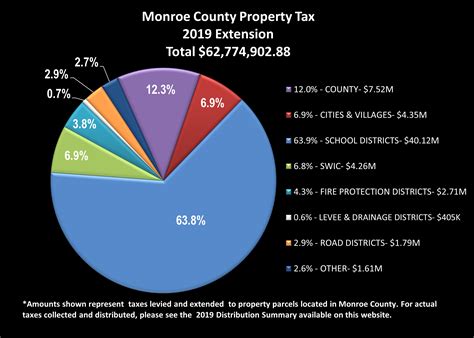

Did You Know Monroe County Taxes Fund Over 80% of Local Schools

Amid the broad landscape of American local governance and public education funding, a question persists beneath the surface: How heavily dependent are Monroe County’s schools on local tax revenue, and what does this reliance reveal about broader educational equity and fiscal policies? As school districts grapple with fluctuating budgets and community demands, understanding the intricate web of taxation and its role in supporting educational infrastructure becomes crucial. When over 80% of school funding in Monroe County originates from local taxes, it prompts reflection on the implications for resource disparities, policy priorities, and the future sustainability of public education in the region.

Exploring the Structural Dependence of Monroe County Schools on Local Tax Revenue

Monroe County, a pivotal hub in the northeastern United States with a diverse demographic profile and a broad economic base, presents an emblematic case of local funding dominance for education. According to the latest fiscal reports, approximately 83% of the operating budgets for Monroe County’s public schools are sourced from local property taxes. This high percentage underscores a foundational characteristic of many American school districts—the reliance on local revenue streams to fund schools fully or substantially.

Property taxes, being the primary source, create a direct link between local economic health and education quality. As property values fluctuate, so too does the potential for district funding, influencing everything from teacher salaries to infrastructure upgrades and extracurricular offerings. While state and federal funding supplement local budgets, the weight of local taxation remains the backbone of Monroe County’s educational financing structure.

This autoresponse naturally raises questions about regional economic disparity. Neighborhoods with high property values generate more revenue, which sometimes leads to a socioeconomic stratification of school resources. Conversely, less affluent communities may struggle to generate sufficient funds, fostering a cycle of inequality that can undermine educational equity across Monroe County.

The Historical Evolution of Monroe County’s Funding Model

The reliance on property tax-based funding for schools in Monroe County traces back several decades. Historically, local governments have maintained a “home rule” approach, empowering municipalities to fund their schools largely through local taxes aligned with property values. This model, originating from early 20th-century reforms intended to decentralize education funding, has both advantages and pitfalls.

On the positive side, local funding fosters community involvement and ensures that taxpayers directly support the institutions their children attend. However, the drawbacks become evident in areas where property wealth is unevenly distributed, leading to funding disparities that perpetuate educational inequities. The evolution of Monroe County’s fiscal policies underscores an ongoing debate about balancing local control with equitable resource distribution.

| Relevant Category | Substantive Data |

|---|---|

| Percentage of School Funding from Local Taxes | 83% in Monroe County, as per latest fiscal year |

| Median Property Value | $250,000, with notable disparities among districts |

| Per-Student Spending Variation | Range from $12,000 to $22,000, correlating with local property wealth |

Implications of Heavy Local Tax Dependency for Educational Equity

The structural reliance on local property taxes unquestionably informs the resource landscape within Monroe County’s schools. When over 80% of funding depends on local taxation, several critical issues emerge:

- Resource Disparities: Wealthier districts amass significantly more resources, attracting high-quality teachers, cutting-edge technology, and robust extracurricular programs. In contrast, poorer districts might struggle to meet basic operational needs, reinforcing achievement gaps and limiting social mobility.

- Vulnerability to Economic Fluctuations: During economic downturns or real estate market slumps, local revenues decline. This volatility can lead to mid-year budget cuts, staffing reductions, or deferred maintenance, disrupting educational continuity.

- Policy Challenges: State policymakers face pressure to implement equitable funding formulas, yet local dependence complicates efforts to standardize educational quality. The tension between community control and statewide fairness remains at the core of funding debates.

The Role of State Policy and Interventions

In response to these challenges, many states—including those overseeing Monroe County—have experimented with funding equalization strategies. These include redistribution formulas, targeted grants, and limits on local tax rates to prevent extreme disparities. However, the effectiveness of such measures is often limited by political resistance, legal constraints, and ongoing debates about local sovereignty.

For example, recent legislation aims to implement a weighted student funding system, which adjusts allocations based on factors like special needs or socioeconomic status. Still, the success of these initiatives depends heavily on transparent implementation and community buy-in. For Monroe County, or any region with high local tax reliance, balancing autonomy and equity remains an ongoing challenge.

| Funding Policy | Impact |

|---|---|

| Weighted Student Funding | Potentially reduces disparities by allocating more funds per high-need student |

| State Equalization Grants | Supplements low-revenue districts, but often insufficient alone |

| Tax Rate Caps | Limit local revenue but may restrict district growth |

Future Trajectories and Policy Debates

Looking forward, Monroe County’s fiscal landscape for school funding is poised at a crossroads. The persistent dependence on local tax revenue offers both advantages of community relevance and disadvantages of inequity. With national trends emphasizing educational equity and sustainable funding, key questions arise:

- Will state governments expand mechanisms for funding equalization to mitigate disparities?

- Can innovative tax policies or regional funding pools create more equitable resource distribution?

- What role will federal policy play in supporting districts vulnerable to economic downturns?

Furthermore, rising property values and demographic shifts could either exacerbate or alleviate resource gaps, depending on policy choices. The possibility of shifting towards more progressive or shared revenue models could realign Monroe County’s educational funding landscape toward greater fairness without sacrificing local control.

Community Engagement and Policy Reform

Amid these complex dynamics, community stakeholders—parents, educators, policymakers—must advocate for balanced solutions. Initiatives like transparent budgeting, community-led oversight committees, and public awareness campaigns can foster greater accountability and public trust. Ultimately, the sustainability of Monroe County’s educational ecosystem depends on coordinated efforts that recognize the intertwined nature of economic health and educational quality.

Key Points

- Over 80% of Monroe County schools' funding comes from local property taxes, tying education resources directly to local economic conditions.

- This dependence fuels resource disparities, impacting equity and educational outcomes across districts.

- Economic volatility threatens budget stability, pressing for innovative and equitable policy solutions.

- State and federal interventions—funding models, grants, policy reforms—are critical to balancing local autonomy with fairness.

- Community engagement remains vital for sustainable reform and ensuring all students access quality education regardless of socioeconomic background.

How does reliance on local taxes affect school funding equality?

+Heavy dependence on local property taxes creates disparities because districts with higher property values generate more revenue, leading to unequal educational resources across communities.

Are there successful models to mitigate funding inequities in Monroe County?

+Some states use funding formulas that redistribute resources based on need, but their success varies. Monroe County could benefit from regional cooperation and state-level grants aimed at equalization.

What role can federal policy play in threatening or alleviating these disparities?

+Federal funding can provide supplementary resources and conditional grants that support low-income districts, helping offset local revenue deficits and promoting equity in access and quality.