Income Tax Calculator Virginia

Welcome to our comprehensive guide on understanding and navigating the income tax system in the state of Virginia. In this article, we will delve into the intricacies of Virginia’s tax structure, providing you with an expert-level analysis and a powerful tool to calculate your income taxes accurately. As we explore the unique features of Virginia’s tax system, you’ll gain insights into the factors that impact your tax liability and learn how to utilize our state-of-the-art income tax calculator tailored specifically for Virginia residents.

Introduction to Virginia’s Tax Landscape

Virginia, known for its rich history and diverse economy, has a tax system that reflects its vibrant business environment and the needs of its residents. With a progressive tax structure, the state aims to provide a balanced approach to taxation, ensuring fairness and contributing to the overall prosperity of the Commonwealth.

Our mission is to demystify the complex world of income taxes and empower you to take control of your financial obligations. By the end of this guide, you’ll not only have a deeper understanding of Virginia’s tax system but also the practical knowledge to calculate your taxes accurately using our innovative calculator.

Understanding Virginia’s Tax Structure

Progressive Tax Rates

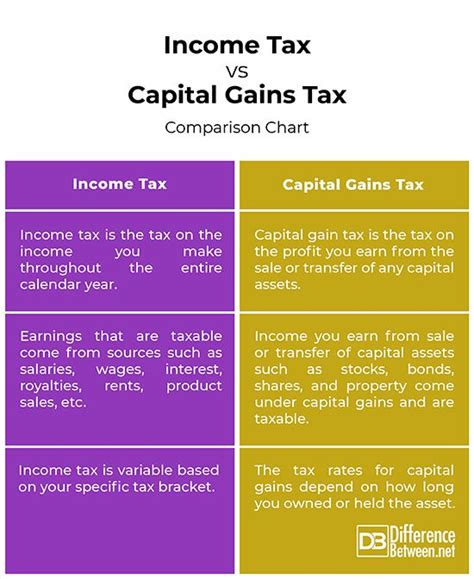

Virginia operates on a progressive tax system, which means that as your income increases, so does your tax rate. This approach ensures that higher-income earners contribute a larger proportion of their income to the state’s revenue, promoting equity and social welfare.

The state has five income tax brackets, ranging from 2% to 5.75%. These brackets are designed to capture different income levels, with each subsequent bracket applying a higher tax rate. For example, an individual earning up to 3,000 falls into the lowest tax bracket of 2%, while incomes exceeding 17,000 are taxed at the highest rate of 5.75%.

Taxable Income and Deductions

When calculating your taxable income, it’s essential to consider various deductions and credits offered by the state. Virginia allows residents to deduct certain expenses, such as medical costs, charitable contributions, and state and local taxes paid. These deductions can significantly reduce your taxable income, leading to lower tax liabilities.

Additionally, Virginia offers tax credits for specific circumstances, such as the Earned Income Tax Credit for low- to moderate-income individuals and families, and the Child and Dependent Care Credit for eligible childcare expenses. These credits can provide further relief and reduce your overall tax burden.

Utilizing the Income Tax Calculator for Virginia

Step-by-Step Guide

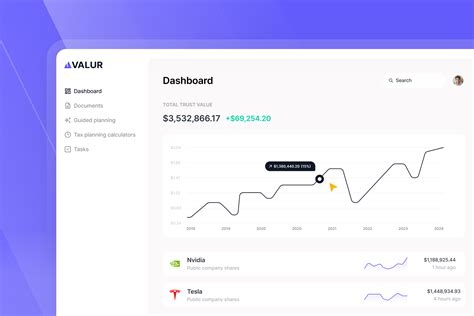

Our income tax calculator for Virginia is designed to be user-friendly and accurate. Here’s a step-by-step guide on how to utilize it effectively:

Input Your Income: Begin by entering your annual income. Our calculator considers both earned income (such as wages and salaries) and unearned income (e.g., investments and rental income).

Select Filing Status: Choose your filing status, whether you’re filing as an individual, married filing jointly, married filing separately, or head of household. This step is crucial as it determines the applicable tax rates and deductions.

Enter Deductions and Credits: Input any applicable deductions and credits. Our calculator provides a comprehensive list of deductions, including those for medical expenses, charitable contributions, and state and local taxes. Additionally, you can claim credits such as the Earned Income Tax Credit or the Child and Dependent Care Credit if eligible.

Calculate Your Tax Liability: Once you’ve provided all the necessary information, our calculator will compute your tax liability. It takes into account your income, filing status, deductions, and credits to determine the exact amount of tax you owe to the state of Virginia.

Benefits of Using the Calculator

- Accuracy: Our calculator is based on the latest Virginia tax laws and regulations, ensuring precise calculations and peace of mind.

- Simplicity: With an intuitive interface, the calculator makes tax filing a breeze, saving you time and effort.

- Personalized Results: By considering your unique circumstances, the calculator provides tailored results, reflecting your specific tax situation.

- Real-Time Updates: We keep our calculator up-to-date with any changes in Virginia’s tax code, ensuring you always have the most current information.

Real-World Examples and Case Studies

To illustrate the practical application of our income tax calculator, let’s explore a few real-world scenarios:

Case Study 1: Single Filers

Consider John, a single individual earning 50,000 annually. By using our calculator, John discovers that he falls into the 4% tax bracket and owes approximately 2,000 in state income tax. With the calculator’s help, he can easily plan his financial strategy and make informed decisions about deductions and savings.

Case Study 2: Married Filing Jointly

Sarah and Michael, a married couple with a combined income of 120,000, utilize our calculator to determine their tax liability. They find that, as a married couple filing jointly, they are in the 5.75% tax bracket and owe around 6,800 in state income tax. The calculator’s accuracy helps them understand their financial obligations and plan their budget accordingly.

Case Study 3: Tax Credits and Deductions

Emily, a single mother with two children, earns $35,000 annually. By inputting her information into our calculator, she discovers that she is eligible for the Earned Income Tax Credit, which significantly reduces her tax liability. Additionally, she claims deductions for childcare expenses, further lowering her tax burden. The calculator’s comprehensive analysis empowers Emily to maximize her tax savings.

The Impact of Tax Laws and Policy Changes

Virginia’s tax landscape is subject to changes and updates, influenced by economic conditions and legislative decisions. Staying informed about these changes is crucial for accurate tax planning. Our income tax calculator is designed to adapt to these shifts, ensuring that you always have access to the most current tax information.

Recent Tax Reforms

In recent years, Virginia has implemented several tax reforms aimed at stimulating economic growth and providing relief to residents. For instance, the state introduced a new tax bracket for higher-income earners, ensuring a fair distribution of tax responsibilities. Additionally, Virginia expanded its Earned Income Tax Credit, making it more accessible to low- and moderate-income individuals and families.

Future Tax Prospects

Looking ahead, Virginia’s tax policies are likely to continue evolving to address emerging economic challenges and opportunities. As a responsible taxpayer, it’s essential to stay updated on these changes to ensure compliance and take advantage of any new tax benefits. Our income tax calculator will remain a reliable tool, providing real-time updates and accurate calculations.

Frequently Asked Questions (FAQ)

How often are the tax laws in Virginia updated, and where can I find the latest information?

+Virginia's tax laws are subject to periodic updates, typically aligned with the legislative calendar. To stay informed, you can refer to the official website of the Virginia Department of Taxation, which provides the latest tax information and any recent changes.

Are there any special tax considerations for residents who work remotely or across state lines?

+Yes, remote work and cross-state employment can have unique tax implications. Virginia has specific guidelines for allocating income taxes when individuals work remotely or across state lines. Our calculator takes these considerations into account, ensuring accurate calculations based on your specific circumstances.

What is the deadline for filing income tax returns in Virginia, and are there any extensions available?

+The deadline for filing income tax returns in Virginia typically aligns with the federal deadline, which is April 15th. However, in certain circumstances, taxpayers may be eligible for extensions. It's important to note that while the filing deadline may be extended, the payment deadline remains the same. Our calculator provides guidance on these deadlines and any applicable extensions.

Can I use the income tax calculator for Virginia if I have multiple sources of income, such as wages, investments, and rental income?

+Absolutely! Our income tax calculator for Virginia is designed to accommodate various sources of income. Whether you have wages, investments, rental income, or a combination of these, our calculator considers all income types and provides an accurate tax calculation based on your unique financial situation.

Are there any tax credits or deductions specifically for homeowners in Virginia, and how can I claim them using the calculator?

+Yes, Virginia offers tax credits and deductions for homeowners, including the Virginia Resident Homeowner Tax Credit and the Property Tax Relief Program. To claim these benefits using our calculator, you'll need to input the relevant information, such as your property taxes paid and any applicable credits. Our calculator will guide you through the process and ensure you receive the maximum tax savings.

Final Thoughts and Expert Insights

As we conclude our exploration of Virginia’s income tax system, it’s evident that understanding and navigating this landscape can be complex. However, with the right tools and knowledge, you can confidently manage your tax obligations. Our income tax calculator for Virginia is designed to be your trusted companion, providing accurate calculations and empowering you to make informed financial decisions.

Stay tuned for future updates and insights as we continue to monitor and analyze Virginia’s tax policies, ensuring you have the most current information at your fingertips. Remember, staying informed and utilizing resources like our calculator can make all the difference in optimizing your tax strategy and maximizing your financial well-being.