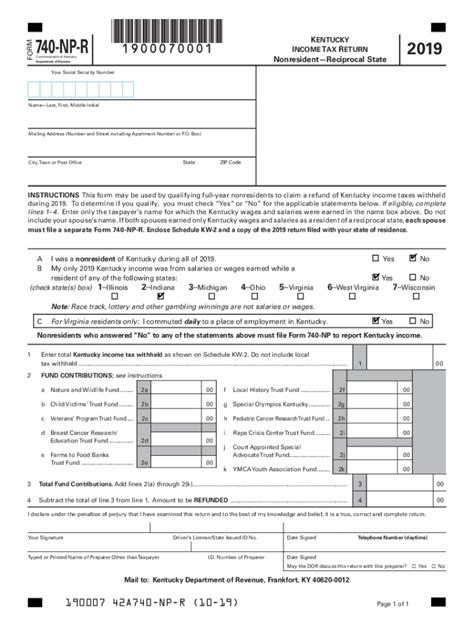

Kentucky Tax Return Status

Taxes are an essential aspect of any functioning society, and understanding the status of your tax returns is crucial for individuals and businesses alike. This comprehensive guide delves into the intricacies of the Kentucky tax return status, offering insights into the process, timelines, and factors that influence the return journey. Whether you're a Kentucky resident filing your annual taxes or a business owner seeking clarity on tax obligations, this article aims to provide a detailed roadmap to navigate the state's tax system effectively.

Navigating the Kentucky Tax Landscape

The Kentucky Department of Revenue (DOR) oversees the collection and management of various taxes within the state, including income tax, sales tax, and property tax. Understanding the DOR's processes and procedures is key to staying compliant and avoiding penalties.

Kentucky operates on a fiscal year basis, which runs from July 1st to June 30th of the following year. This means that tax returns are typically due by April 15th of the year following the end of the fiscal year. For instance, for the fiscal year ending June 30, 2023, tax returns would be due on April 15, 2024.

Income Tax Returns

Kentucky residents and businesses with income sourced from within the state are required to file income tax returns. The state offers both individual and corporate income tax forms, which must be completed accurately to ensure proper tax liability calculation.

Kentucky's income tax rates are progressive, meaning they increase as taxable income rises. For individuals, the tax rates range from 2% to 6%, while corporate tax rates are set at 4% for regular corporations and 5% for S corporations.

To illustrate, consider a hypothetical scenario where an individual with a taxable income of $50,000 resides in Kentucky. Based on the state's progressive tax system, their tax liability would fall within the 4% bracket, resulting in a tax amount of $2,000.

| Taxable Income | Tax Rate | Tax Amount |

|---|---|---|

| $50,000 | 4% | $2,000 |

Sales and Use Tax Returns

Businesses operating in Kentucky, whether selling goods or services, are required to collect and remit sales tax. The current sales tax rate in Kentucky is 6%, with additional local option sales taxes ranging from 0% to 4% depending on the jurisdiction.

For instance, in Louisville, the combined sales tax rate is 6% (state rate) + 2% (local option tax), resulting in a total sales tax of 8% for goods and services sold within the city limits.

| Sales Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Kentucky (Statewide) | 6% |

| Louisville (City) | 8% |

Businesses must file sales tax returns monthly, quarterly, or annually, depending on their sales volume and tax liability. Late filings or non-compliance can result in penalties and interest charges.

Property Tax Returns

Property owners in Kentucky are subject to property taxes, which are assessed annually based on the fair market value of their property. The tax rate varies depending on the location and type of property, with rates typically ranging from 0.25% to 1.25% of the assessed value.

For instance, a residential property in Louisville with an assessed value of $200,000 would have a property tax liability of approximately $2,500 (assuming a tax rate of 1.25%).

| Property Type | Tax Rate | Assessed Value | Estimated Tax |

|---|---|---|---|

| Residential | 1.25% | $200,000 | $2,500 |

Checking Your Kentucky Tax Return Status

The Kentucky DOR provides online tools and resources to help taxpayers track the status of their tax returns. These tools offer real-time updates and notifications, ensuring transparency and peace of mind during the tax filing process.

Online Status Check

The DOR's website offers a secure online portal where taxpayers can log in and view the status of their tax returns. This portal provides information on the return's processing stage, any associated refunds, and potential errors or discrepancies.

To access this feature, taxpayers need to create an account using their personal details and tax information. Once logged in, they can view their current and previous tax returns, along with the corresponding status updates.

Refund Status and Timeline

Kentucky taxpayers are often eager to know the status of their refunds, especially after filing their tax returns. The DOR aims to process refunds within 45 days of receiving a complete and accurate return.

However, various factors can impact the refund timeline, including the method of filing (paper or electronic), the complexity of the return, and any additional reviews or audits required. Taxpayers can track their refund status online using their unique refund reference number.

For instance, if a taxpayer filed their return electronically and included direct deposit information, they could expect to receive their refund within 2-3 weeks. On the other hand, if the return was filed on paper and required manual review, the refund timeline could extend to 6-8 weeks or more.

Audit and Review Process

In some cases, the DOR may select a tax return for audit or review. This process is designed to ensure accurate reporting and compliance with tax laws. Taxpayers who receive a notice of audit should respond promptly and provide the necessary documentation to support their tax filings.

The audit process can vary in length, depending on the complexity of the return and the cooperation of the taxpayer. It's crucial for taxpayers to maintain accurate records and respond to all audit requests in a timely manner to avoid further complications.

Frequently Asked Questions

What is the deadline for filing Kentucky tax returns?

+The deadline for filing Kentucky tax returns is typically April 15th of the year following the end of the fiscal year. For example, the deadline for the fiscal year ending June 30, 2023, would be April 15, 2024.

How can I check the status of my Kentucky tax refund?

+To check the status of your Kentucky tax refund, you can use the DOR's online refund status tool. You'll need your refund reference number, which you can find on your tax return confirmation or notice.

What happens if I miss the tax filing deadline in Kentucky?

+If you miss the tax filing deadline, you may be subject to late filing penalties and interest charges. It's advisable to file your return as soon as possible to minimize these additional costs and maintain compliance with Kentucky tax laws.

Can I file my Kentucky tax return electronically?

+Yes, Kentucky offers electronic filing for both individual and business tax returns. Electronic filing is secure, efficient, and often results in faster processing times and refund issuance.

What are the tax rates for businesses operating in Kentucky?

+Businesses operating in Kentucky are subject to a corporate income tax rate of 4% for regular corporations and 5% for S corporations. Additionally, businesses must collect and remit sales tax at a rate of 6%, with potential local option taxes adding up to a maximum of 10%.

Navigating the Kentucky tax system can be complex, but with the right tools and knowledge, taxpayers can stay informed and compliant. By understanding the various tax types, rates, and timelines, individuals and businesses can effectively manage their tax obligations and ensure timely filings.