Is Gross Before Or After Taxes

The concept of gross income and the order in which taxes are deducted can be a bit tricky to navigate, especially when managing personal finances or understanding business accounting. This article aims to provide clarity on the relationship between gross income and taxes, unraveling the intricacies of this fundamental financial concept.

Understanding Gross Income

Gross income, a cornerstone in financial planning and accounting, represents the total income earned before any deductions, exemptions, or taxes are applied. It encompasses all sources of revenue, including wages, salaries, tips, dividends, interest, rental income, and other forms of earnings. For individuals, this typically includes income from employment, self-employment, investments, and various other sources.

In the realm of business, gross income, often referred to as gross profit or gross margin, holds a slightly different meaning. It is calculated as the difference between revenue (income from sales) and the cost of goods sold (COGS), providing a critical metric for evaluating a company's financial health and performance.

Key Aspects of Gross Income

- Inclusion of All Earnings: Gross income includes all forms of income, whether earned through active work or passive investments.

- Before Deductions: It serves as a starting point for calculating taxable income, as deductions and exemptions are applied afterward.

- Varying Calculations: For individuals, gross income may vary based on employment status, while for businesses, it depends on revenue and COGS.

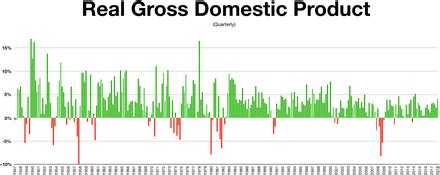

Taxation Process: Gross Income and Beyond

The taxation process involves several stages, with gross income being the initial step. Here’s a simplified breakdown of how taxes are typically applied:

- Gross Income Determination: This is the first step, where all income sources are aggregated to calculate the total gross income.

- Deductions and Exemptions: Various deductions and exemptions are then applied to reduce the gross income, resulting in taxable income. These deductions can include contributions to retirement accounts, certain business expenses, and personal exemptions.

- Tax Calculation: Using the taxable income, applicable tax rates are then used to calculate the total tax liability.

- Tax Withholding or Payment: Depending on the tax system, taxes may be withheld from income throughout the year or paid in full at the end of the tax year.

Taxation Considerations

- Progressive Tax Systems: Many countries employ progressive tax systems, where higher income levels are taxed at higher rates.

- Tax Credits and Refunds: Tax credits and refunds can further reduce tax liabilities or result in refunds for overpaid taxes.

- Tax Planning: Understanding gross income and the taxation process is crucial for effective tax planning, ensuring compliance and optimizing financial strategies.

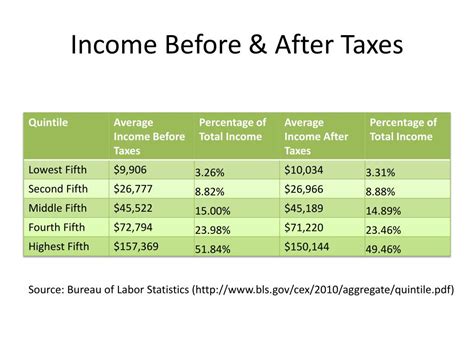

Impact of Gross Income on Taxes

Gross income plays a pivotal role in determining an individual’s or business’s tax liability. Higher gross incomes often result in higher tax liabilities, as they typically fall into higher tax brackets. However, the actual tax burden can be significantly reduced through strategic tax planning and by maximizing allowable deductions and exemptions.

Tax Strategies for Individuals and Businesses

- Maximizing Deductions: Individuals can benefit from contributing to retirement accounts, such as 401(k)s or IRAs, which reduce taxable income. Businesses can also deduct a range of expenses, including research and development costs, advertising, and employee benefits.

- Capitalizing on Tax Credits: Tax credits, such as those for energy-efficient home improvements or childcare expenses, can further reduce tax liabilities.

- Tax Optimization: Consulting with tax professionals can help individuals and businesses navigate complex tax laws and regulations, ensuring they take advantage of all available deductions and credits.

Real-World Examples

Let’s illustrate the impact of gross income on taxes with a few real-world scenarios:

| Scenario | Gross Income | Deductions | Taxable Income | Tax Liability |

|---|---|---|---|---|

| Individual A | $60,000 | $10,000 (Retirement Contributions) | $50,000 | $7,500 |

| Business B | $250,000 (Revenue) | $50,000 (COGS, Advertising) | $200,000 | $40,000 |

| High-Income Individual C | $500,000 | $200,000 (Retirement, Medical) | $300,000 | $80,000 |

Insights from the Examples

These examples demonstrate how deductions can significantly impact taxable income and, consequently, tax liability. In the case of Individual A, retirement contributions reduced their taxable income by a substantial amount, resulting in a lower tax burden. Similarly, Business B’s deductions for COGS and advertising expenses lowered their taxable income, leading to a more manageable tax payment.

Future Implications and Tax Planning

As tax laws and regulations evolve, staying informed and adapting financial strategies is crucial. Here are some key considerations for the future:

- Tax Law Changes: Keep abreast of any changes in tax laws, as these can impact deductions, credits, and tax rates.

- Long-Term Planning: Develop long-term financial plans that account for potential tax liabilities and strategies to minimize them.

- Consult Professional Advice: Engaging tax professionals or financial advisors can provide tailored guidance based on individual or business circumstances.

How does gross income differ for individuals and businesses?

+For individuals, gross income includes all earnings from various sources, while for businesses, it is calculated as revenue minus the cost of goods sold.

Can gross income be reduced before taxes are applied?

+Yes, deductions and exemptions can be applied to gross income to reduce taxable income, resulting in a lower tax liability.

What are some common deductions for individuals and businesses?

+Individuals can deduct retirement contributions, medical expenses, and personal exemptions, while businesses can deduct expenses like advertising, R&D, and employee benefits.