Missouri Retail Tax

Welcome to a comprehensive exploration of the Missouri Retail Tax, a vital component of the state's tax system. Understanding this tax is essential for businesses and consumers alike, as it plays a significant role in the state's economy and influences various aspects of commerce.

The Fundamentals of Missouri Retail Tax

The Missouri Retail Tax, also known as the Sales and Use Tax, is a consumption tax levied on the sale of tangible personal property and certain services within the state. It is a critical source of revenue for Missouri, contributing to the funding of various public services and infrastructure projects.

The tax is applied to a wide range of goods and services, including clothing, electronics, furniture, and even digital products. However, there are certain exemptions and special provisions that can make the tax landscape more complex. For instance, certain food items, prescription drugs, and manufacturing machinery are exempt from the retail tax.

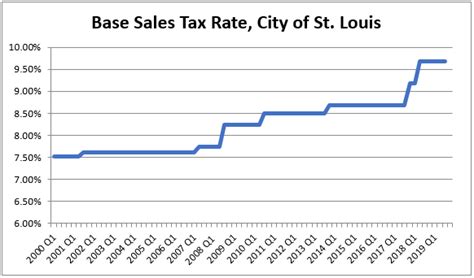

One unique aspect of Missouri's tax system is the local option tax. This allows individual counties and municipalities to impose an additional tax on top of the state's sales tax rate. As a result, the total sales tax rate can vary significantly across the state, ranging from 4.225% to 9.875% as of January 2024.

A Historical Perspective

The origins of the Missouri Retail Tax can be traced back to the 1930s, during the Great Depression. It was implemented as a way to generate revenue for the state and provide much-needed funding for public services. Over the years, the tax has undergone various revisions and amendments to adapt to the changing economic landscape and consumer behavior.

A significant milestone in the history of Missouri's tax system was the passage of the Sales Tax Simplification Act in 2013. This legislation aimed to streamline the tax collection process and reduce compliance burdens on businesses. It introduced new registration requirements and simplified the tax filing process, making it more efficient for both taxpayers and the state.

| Tax Rate History | Key Milestones |

|---|---|

| 1933 | Initial implementation of sales tax at a rate of 2% |

| 1943 | Tax rate increased to 3% to fund war efforts |

| 1969 | Introduction of local option tax, allowing cities and counties to add an additional tax |

| 2013 | Sales Tax Simplification Act passed, streamlining tax collection |

| 2024 | Current state sales tax rate is 4.225%, with local option taxes varying |

Compliance and Filing Requirements

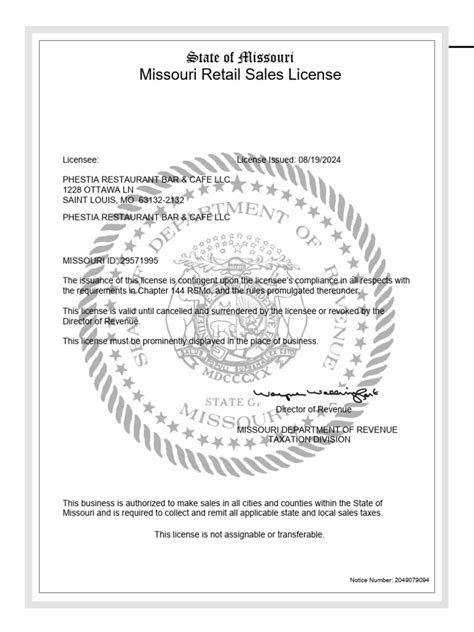

For businesses operating in Missouri, understanding and complying with the Retail Tax regulations is crucial. The Missouri Department of Revenue provides comprehensive guidelines and resources to assist taxpayers in navigating the complex tax landscape.

Businesses are required to register with the state to obtain a seller's permit, which authorizes them to collect and remit sales tax. The registration process involves providing detailed information about the business, including its legal structure, ownership, and primary place of business.

Taxable Events and Exemptions

Missouri’s tax system distinguishes between taxable and exempt transactions. Taxable events include the sale of most tangible personal property and certain services. However, there are numerous exemptions and special provisions that can make determining taxability complex.

For instance, sales to government entities, religious organizations, and certain nonprofit organizations are generally exempt from sales tax. Additionally, Missouri offers tax exemptions for specific industries, such as agriculture and manufacturing, to promote economic development.

Understanding these exemptions and their application is crucial for businesses to avoid overcharging tax or facing penalties for non-compliance.

Tax Collection and Remittance

Businesses are responsible for collecting the appropriate tax rate on each taxable transaction. This involves accurately calculating the tax amount, which can vary based on the jurisdiction where the sale occurs, as local option taxes can apply.

The collected tax must be remitted to the Missouri Department of Revenue on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to quarterly filings. Late filings or non-compliance can result in penalties and interest charges.

The Impact on Businesses and Consumers

The Missouri Retail Tax has a significant influence on both businesses and consumers. For businesses, it represents a critical aspect of their financial obligations and can impact pricing strategies and profit margins.

Consumers, on the other hand, bear the direct burden of the tax, which can influence their purchasing decisions and overall spending behavior. The varying tax rates across the state can create a unique shopping landscape, with consumers potentially traveling to areas with lower tax rates to save on purchases.

A Comparative Analysis

Comparing Missouri’s tax system with other states can provide valuable insights. For instance, Missouri’s average combined state and local sales tax rate is slightly lower than the national average. However, the state’s tax landscape is more complex due to the local option tax, which can lead to significant variations in tax rates.

Additionally, Missouri's tax system offers certain advantages to businesses, such as a simplified registration process and clear guidelines for tax collection. This can make it easier for businesses to comply with tax regulations and focus on their core operations.

Future Implications and Potential Reforms

As the economic landscape continues to evolve, so too will Missouri’s tax system. The state government regularly reviews and assesses the tax structure to ensure it remains fair, efficient, and aligned with the state’s economic goals.

One potential area of reform is the simplification of the tax system. While Missouri has made significant strides in this regard, there is still room for improvement, particularly in streamlining the registration process and tax rate determination.

Additionally, with the rise of e-commerce and digital transactions, the state may need to adapt its tax regulations to ensure that online businesses are compliant and contribute fairly to the state's revenue. This could involve implementing new tax collection mechanisms or amending existing laws to encompass the evolving nature of commerce.

Conclusion

The Missouri Retail Tax is a crucial component of the state’s tax system, impacting businesses and consumers alike. Its complex nature, with varying tax rates and exemptions, requires a thorough understanding to ensure compliance and efficient tax management.

As the state continues to evolve and adapt to economic changes, the Retail Tax will likely undergo further revisions to remain effective and equitable. By staying informed and engaged with the tax system, businesses and consumers can navigate the tax landscape with confidence and contribute to the economic vitality of Missouri.

What is the current state sales tax rate in Missouri as of 2024?

+The current state sales tax rate in Missouri as of 2024 is 4.225%.

Are there any local option taxes in Missouri, and if so, what are they?

+Yes, Missouri allows for local option taxes, which are additional taxes imposed by individual counties and municipalities. These taxes can vary significantly, ranging from 0% to 5.65% as of 2024.

How often do businesses need to remit sales tax in Missouri?

+The frequency of remittance depends on the business’s sales volume. Businesses with high sales volumes are required to remit sales tax monthly, while those with lower sales may remit quarterly.

Are there any online resources available to assist businesses in understanding and complying with Missouri’s tax regulations?

+Yes, the Missouri Department of Revenue provides an extensive online resource center with detailed guidelines, forms, and FAQs to assist businesses in navigating the tax landscape. The website also offers tools for tax rate lookup and registration.

What are some potential reforms or changes that could be implemented in Missouri’s tax system in the future?

+Potential reforms could include further simplifying the tax system, particularly the registration process, and adapting tax regulations to encompass the growing e-commerce sector. Additionally, there may be discussions around adjusting tax rates or introducing new tax incentives to promote economic development.