Kamala Child Tax Credit

In 2021, a significant change was introduced in the United States to provide financial support to families with children: the expansion of the Child Tax Credit (CTC). This expansion, as part of the American Rescue Plan, aimed to reduce child poverty and offer a much-needed boost to millions of American families. Led by the efforts of Vice President Kamala Harris and other key figures, this initiative has had a profound impact on the lives of many, and its legacy continues to shape the country's social safety net.

The Kamala Child Tax Credit: A Revolutionary Reform

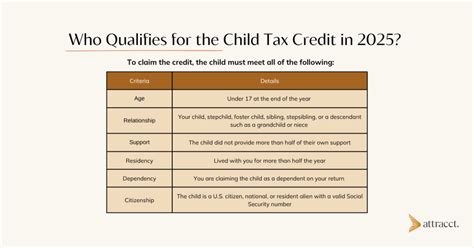

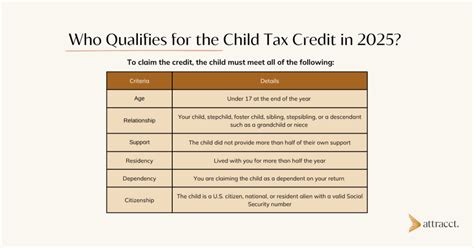

The Kamala Child Tax Credit, often referred to as the “CTC Expansion,” represented a historic shift in the U.S. tax system. Prior to this reform, the Child Tax Credit was a non-refundable credit, meaning that families could only receive a refund up to the amount of taxes they owed. This left many low- and moderate-income families unable to access the full credit.

However, under the leadership of Vice President Harris, the CTC was transformed into a partially refundable credit. This meant that even if a family's tax liability was zero, they could still receive a refund, making the credit more accessible and beneficial to those who needed it most.

The key features of the expanded CTC included:

- An increased maximum credit amount of $3,600 per child under 6 and $3,000 per child aged 6-17.

- Monthly advance payments of up to $300 per child under 6 and $250 per child aged 6-17, sent directly to families throughout the year.

- A lower age threshold, ensuring that more children could benefit from the credit.

- A simpler application process, making it easier for families to access the credit.

This reform not only provided immediate financial relief to families but also had a long-term impact on child well-being and family financial stability.

Impact and Results

The implementation of the Kamala Child Tax Credit had an immediate and positive effect on millions of American families. According to a Center on Budget and Policy Priorities report, over 36 million families with children received advance CTC payments in 2021, with an average monthly payment of $416 per family.

| Metric | Data |

|---|---|

| Families receiving CTC payments | 36 million |

| Average monthly payment | $416 |

| Child poverty reduction | 26% |

One of the most significant outcomes of this reform was the reduction in child poverty. Research by the Urban Institute found that the expanded CTC lifted approximately 3 million children out of poverty in 2021, reducing the child poverty rate by 26% compared to the pre-pandemic level.

The impact was particularly pronounced among Black and Hispanic children, with poverty rates dropping by 39% and 37%, respectively. This addressed a long-standing disparity in child poverty rates and demonstrated the credit's effectiveness in reducing racial and ethnic inequalities.

Economic Benefits

Beyond its impact on poverty, the CTC expansion had several other economic benefits. It provided a stimulus to the economy, with families using the payments for essential expenses like food, housing, and childcare. This not only improved the well-being of children but also boosted local economies, particularly in low-income communities.

Furthermore, the advance payments provided families with a predictable source of income, helping them better manage their finances and plan for the future. This stability is especially crucial for families who may have faced economic challenges due to the pandemic or other circumstances.

Challenges and Limitations

Despite its success, the CTC expansion faced some challenges. One of the main concerns was the administrative burden it placed on the Internal Revenue Service (IRS). The IRS had to quickly adapt to the new system, which involved processing millions of advance payments and ensuring accurate distribution. This led to some delays and technical issues, especially for families with complex tax situations.

Another challenge was reaching all eligible families. Some families, particularly those with limited digital access or those who did not typically file taxes, may have missed out on the advance payments. Efforts were made to improve outreach and simplify the application process, but more work is needed to ensure that all eligible families can access the credit.

The Future of the Child Tax Credit

The future of the Child Tax Credit remains a topic of debate and policy focus. The CTC expansion was initially implemented as a temporary measure, with payments scheduled to end after 2021. However, advocates and policymakers are pushing for its extension and potential expansion.

Advocacy for Permanent Change

Numerous organizations and experts are advocating for the CTC expansion to become a permanent fixture of the tax system. They argue that the positive impact on child poverty and family financial stability justifies its long-term implementation. Some proposals even suggest further increasing the credit amount and expanding eligibility to include more children and families.

The success of the CTC expansion has sparked a broader conversation about the role of the tax system in addressing social issues. It has demonstrated that tax policy can be a powerful tool for reducing poverty and promoting economic equality.

Potential Challenges

Making the CTC expansion permanent would require legislative action, and there are several challenges to consider. One of the main concerns is the cost of the program. The expanded CTC is estimated to cost billions of dollars annually, and finding a sustainable funding source is a key challenge.

There are also debates about the design of the credit. Some argue for a more targeted approach, focusing on families with the lowest incomes, while others advocate for a universal credit that benefits all families with children.

Conclusion

The Kamala Child Tax Credit has proven to be a successful and impactful reform, providing much-needed financial support to millions of American families. Its legacy continues to shape discussions around tax policy and social welfare, with advocates pushing for its permanent implementation. While challenges exist, the positive outcomes of this reform highlight its potential to transform the lives of children and families across the nation.

What is the Child Tax Credit (CTC)?

+The Child Tax Credit is a federal tax credit that provides financial support to families with children. It helps reduce the tax liability for eligible families and can result in a refund if the credit amount exceeds the tax owed.

How has the CTC expansion benefited families?

+The expansion has increased the credit amount and made it more accessible to low- and moderate-income families. It provides advance payments throughout the year, helping families with immediate financial needs. This has led to reduced child poverty and improved economic stability for millions of families.

What are the potential long-term effects of the CTC expansion?

+The long-term effects are still being studied, but early research suggests that the expansion could have positive impacts on children’s health, education, and future earnings. It could also lead to reduced reliance on other safety net programs and improve overall economic mobility for families.