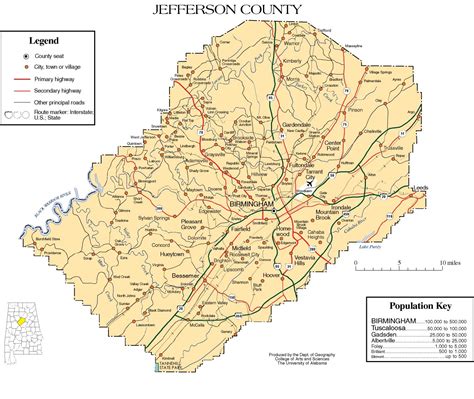

Jefferson County Alabama Tax Map

The Jefferson County Alabama Tax Map is a crucial tool for property owners, real estate professionals, and anyone interested in understanding the tax landscape of this vibrant county. This comprehensive map provides a detailed overview of the tax districts, assessment areas, and property boundaries, offering valuable insights into the tax structure and potential implications for property owners. In this article, we will delve into the intricacies of the Jefferson County Alabama Tax Map, exploring its features, benefits, and real-world applications.

Unveiling the Jefferson County Alabama Tax Map

Jefferson County, nestled in the heart of Alabama, boasts a rich history and a diverse array of communities. With a population of over 650,000 residents, it is the most populous county in the state, encompassing vibrant cities like Birmingham, Hoover, and Vestavia Hills. The county’s tax map plays a vital role in ensuring fair and efficient taxation, as it provides a comprehensive visual representation of the tax districts and assessment areas.

The Jefferson County Alabama Tax Map is an intricate document that combines geographic information with tax-related data. It serves as a reference guide for property owners, helping them understand their tax obligations and the unique characteristics of their specific tax district. The map is meticulously designed to cover the entire county, with each tax district clearly demarcated and labeled.

Key Features of the Tax Map

- Tax District Boundaries: The map delineates the boundaries of each tax district, providing a clear visual representation of the geographic areas under the jurisdiction of different taxing authorities. This includes city, county, and school board tax districts.

- Assessment Areas: Within each tax district, the map identifies assessment areas, which are specific regions used for assessing property values. These areas are crucial for determining the tax rates and ensuring equitable taxation.

- Property Identification: The Jefferson County Alabama Tax Map includes detailed information about individual properties, such as parcel numbers, property lines, and owner details. This allows property owners to easily identify their specific parcel and understand its tax-related characteristics.

- Tax Rates and Information: The map provides an overview of the tax rates applicable to each district and assessment area. This information is essential for property owners to estimate their tax liabilities accurately.

- Online Accessibility: Jefferson County has made the tax map readily available online, offering a user-friendly interface for residents and professionals to access the map and obtain the necessary tax-related information. This digital platform ensures convenient access and ease of use.

Benefits of the Jefferson County Alabama Tax Map

The Jefferson County Alabama Tax Map offers a multitude of benefits to various stakeholders:

- Transparency and Fair Taxation: By providing a clear visual representation of tax districts and assessment areas, the map promotes transparency in the tax system. Property owners can easily understand the tax structure and ensure they are being taxed fairly based on their location.

- Property Assessment Accuracy: The map’s detailed information about properties and assessment areas helps ensure accurate property assessments. This leads to fair valuations, reducing the chances of over- or under-taxation.

- Real Estate Planning: Real estate professionals and investors can utilize the tax map to make informed decisions. By understanding the tax implications of different areas, they can strategize their investments and property acquisitions more effectively.

- Community Engagement: The tax map encourages community engagement and participation. Residents can actively participate in local tax discussions and planning, fostering a sense of ownership and involvement in their community’s financial well-being.

- Efficient Tax Administration: The map streamlines the tax administration process for county officials. It simplifies the identification of properties, tax districts, and assessment areas, making tax collection and record-keeping more efficient.

Real-World Applications

The Jefferson County Alabama Tax Map finds practical applications in various scenarios:

- Property Purchase Decisions: Prospective homebuyers can use the tax map to evaluate the tax implications of different neighborhoods. This helps them make informed decisions about the affordability and potential tax benefits of a particular property.

- Business Location Analysis: Entrepreneurs and business owners can utilize the tax map to assess the tax landscape for potential commercial properties. They can compare tax rates and districts to make strategic choices for their business ventures.

- Tax Planning and Appeals: Property owners can leverage the tax map to review their tax assessments and ensure accuracy. If they identify any discrepancies or believe their property is overvalued, the map provides the necessary information to initiate a tax appeal process.

- Community Development Initiatives: Local governments and community organizations can use the tax map to identify areas with unique tax structures or assessment challenges. This information can guide community development projects and infrastructure planning.

- Educational Resource: The tax map serves as an educational tool for students, researchers, and academics interested in understanding the intricacies of local tax systems and their impact on communities.

| Tax District | Assessment Area | Tax Rate (Millage) |

|---|---|---|

| Birmingham City | Area 1 | 35.50 |

| Hoover City | Area 2 | 25.00 |

| Vestavia Hills City | Area 3 | 28.00 |

| Jefferson County | County-Wide | 30.00 |

Conclusion

The Jefferson County Alabama Tax Map is a powerful tool that empowers property owners, real estate professionals, and community members to navigate the tax landscape with confidence. By providing a comprehensive overview of tax districts, assessment areas, and property-specific information, the map promotes transparency, fairness, and efficiency in the tax system. Whether you’re a homeowner, investor, or community advocate, the Jefferson County Alabama Tax Map is an invaluable resource for understanding the tax implications of your property and contributing to the economic vitality of the county.

How often is the Jefferson County Alabama Tax Map updated?

+The tax map is typically updated annually to reflect any changes in tax districts, assessment areas, or property information. These updates ensure that the map remains accurate and up-to-date.

Can I access the tax map online?

+Yes, Jefferson County provides an online platform where residents and professionals can access the tax map. The online version is user-friendly and allows for easy navigation and information retrieval.

How can I use the tax map to estimate my property taxes?

+By locating your property on the tax map, you can identify your tax district and assessment area. The map provides the tax rates applicable to your district, which you can use to estimate your property taxes based on your assessed value.

Are there any resources available to help me understand the tax map better?

+Yes, Jefferson County offers resources such as user guides and tutorials to assist residents in navigating the tax map. These resources provide step-by-step instructions and explanations to ensure a seamless understanding of the map’s features.

Can I contact the Tax Assessor’s Office for further assistance?

+Absolutely! The Tax Assessor’s Office is available to provide additional guidance and support. They can answer specific questions, clarify tax-related matters, and assist with any complexities related to the tax map or property assessments.