Maine Unemployment Tax Rate 2025

As we look ahead to the year 2025, businesses in Maine are likely wondering about the future of their unemployment tax rates. The unemployment tax system plays a crucial role in providing financial support to workers who lose their jobs through no fault of their own. It is a safety net that ensures a measure of financial stability during periods of unemployment, and it is funded through taxes paid by employers. Understanding the unemployment tax rate and its implications is essential for businesses to plan their financial strategies effectively.

The Current Landscape of Maine’s Unemployment Tax System

Maine’s unemployment tax system operates under a wage-based formula, which means that the tax rate is calculated based on the total wages paid by an employer. This system aims to ensure that businesses contribute proportionally to the unemployment fund, taking into account their payroll size and turnover. As of my last update in January 2023, Maine’s unemployment tax rate structure was as follows:

- The base rate for most employers is 1.7%.

- Employers with high unemployment claims experience may face a higher rate, up to a maximum of 9.7%.

- New employers start with a rate of 1.7% and are subject to adjustments based on their experience rating over time.

- Certain industries, such as construction, have different tax rates and are classified as "scheduled industries."

It is important to note that Maine's unemployment tax rates are subject to change periodically to ensure the stability and sustainability of the unemployment trust fund. These adjustments are typically based on economic conditions, unemployment claim trends, and the fund's financial health.

Projecting Maine’s Unemployment Tax Rates for 2025

Predicting the exact unemployment tax rates for 2025 is a challenging task, as it involves analyzing various economic factors and their potential impact on the state’s unemployment fund. However, based on historical trends and current economic conditions, we can make some informed projections.

Economic Outlook for Maine

Maine’s economy has shown resilience in recent years, with a focus on key sectors such as tourism, healthcare, and renewable energy. The state has also made efforts to diversify its economic base, which has contributed to a more stable employment landscape. As we look ahead to 2025, several factors could influence the unemployment tax rates:

- Job Growth and Retention: A strong job market with consistent growth and low unemployment rates could lead to more stable tax rates. Maine's efforts to attract and retain businesses could play a significant role in this aspect.

- Economic Uncertainty: Global economic fluctuations and potential recessions could impact Maine's economy, leading to higher unemployment claims and, consequently, higher tax rates.

- Industry Trends: The performance of specific industries, such as tourism and seasonal businesses, can greatly affect unemployment rates and, by extension, tax contributions.

Historical Rate Adjustments

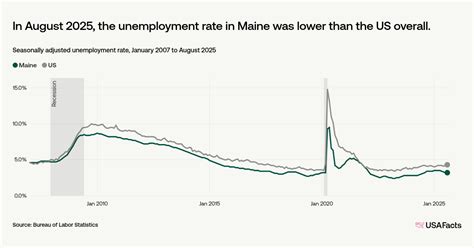

Examining Maine’s historical rate adjustments provides valuable insights. Over the past decade, the state has generally maintained a stable tax rate structure, with only minor adjustments to address specific economic conditions. For instance, during the economic downturn in 2020, Maine implemented temporary measures to support businesses and stabilize the unemployment fund.

Projections for 2025

Based on the current economic trajectory and historical trends, it is reasonable to expect the following scenarios for Maine’s unemployment tax rates in 2025:

- Scenario 1: Stable Rates - If Maine's economy continues on its current path of steady growth and low unemployment, the tax rates are likely to remain stable, with only minor adjustments. The base rate could remain at 1.7%, and high-risk employers may continue to face rates up to 9.7%.

- Scenario 2: Moderate Adjustments - In the event of a mild economic downturn or increased unemployment claims, the state may need to adjust rates to ensure the fund's solvency. This could result in a slight increase in the base rate, perhaps to 1.8% or 1.9%, with a corresponding adjustment for high-risk employers.

- Scenario 3: Significant Rate Changes - A severe economic recession or a substantial increase in unemployment claims could lead to more significant rate adjustments. In this scenario, the base rate might increase to 2.0% or higher, and the maximum rate for high-risk employers could reach 10% or above.

Strategies for Businesses to Prepare

Given the potential range of scenarios, businesses in Maine should consider the following strategies to prepare for the upcoming changes in unemployment tax rates:

- Monitor Economic Indicators: Stay informed about Maine's economic performance, including unemployment rates, job growth, and industry-specific trends. This information can help businesses anticipate potential rate adjustments.

- Review Historical Data: Analyze historical unemployment tax rate adjustments to understand the state's approach to managing the unemployment fund. This can provide insights into the potential range of rate changes.

- Plan for Multiple Scenarios: Develop financial strategies that account for different unemployment tax rate scenarios. This could involve budgeting for potential rate increases and exploring ways to optimize payroll management.

- Collaborate with Industry Associations: Engage with industry associations and peer networks to share insights and best practices related to unemployment tax management. This can provide valuable perspectives and potential solutions.

- Stay Informed on Policy Changes: Keep abreast of any proposed changes to Maine's unemployment tax system. Understanding the legislative landscape can help businesses anticipate and prepare for significant reforms.

The Importance of a Stable Unemployment Fund

A well-managed unemployment fund is crucial for both workers and businesses. It provides a safety net for employees during periods of unemployment, promoting financial stability and supporting the overall economic health of the state. Additionally, a stable fund ensures that businesses have a predictable tax structure, which is essential for long-term planning and investment.

Balancing Act for Maine’s Unemployment System

Maine’s unemployment tax system must strike a delicate balance between ensuring the fund’s solvency and providing relief to businesses. By maintaining a robust fund, the state can offer timely and adequate unemployment benefits to those in need, which, in turn, stimulates economic activity and supports a healthy job market. On the other hand, businesses benefit from a predictable tax structure, allowing them to plan their financial strategies effectively.

The Role of Data-Driven Decisions

To make informed decisions regarding unemployment tax rates, Maine’s Department of Labor relies on comprehensive data analysis. This includes examining unemployment claim trends, economic indicators, and the financial health of the unemployment trust fund. By leveraging data-driven insights, the state can make adjustments to the tax rate structure in a way that is responsive to economic conditions while ensuring the long-term sustainability of the fund.

Benefits of Data-Informed Rate Adjustments

Data-driven rate adjustments offer several advantages. Firstly, they allow for a more precise response to economic fluctuations, ensuring that the unemployment tax rates are fair and proportional to the risks faced by different businesses. Secondly, this approach promotes transparency and predictability, which is beneficial for both employers and employees. Lastly, by using data to guide rate adjustments, Maine can maintain a well-funded unemployment system, providing a vital safety net for workers while minimizing the burden on employers.

Conclusion

As we anticipate the unemployment tax rates for 2025 in Maine, it is evident that the state’s economic trajectory and unemployment claim trends will play a pivotal role. While predicting exact rates is challenging, businesses can prepare by staying informed, monitoring economic indicators, and developing strategies that account for a range of scenarios. By understanding the importance of a stable unemployment fund and the benefits of data-driven decisions, Maine can continue to support its workforce and businesses effectively.

How are unemployment tax rates determined in Maine?

+Maine’s unemployment tax rates are calculated based on a wage-based formula, considering factors like total wages paid and an employer’s experience rating. This system aims to ensure proportional contributions to the unemployment fund.

What factors influence the potential rate adjustments in 2025?

+Factors such as job growth, economic uncertainty, and industry-specific trends can impact unemployment rates and, consequently, tax contributions. These factors will likely influence rate adjustments in 2025.

How can businesses prepare for potential rate changes?

+Businesses can prepare by monitoring economic indicators, reviewing historical rate adjustments, planning for multiple scenarios, collaborating with industry associations, and staying informed about policy changes.