Mecklenburg County Tax Bill Lookup

Mecklenburg County, located in the heart of North Carolina, is a vibrant and rapidly growing metropolitan area. As one of the most populous counties in the state, it encompasses the city of Charlotte and several other thriving municipalities. With a diverse economy, a rich cultural scene, and a high quality of life, Mecklenburg County attracts residents and businesses alike. However, with growth comes increased responsibilities, and property taxes are a significant aspect of the county's revenue stream. Property owners in Mecklenburg County are required to pay taxes annually, and these taxes contribute to the maintenance and development of the region's infrastructure, schools, and public services.

Understanding the Mecklenburg County Tax Bill

The Mecklenburg County Tax Bill is a detailed document that outlines the property tax obligations for each individual property owner within the county. It is an essential piece of information for homeowners, investors, and anyone with an interest in the real estate market. The tax bill provides a comprehensive breakdown of the assessed value of the property, the applicable tax rates, and the final tax amount due. Understanding and accessing this information is crucial for property owners to manage their financial responsibilities and plan their budgets accordingly.

The Importance of Tax Bill Lookup

Tax Bill Lookup is a vital tool for Mecklenburg County residents and stakeholders. It offers several key benefits, including:

- Quick and Easy Access: Property owners can retrieve their tax bill information promptly, eliminating the need for lengthy searches or visits to government offices.

- Transparency: The lookup system provides a transparent view of tax assessments, ensuring that property owners understand the basis for their tax obligations.

- Comparison and Analysis: Tax Bill Lookup allows users to compare tax assessments across different properties, aiding in real estate investment decisions and identifying potential disparities.

- Planning and Budgeting: By accessing their tax bills, property owners can plan their finances effectively, allocate resources, and make informed decisions about property improvements or renovations.

How to Perform a Mecklenburg County Tax Bill Lookup

Performing a Mecklenburg County Tax Bill Lookup is a straightforward process. Here’s a step-by-step guide:

- Visit the Official Mecklenburg County Website: Go to the official website of Mecklenburg County, which is the primary source for tax-related information.

- Navigate to the Property Tax Section: On the county website, locate and click on the “Property Taxes” or “Tax Lookup” section. This will direct you to the dedicated page for tax-related services.

- Select the Tax Bill Lookup Option: On the property tax page, you will find various options, including tax bill lookup, payment options, and assessment information. Choose the “Tax Bill Lookup” or “Property Tax Search” option.

- Enter Property Information: You will be prompted to enter specific details about the property for which you wish to retrieve the tax bill. This may include the property address, parcel number, or owner’s name.

- Submit and Retrieve the Tax Bill: After entering the required information, click on the “Submit” or “Search” button. The system will process your request, and you will be presented with the tax bill details for the specified property.

It is important to note that the Mecklenburg County Tax Bill Lookup system is designed to be user-friendly and accessible. However, if you encounter any issues or have questions, you can reach out to the Mecklenburg County Tax Office for assistance.

Detailed Analysis of the Tax Bill Information

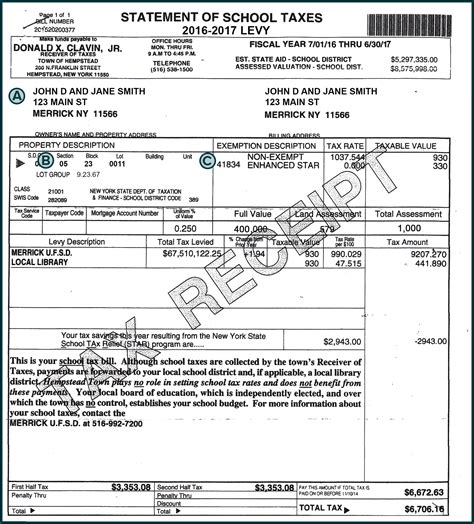

The Mecklenburg County Tax Bill contains a wealth of information that is crucial for property owners and investors. Let’s delve into a detailed analysis of the key components:

Property Identification

The tax bill begins with the basic identification of the property. This includes the property address, parcel number, and the legal description, which provides a precise location and identification of the land and any improvements.

| Property Address | Parcel Number | Legal Description |

|---|---|---|

| 123 Main Street, Charlotte, NC 28202 | 0123456789 | Lot 5, Block A, Pinehurst Subdivision |

Assessed Value and Taxable Value

The heart of the tax bill is the assessment of the property’s value. The Mecklenburg County Tax Office assesses the value of each property based on factors such as location, improvements, and market conditions. The assessed value is then used to calculate the taxable value, which is typically a percentage of the assessed value.

| Assessed Value | Taxable Value |

|---|---|

| $350,000 | $280,000 |

Tax Rates and Calculations

The tax bill provides a breakdown of the applicable tax rates for different purposes, such as general fund, schools, and special districts. These rates are typically expressed in cents per $100 of assessed value. The tax bill also shows the calculations used to determine the final tax amount due.

| Tax Purpose | Tax Rate (cents per $100) |

|---|---|

| General Fund | 45.67 |

| Schools | 62.34 |

| Special Districts | 21.90 |

Tax Amount Due

The tax bill concludes with the total tax amount due for the current year. This is the sum of the calculated taxes for each purpose, providing a clear understanding of the financial obligation.

| Total Tax Amount Due |

|---|

| $7,727.20 |

💡 It's essential to review the tax bill carefully and understand the components to ensure accuracy and identify any potential discrepancies. Property owners can contact the Mecklenburg County Tax Office for further clarification or to address any concerns.

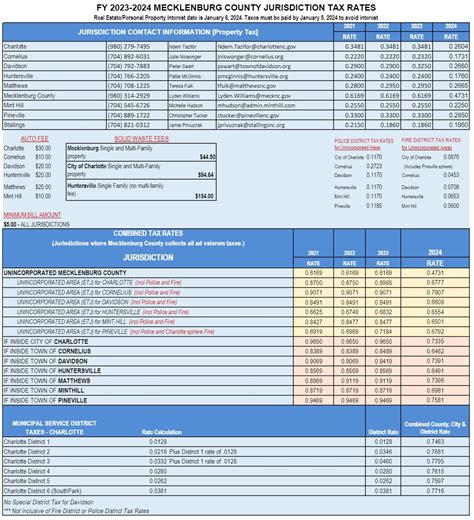

Comparative Analysis: Mecklenburg County Tax Rates

To gain a broader perspective, let’s compare the tax rates in Mecklenburg County with those of neighboring counties and the state average. This analysis will provide insights into the competitiveness and fairness of Mecklenburg County’s tax structure.

| County | General Fund Tax Rate (cents per $100) | Schools Tax Rate (cents per $100) | Special Districts Tax Rate (cents per $100) |

|---|---|---|---|

| Mecklenburg County | 45.67 | 62.34 | 21.90 |

| Union County | 42.12 | 60.78 | 20.46 |

| Cabarrus County | 48.95 | 58.21 | 19.65 |

| State Average | 44.21 | 59.87 | 20.32 |

The comparative analysis reveals that Mecklenburg County's tax rates are generally competitive with its neighboring counties and slightly above the state average. This indicates that the county's tax structure is designed to provide adequate funding for essential services while remaining within a reasonable range compared to other regions.

Future Implications and Trends

As Mecklenburg County continues to grow and evolve, the tax landscape is likely to experience changes and adjustments. Several factors will influence the future of property taxes in the region:

Population Growth and Development

Mecklenburg County’s population is projected to continue its steady growth, which will lead to increased demand for public services and infrastructure. This growth will likely drive the need for higher tax revenues to support these developments.

Economic Factors

The local and national economic climate plays a significant role in property tax assessments. Fluctuations in the real estate market, interest rates, and overall economic performance can impact property values and, consequently, tax assessments.

Public Service Demands

The demand for quality education, healthcare, public safety, and other essential services will shape the future of tax policies. As these services require adequate funding, tax rates may be adjusted to meet the increasing demands.

Tax Policy Changes

Legislative changes at the state and local levels can have a direct impact on property taxes. These changes may include modifications to assessment methods, tax rate structures, or the introduction of new tax incentives or programs.

Staying informed about these factors and keeping an eye on tax-related developments is crucial for property owners and stakeholders in Mecklenburg County. Being proactive in understanding the tax landscape can lead to better financial planning and informed decision-making.

What if I disagree with the assessed value on my tax bill?

+If you believe the assessed value of your property is incorrect, you have the right to appeal. The process typically involves submitting an appeal to the Mecklenburg County Tax Office, providing supporting evidence, and attending a hearing. It’s important to review the appeal process guidelines and gather relevant documentation to support your case.

How often are property tax assessments conducted in Mecklenburg County?

+Property tax assessments in Mecklenburg County are conducted annually. The Tax Office assesses properties based on factors such as market conditions, improvements, and sales data to determine the current value of each property. This ensures that tax obligations are aligned with the property’s value.

Are there any tax exemptions or reductions available in Mecklenburg County?

+Yes, Mecklenburg County offers various tax exemptions and reductions to eligible property owners. These include homestead exemptions, military exemptions, senior citizen and disability exemptions, and certain agricultural or forestland exemptions. It’s important to research and understand the specific requirements and application processes for these exemptions.

Can I pay my Mecklenburg County property taxes online?

+Absolutely! Mecklenburg County provides convenient online payment options for property taxes. You can access the online payment portal through the county’s official website. The system allows you to make payments using various methods, such as credit cards, debit cards, or electronic checks. Online payments are secure and provide a hassle-free way to manage your tax obligations.