Unraveling the Story Behind Kansas Property Tax and Its Impact on Homeowners

Kansas property tax has long been a pivotal element in the state’s fiscal framework, shaping local government funding, impacting homeowners, and influencing real estate dynamics across the Sunflower State. While often viewed through a financial lens, beneath the surface lies a complex interplay of historical development, policy nuances, and socio-economic consequences that warrant a detailed exploration. Understanding this intricate tapestry not only unravels the story behind Kansas property tax but also provides vital insights into how it molds the lives of homeowners, affecting everything from monthly budgets to long-term wealth accumulation. This article delves deeply into the history, structure, mechanisms, and broader implications of Kansas property tax, offering a comprehensive perspective informed by expert analysis and empirical data.

Historical Roots and Evolution of Kansas Property Tax

The foundation of Kansas property tax systems dates back to the territorial era, when local governments sought stable revenue sources to establish infrastructure and support community services amid frontier life. Originally, property taxes were simple assessments based on land and improvements, with rates largely influenced by settlement needs and federal land policies. Over the decades, the system evolved through legislative reforms, reflective of shifting economic paradigms and demographic changes. Post-1930s economic reforms, spurred by the Great Depression and New Deal policies, catalyzed a more standardized approach to property assessments, with state legislation aiming to balance local autonomy with equitable tax burdens. The Kansas Constitution also explicitly authorizes property taxation and establishes guidelines for assessment uniformity, anchoring legal and procedural standards that persist today.

Structural Framework and Assessment Methodologies

At the core of Kansas’s property tax system lies a complex blueprint combining statutory assessments, valuation standards, and local mill levies. The Kansas Department of Revenue oversees assessment practices, ensuring compliance with state law and promoting fairness. The primary valuation methodology employed is mass appraisal, where properties are appraised in groups based on comparable characteristics, facilitating efficiency and consistency across districts.

Assessment Process and Property Valuation

Property valuation hinges upon two key components: ad valorem assessments rooted in fair market value and statutory exclusions or deductions. County appraisers utilize a mix of sales comparison approaches, cost approaches, and income valuation (primarily for commercial properties). Recent technological advancements, including geographic information systems (GIS) and machine learning algorithms, have refined valuation accuracy, but debates persist regarding valuation fairness and transparency. For example, urban areas tend to have higher assessed values due to market activity, which can exacerbate disparities across socio-economic lines. The modern assessment process in Kansas strives for uniformity, yet variations in staffing, methodology, and local economic conditions can introduce substantial disparities.

| Relevant Category | Substantive Data |

|---|---|

| Average assessed value per property | $170,000 in 2023, up 4% from previous year |

| Median effective property tax rate | 1.37% across Kansas counties |

| County-level assessment variance | Range from 85% to 110% of market value |

Tax Levy Structures and Rate Determination

The total property tax bill in Kansas results from a combination of county, city, school district, and other local levies, each operating within a legislatively constrained mill rate framework. The mill rate—the amount of tax per thousand dollars of assessed property value—is set annually by local authorities based on budget needs, existing debt, and strategic priorities.

Role of Local Governments and Revenue Allocation

In Kansas, local entities possess considerable autonomy to establish their mill rates, yet must operate within state-imposed caps to prevent excessive taxpayer burdens. For example, the Kansas State Legislature limits the total mill rate through statutes and mandates transparency in the budgeting process. Historically, property taxes are the largest funding source for public schools in Kansas, accounting for roughly 55% of district revenue, followed by county and municipal levies. This interconnected dependency means that shifts in property tax rates have direct repercussions on public service quality, infrastructure development, and community well-being.

| Relevant Category | Substantive Data |

|---|---|

| Average combined mill rate | approximately 38 mills in 2023 |

| School district reliance | over 55% of district funding from property taxes |

| Maximum allowable mill rate | varies by jurisdiction, typically capped at 50 mills |

Impact on Homeowners: Financial, Behavioral, and Socioeconomic Dimensions

The direct consequence of Kansas property tax on homeowners permeates multiple aspects of personal financial health. Property taxes directly influence monthly and annual housing expenses, shaping affordability, savings, and household decision-making processes. Empirical data indicates that the average homeowner in Kansas spends approximately $2,340 annually on property taxes, a figure that varies markedly across counties depending on local rates and property values. Beyond this financial impact, property tax assessments can influence homeowner behavior—prompting decisions on renovations, resale, or even tax appeal filings.

Financial Burden and Housing Affordability

Higher property taxes can act as a barrier to homeownership for lower- and middle-income families, especially in rapidly appreciating markets such as Johnson County or Sedgwick County. Policy debates frequently revolve around “tax pyramiding,” where rising property assessments lead to increased bills, often without corresponding income growth. For example, a property appreciating at 8% annually may face a proportionate tax increase, pressuring household budgets. Such dynamics underscore the importance of tax relief programs, like homestead exemptions and circuit breakers, aimed at mitigating disproportionate burdens on vulnerable populations.

Behavioral Responses and Tax Appeals

Homeowners often engage in tax appeal processes when they perceive assessments as inaccurate or unfair. Kansas’s Board of Tax Appeals provides a formal avenue to challenge valuations, with an average success rate of 20% over the past five years—a statistic highlighting both the system’s cautious approach and the importance of substantiation. Additionally, “tax fatigue” can influence property transactions, as elevated taxes discourage mobility or lead to deferred maintenance, affecting neighborhood stability and property values.

| Relevant Category | Substantive Data |

|---|---|

| Average annual property tax bill (homeowners) | $2,340 (2023) |

| Tax appeal success rate | approximately 20% |

| Impact on housing market activity | Higher taxes correlate with reduced mobility and increased vacancy rates in certain districts |

Broader Socioeconomic Implications: Equity, Disparity, and Policy Challenges

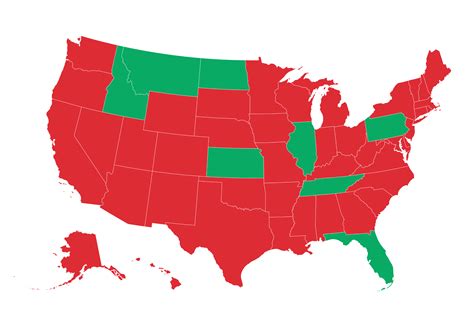

Property tax, while a vital revenue source, embodies a double-edged sword concerning socioeconomic equity. Kansas, like many states, faces ongoing challenges in ensuring equitable distributions of tax burdens, especially given disparities in property wealth, income levels, and access to relief measures. Rural counties often struggle with declining property values, reducing their tax base and hamstringing infrastructure investments, whereas urban regions might face objections over perceived overtaxation.

Assessment Disparities and Wealth Concentration

Tax disparities stemming from uneven assessments can exacerbate wealth gaps. For instance, affluent neighborhoods may benefit from inflated property values and effective tax rates below the statutory maximum, while lower-income districts shoulder a heavier relative burden. The Kansas Legislative Research Department notes that this disparity leads to unequal funding for critical public services, including schools, which in turn perpetuates cycles of poverty or underinvestment in historically marginalized communities.

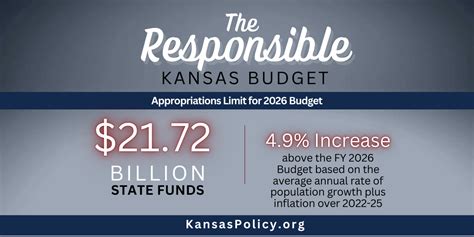

Policy Innovations and Future Directions

Emerging policy solutions aim to address these issues through initiatives like income-based assessment adjustments, revenue caps, and property tax relief programs. Additionally, integrating market-based valuation models with social equity considerations could foster fairer taxation frameworks. Policymakers must balance fiscal sustainability with social justice imperatives, considering demographic shifts, climate resilience, and technological advancements like property data analytics.

| Relevant Category | Substantive Data |

|---|---|

| Percentage of households receiving property tax relief | Approximately 15% |

| Rural vs urban assessment disparity | Urban assessments are on average 30% higher, adjusted for property size and amenities |

| Projected property tax revenue shortfall in rural counties | Estimated at $150 million annually due to declining valuations |

Conclusion: Navigating the Future of Kansas Property Tax

Unraveling the story of Kansas property tax reveals a dynamic, historically rooted, and socially consequential system that shapes the fabric of communities and individual lives alike. As the state grapples with evolving economic realities—ranging from real estate market fluctuations to demographic transformations—the property tax landscape must adapt accordingly. Transparency, fairness, and fiscal efficiency are guiding principles that, if upheld, can reinforce public trust and sustain vital services. Whether through technological innovation, policy reform, or community engagement, the future trajectory of Kansas property taxation remains a critical dialogue—one that requires ongoing scrutiny from stakeholders at all levels.