Lake County In Property Tax

Lake County, nestled in the heart of Florida, boasts a diverse landscape ranging from picturesque lakes to vibrant urban centers. While its natural beauty and recreational opportunities attract residents and visitors alike, one aspect that holds significant importance for homeowners is property taxes. Understanding the intricacies of Lake County's property tax system is crucial for individuals navigating the real estate market in this region. This comprehensive guide aims to shed light on the key aspects of property taxes in Lake County, offering an in-depth analysis to help readers make informed decisions.

The Fundamentals of Lake County Property Taxes

Property taxes in Lake County are an essential revenue source for the local government, contributing to the maintenance of vital services and infrastructure. These taxes are levied on both residential and commercial properties, with the amount owed determined by the assessed value of the property and the tax rates set by various governing bodies.

The property tax system in Lake County operates on a calendar year basis, with the tax year running from January 1st to December 31st. Property owners are responsible for paying taxes on their properties annually, and the tax bill is typically sent out in November, due by March 31st of the following year. Failure to pay by the due date may result in penalties and interest, so it is crucial for homeowners to stay informed and organized.

The assessment process is a crucial step in determining property taxes. In Lake County, the Property Appraiser's Office is responsible for evaluating properties and assigning their assessed values. This value is determined by considering factors such as the property's location, size, improvements, and market conditions. The assessed value serves as the basis for calculating the property taxes owed.

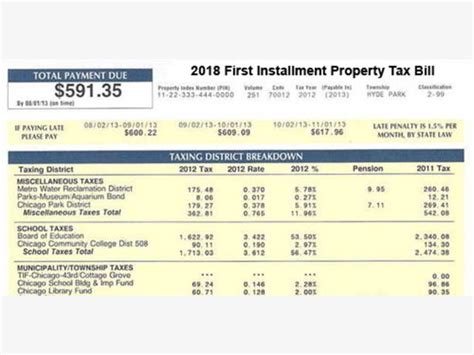

Tax Rates and Millage

The tax rate, often referred to as the millage rate, is a critical component in calculating property taxes. In Lake County, the millage rate is set by several entities, including the county government, local municipalities, school districts, and special districts. These rates are expressed in mills, where one mill represents one-tenth of a dollar per $1,000 of the assessed property value.

| Taxing Authority | Millage Rate (in mills) |

|---|---|

| Lake County Government | 5.3000 |

| Lake County School Board | 7.0000 |

| Municipalities (e.g., City of Eustis) | Varies |

| Special Districts (e.g., Fire Rescue) | Varies |

For instance, if a property has an assessed value of $200,000 and the applicable millage rate is 10 mills, the property taxes would be calculated as follows: $200,000 x 0.010 = $2,000. This means the property owner would owe $2,000 in property taxes for that year.

Tax Exemptions and Discounts

Lake County offers various tax exemptions and discounts to eligible property owners, providing financial relief and encouraging homeownership. Some of the notable exemptions and discounts include:

- Homestead Exemption: Residents who own and occupy their property as their primary residence can apply for a homestead exemption, which reduces the assessed value of their property by up to $50,000. This exemption not only lowers the property tax burden but also ensures that homeowners are not taxed on the full market value of their homes.

- Senior Exemption: Lake County extends an additional exemption to residents aged 65 and above. Those who qualify can receive an extra $50,000 exemption on their property's assessed value, further reducing their property taxes.

- Disabled Veteran Exemption: Honorably discharged veterans with service-connected disabilities may be eligible for an exemption on a portion of their property's assessed value. This exemption aims to support and honor the service of our veterans.

- Early Payment Discount: Property owners who pay their taxes early can benefit from a discount. In Lake County, paying the taxes by March 31st can result in a 4% discount, while paying by April 30th provides a 3% discount.

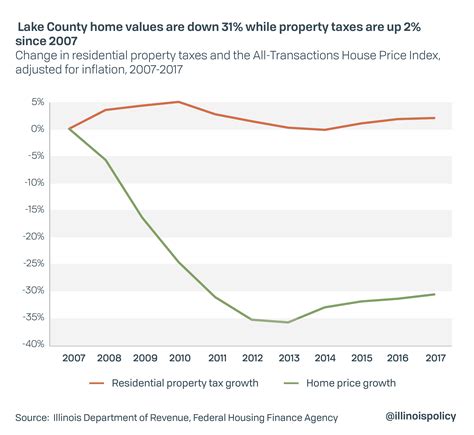

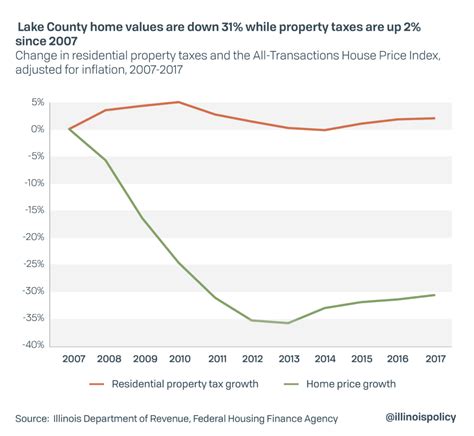

The Impact of Property Taxes on Lake County’s Real Estate Market

Property taxes play a significant role in shaping the real estate landscape of Lake County. For prospective homebuyers, understanding the property tax implications is crucial when considering a purchase. Here’s how property taxes influence the market:

Influencing Home Prices

The property tax burden can directly impact the affordability of homes in Lake County. Buyers often factor in the annual property tax expenses when determining their budget for a new home. Higher tax rates may discourage potential buyers, especially those on a tighter budget, as it increases the overall cost of homeownership. On the other hand, lower tax rates can make the area more attractive and competitive in the real estate market.

Real Estate Investment Strategies

Real estate investors also consider property taxes when evaluating investment opportunities. The tax implications can affect the cash flow and overall profitability of an investment property. Investors often seek locations with competitive tax rates to maximize their returns and minimize expenses. Understanding the tax landscape is crucial for making informed investment decisions.

Community Development and Revitalization

Property taxes are a significant revenue source for local governments, which use these funds to invest in community development projects. This includes infrastructure improvements, public safety initiatives, and educational programs. A robust property tax system can contribute to the overall well-being and prosperity of Lake County’s communities.

Homeowner Retention and Satisfaction

A well-managed and fair property tax system can contribute to homeowner satisfaction and retention. When property taxes are perceived as reasonable and transparent, homeowners are more likely to remain in the area, fostering a sense of community and stability. On the contrary, high or unpredictable tax burdens may lead to homeowner dissatisfaction and potential migration.

Lake County’s Property Tax Administration

Lake County takes pride in its efficient and transparent property tax administration. The Lake County Tax Collector’s Office is responsible for collecting property taxes and ensuring timely and accurate processing. Property owners can access their tax information online, make payments, and stay updated on any changes or adjustments.

The Tax Collector's Office also offers convenient payment options, including online payments, mail-in payments, and walk-in payments at designated locations. This flexibility allows property owners to choose the most suitable method for their needs.

Additionally, the office provides resources and assistance to homeowners facing financial difficulties. They offer payment plans and work with homeowners to find solutions that prevent property tax delinquency and potential foreclosure.

Future Outlook and Trends

As Lake County continues to grow and develop, the property tax landscape is likely to evolve. Here are some potential trends and considerations for the future:

Population Growth and Development

Lake County’s population is projected to increase, which may lead to a higher demand for housing and commercial spaces. This growth can impact property values and, consequently, property taxes. As the county expands, efficient tax administration and fair assessment practices will be crucial to ensure a balanced and sustainable tax system.

Technological Advancements

The integration of technology in property tax administration is an ongoing trend. Lake County can leverage innovative solutions to enhance the efficiency and accuracy of the assessment process. This includes utilizing advanced data analytics and property valuation tools to ensure fair and consistent assessments.

Community Engagement and Transparency

Building trust and transparency between the government and taxpayers is essential. Lake County can further enhance its communication and outreach efforts to educate residents about property taxes. By fostering a culture of transparency and engagement, the county can ensure that taxpayers understand the tax system and feel empowered to participate in the process.

Tax Reform and Policy Changes

As with any tax system, there may be ongoing discussions and proposals for reform. Lake County may consider adjustments to tax rates, exemptions, or assessment methodologies to ensure fairness and equity. Staying informed about these potential changes is crucial for homeowners and investors to adapt their strategies accordingly.

Conclusion

Understanding the intricacies of Lake County’s property tax system is a crucial aspect of homeownership and real estate investment in the region. By exploring the fundamentals, exemptions, and potential future trends, residents and investors can make informed decisions. Lake County’s commitment to transparency, efficiency, and fair tax administration ensures a robust and sustainable system that supports the growth and prosperity of its communities.

How are property taxes calculated in Lake County?

+

Property taxes in Lake County are calculated by multiplying the assessed value of the property by the applicable millage rate. The assessed value is determined by the Property Appraiser’s Office, while the millage rate is set by various taxing authorities.

What is the deadline for paying property taxes in Lake County?

+

The deadline for paying property taxes in Lake County is March 31st of each year. However, paying early can result in a discount on the tax amount.

Are there any tax exemptions or discounts available in Lake County?

+

Yes, Lake County offers several tax exemptions and discounts. These include the homestead exemption, senior exemption, disabled veteran exemption, and early payment discounts.

How can I stay informed about my property tax information and payments?

+

You can access your property tax information and make payments online through the Lake County Tax Collector’s Office website. Additionally, they provide resources and assistance for taxpayers facing financial difficulties.

What should I do if I disagree with my property’s assessed value?

+

If you believe your property’s assessed value is inaccurate, you can file an appeal with the Property Appraiser’s Office. They provide guidance and information on the appeal process.