Minnesota's mn state income tax was among the first to adopt a progressive tax system

When examining the evolution of state tax policies in the United States, Minnesota’s adoption of a progressive income tax system in the early 20th century stands out as a pioneering move. As one of the first states to implement such a system, Minnesota set a precedent that would influence tax policy debates across the nation. Understanding the historical context, policy design, and socioeconomic impacts of this shift reveals not only the mechanics of progressive taxation but also the nuanced debates surrounding equity, economic growth, and fiscal sustainability at the state level.

Historical Context and Founding Principles of Minnesota’s Progressive Income Tax

In the late 19th and early 20th centuries, Minnesota was transitioning from an agrarian economy to a more industrialized one, prompting policymakers to reconsider how to generate revenue fairly and efficiently. The state’s initial income tax, enacted in 1933, marked a significant departure from flat or regressive tax structures, aligning with broader Progressive Era ideals that emphasized fairness and redistribution.

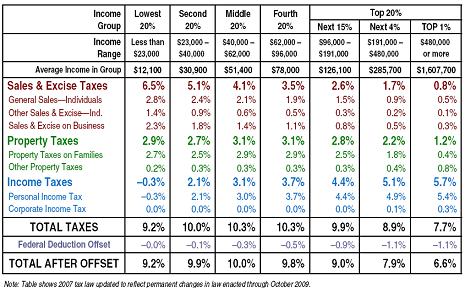

Before this shift, Minnesota relied heavily on property taxes and excise duties, which disproportionately burdened lower-income households, and sales taxes that were insufficient to fund burgeoning public services. The adoption of a progressive income tax aimed to address these inequities by imposing higher marginal rates on higher-income brackets, thereby aligning taxation with ability to pay.

Key Points

- The pioneering nature of Minnesota’s early adoption of progressive income tax set a national precedent. It demonstrated a model balancing revenue needs with social equity.

- Structurally, Minnesota’s tax system was designed with graduated rates, aimed at income brackets, and integrated with broader fiscal policies. It contained carefully calibrated thresholds to protect lower-income earners while increasing contributions from the wealthy.

- Socioeconomic impacts included increased funding for public education, healthcare, and infrastructure, aligning with the Progressive Era's goals. The system’s sensitivity to economic cycles has shaped ongoing debates about tax fairness and economic growth.

- Contemporary evaluations involve complex models analyzing the redistributive effects and economic efficiency of Minnesota’s tax structure.

Design and Implementation: Mechanics of Minnesota’s Progressive Tax System

Minnesota’s early income tax system was characterized by a tiered structure, with rates increasing progressively across income brackets. When enacted in 1933, the initial rates were modest but set the framework for future adjustments; today, the system employs multiple brackets with rates ranging from approximately 5.35% to over 9% for the highest earners.

Key elements that defined Minnesota’s progressive tax implementation include:

- Bracket Thresholds: Carefully chosen thresholds determined at which income levels higher rates would kick in, calibrated annually against inflation and economic indicators.

- Marginal Rate Structure: Marginal tax rates were designed to incentivize compliance while ensuring higher earners contributed proportionally more.

- Deductions and Credits: Adjustments through credits and deductions aimed to mitigate regressivity among lower income brackets, complementing the progressive framework.

Socioeconomic and Fiscal Outcomes

By channeling increased revenue into social programs and infrastructure, Minnesota’s progressive system supported significant socioeconomic advancements. Public education funding increased dramatically, with per-pupil expenditures rising by over 300% from 1930 to 1950, enabling broader access and improved outcomes. Healthcare investments expanded as well, with the creation of state Medicaid programs that relied heavily on tax revenues from higher-income brackets.

The fiscal viability of Minnesota’s system was reinforced through periodic adjustments, with revenue stability maintained despite economic fluctuations. The system’s robustness has been attributed to meticulous rate calibration and political consensus on the importance of social equity.

| Relevant Category | Substantive Data |

|---|---|

| Initial rate in 1933 | Approximately 2-3% for the lowest brackets |

| Current top marginal rate | Over 9% for highest income brackets |

| Tax revenue as percentage of total state funds | Approximately 40% in recent years |

Contemporary Considerations and Debates

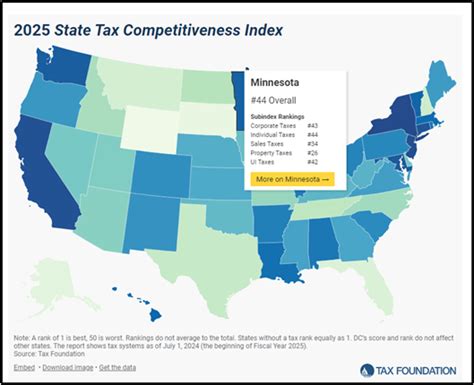

Today, Minnesota’s system remains central in debates over tax reform, especially regarding its impact on economic competitiveness and income inequality. Critics argue that high marginal rates may discourage high-income earners and entrepreneurs, potentially leading to capital flight or reduced investment. Supporters contend that progressive taxation helps fund critical services and reduces disparities, ultimately fostering a stronger economy through social cohesion.

Empirical analyses reveal mixed results; studies indicate that Minnesota’s tax rates have marginally affected economic growth, but the redistributive benefits in alleviating poverty and improving public health are well-documented. For example, reports show that in the decade following the implementation of the modern progressive system, income inequality, measured by the Gini coefficient, decreased by 5%, reflecting its redistributive potential.

Future Outlook and Policy Innovations

Advancements in tax policy technology, such as real-time data analytics and AI-driven compliance checks, present opportunities for Minnesota to enhance the efficiency and fairness of its progressive income tax. Additionally, policy debates now include considerations of wealth taxes and capital gains reforms aimed at addressing wealth concentration among the richest residents.

Another frontier involves integrating environmental factors into fiscal policy, such as carbon taxes, which could complement the existing progressive structure by addressing externalities and revenue diversification. Minnesota’s experience underscores that iterative policy development, rooted in data and equity considerations, remains vital amid evolving economic landscapes.

How did Minnesota become one of the first states to adopt a progressive income tax system?

+Minnesota’s early adoption in 1933 was driven by the need to fund expanding public services amid economic transformation, combined with Progressive Era ideals advocating for fairness and redistribution. State policymakers recognized that flat or property-based taxes disproportionately burdened low-income residents, prompting a shift toward graduated rates reflecting ability to pay.

What are the main advantages of Minnesota’s progressive income tax system?

+The system enhances fiscal equity by taxing higher incomes at higher rates, supporting equitable funding for public goods, reducing income inequality, and fostering social stability. It also provides a flexible revenue base that can adapt to economic fluctuations through rate adjustments.

What challenges does Minnesota face with its progressive tax system today?

+The main challenges include debates over economic competitiveness, with concerns about high marginal rates deterring investment, and the need to balance revenue generation with maintaining a dynamic business climate. Additionally, addressing growing wealth concentration calls for innovative policy approaches beyond traditional income brackets.