider this tax when forecasting their financial performance and budgeting for the future.

Furthermore, the tax incentives and benefits offered by Nashville can significantly impact a business's decision to locate or expand in the city. These incentives can reduce a business's tax burden, making it more competitive and enhancing its overall financial health.

Tax Planning and Strategies

Effective tax planning is crucial for businesses operating in Nashville. By understanding the city’s tax landscape and implementing strategic tax planning, businesses can minimize their tax liabilities and maximize their financial resources.

One key strategy is to take advantage of the tax incentives and benefits offered by Nashville. By locating in Enterprise Zones or participating in programs like the Nashville Music Business Incentive, businesses can reduce their tax burden and enhance their financial position.

Additionally, businesses can explore tax-efficient structures and strategies, such as optimizing their business entity type or utilizing tax-deductible expenses. These strategies can help businesses minimize their tax obligations and free up resources for investment and growth.

Working with tax professionals who are familiar with Nashville's tax system can be invaluable. These experts can provide guidance on tax compliance, planning, and strategies tailored to a business's specific needs and goals.

Nashville’s Tax Environment: A Case Study

To illustrate the impact of Nashville’s tax system on businesses, let’s consider a hypothetical case study of a small business, Nashville Tech Solutions, a tech startup specializing in software development.

Nashville Tech Solutions has recently established its headquarters in Nashville, drawn by the city's thriving tech scene and supportive business environment. The company employs 20 individuals and has an annual revenue of $2 million.

Tax Burden Analysis

As a new business in Nashville, Nashville Tech Solutions must navigate the city’s tax landscape. The company’s tax obligations include local, state, and federal taxes, each with its own set of rules and rates.

At the local level, Nashville Tech Solutions is subject to the Nashville Business Tax, which is based on the company's gross receipts. With an annual revenue of $2 million, the business tax liability is substantial, amounting to $40,000 annually.

The company is also subject to the Tennessee Franchise and Excise Tax, which is calculated based on net earnings. With a net profit of $500,000, Nashville Tech Solutions is liable for a tax amount of $25,000.

Additionally, the company must pay the Tennessee Sales and Use Tax on its purchases and the Federal Income Tax on its profits. These taxes further contribute to the company's overall tax burden.

| Tax Category | Tax Rate/Assessment | Annual Liability |

|---|---|---|

| Nashville Business Tax | Varies based on gross receipts | $40,000 |

| Tennessee Franchise and Excise Tax | Varies based on net earnings | $25,000 |

| Tennessee Sales and Use Tax | 7% (state rate) + Local Taxes | Varies based on purchases |

| Federal Income Tax | Progressive tax rates based on income | Varies based on net profit |

Tax Incentives and Strategies

To mitigate its tax burden, Nashville Tech Solutions explores the tax incentives and strategies available to small businesses in Nashville.

The company considers locating in one of Nashville's Enterprise Zones, which would provide tax credits and reduced tax rates. This move could significantly reduce the company's tax liability, making it more competitive and allowing for greater investment in its operations.

Additionally, Nashville Tech Solutions explores the Nashville Music Business Incentive, which could provide tax credits for job creation. As a tech startup, the company may not traditionally qualify for this incentive, but by collaborating with local music businesses, it could potentially access these benefits.

Working with tax professionals, Nashville Tech Solutions develops a comprehensive tax strategy. This strategy includes optimizing the company's business structure, utilizing tax-deductible expenses, and exploring tax-efficient investment opportunities. By implementing these strategies, the company aims to minimize its tax burden and maximize its financial resources.

Future of Nashville’s Tax Landscape

As Nashville continues to evolve and grow, its tax