Illinois Estimated Tax Payment

The Illinois Estimated Tax Payment system is a vital component of the state's tax collection process, designed to ensure taxpayers meet their annual tax obligations. This system is particularly relevant for individuals with varying income sources, including self-employment, rental properties, and investments. It is crucial for these taxpayers to understand how to navigate the estimated tax payment process to avoid penalties and ensure compliance with state tax laws.

Understanding Illinois Estimated Tax

Illinois Estimated Tax is a payment system that allows the state to collect taxes throughout the year from individuals whose income is not subject to withholding. This includes self-employed individuals, partners, and S corporation shareholders. The estimated tax is paid in quarterly installments to cover the current year’s tax liability. The payment schedule is typically divided into four equal payments due on the 15th of April, June, September, and January of the following year.

The estimated tax payment is calculated based on the taxpayer's expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. It is crucial to accurately estimate these figures to avoid underpayment penalties. The Illinois Department of Revenue provides resources and tools to help taxpayers calculate their estimated tax payments.

Who Needs to Make Estimated Tax Payments in Illinois?

Not all taxpayers are required to make estimated tax payments. Generally, individuals who expect to owe at least $1,000 in taxes for the year and whose withholdings and credits are insufficient to cover this amount must make estimated tax payments. This includes:

- Self-employed individuals

- Partners in a partnership

- S corporation shareholders

- Rental property owners

- Investors with substantial capital gains

It is important to note that even if a taxpayer is not required to make estimated tax payments, they may still choose to do so to ensure they have enough funds set aside to cover their tax liability when it is due.

Calculating Your Estimated Tax Payment

Calculating your estimated tax payment accurately is crucial to avoid penalties. The Illinois Department of Revenue provides a Worksheet for Estimated Income Tax Payments to assist taxpayers in determining their quarterly estimated tax payments. This worksheet considers factors such as:

- Expected adjusted gross income

- Estimated deductions and credits

- Prior year’s tax liability

- Withholding and estimated tax payments made for the current year

The worksheet guides taxpayers through a series of calculations to arrive at their estimated quarterly payments. It is recommended to review and update these calculations throughout the year as income and expenses may fluctuate.

Considerations for Accurate Estimation

When estimating your tax payments, it is essential to consider all sources of income, including wages, salaries, tips, self-employment income, interest and dividends, capital gains, and any other taxable income. Additionally, taxpayers should account for all applicable deductions and credits, such as the standard deduction, itemized deductions, and any tax credits they may be eligible for.

Taxpayers should also be aware of any changes in their financial situation or tax laws that could impact their tax liability. For instance, changes in filing status, number of dependents, or tax rates could affect the estimated tax calculation.

Making Your Estimated Tax Payment

Illinois offers various methods for making estimated tax payments, providing taxpayers with convenient options to meet their tax obligations. The state accepts payments online, by phone, and through traditional mail methods.

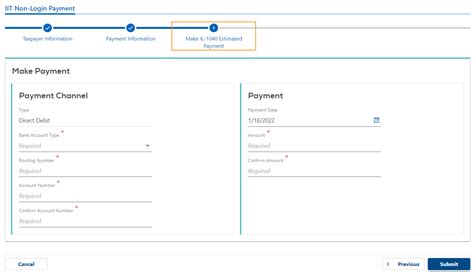

Online Payment Options

The Illinois Department of Revenue’s website offers a secure online payment system where taxpayers can make their estimated tax payments using a credit or debit card, electronic check, or through their bank account. This method provides taxpayers with a quick and convenient way to pay their estimated taxes without the need for physical checks or visits to a tax office.

Phone and Mail Payment Options

For those who prefer more traditional methods, Illinois also accepts estimated tax payments by phone and mail. Taxpayers can call the Department of Revenue’s toll-free number to make a payment using their credit or debit card. Alternatively, taxpayers can mail a check or money order, payable to the Illinois Department of Revenue, to the address provided on the estimated tax payment voucher.

It is important to ensure that all payments are made by the due date to avoid late payment penalties. The payment voucher includes the payment due date, and taxpayers should ensure their payment reaches the Department of Revenue by this date.

Managing Your Estimated Tax Liability

Effectively managing your estimated tax liability is crucial to ensure you are not overpaying or underpaying your taxes. Overpaying can result in a refund, but underpaying can lead to penalties and interest charges.

Adjusting Your Withholdings

If you find that you are consistently overpaying your estimated taxes, you may consider adjusting your withholdings from your wages, salaries, or pensions. By completing a new Form W-4 or Form W-2P, you can instruct your employer or pension payer to withhold additional amounts from each paycheck to cover your tax liability. This can help reduce the amount you need to pay through estimated tax payments.

Quarterly Review and Adjustment

It is recommended to review your estimated tax payments on a quarterly basis. This allows you to assess any changes in your income, deductions, or credits that may impact your tax liability. By making adjustments to your estimated payments as needed, you can ensure you are meeting your tax obligations without overpaying.

Annual Reconciliation

At the end of the year, it is essential to reconcile your estimated tax payments with your actual tax liability. This involves comparing the total amount you paid through estimated tax payments to the amount of tax you owe based on your annual income and deductions. If you paid more than you owe, you will receive a refund. If you paid less, you may be subject to penalties and interest.

Penalties and Interest for Underpayment

If you underpay your estimated taxes, you may be subject to penalties and interest. The Illinois Department of Revenue imposes a penalty for underpayment of estimated tax, which is calculated as a percentage of the amount underpaid. Additionally, interest may be charged on the underpayment amount.

It is important to note that penalties and interest can add up quickly, so it is crucial to make accurate estimated tax payments to avoid these additional charges.

Penalty Relief for Certain Taxpayers

Illinois offers penalty relief for certain taxpayers who underpay their estimated taxes. Taxpayers who experience a substantial financial hardship or those whose estimated tax payments were affected by a natural disaster may be eligible for penalty relief. However, taxpayers must still pay the interest on any underpayment.

| Estimated Tax Due Date | Payment Method |

|---|---|

| April 15th | Online, Phone, or Mail |

| June 15th | Online, Phone, or Mail |

| September 15th | Online, Phone, or Mail |

| January 15th (of the following year) | Online, Phone, or Mail |

Common Misconceptions about Estimated Tax Payments

There are several misconceptions surrounding estimated tax payments that can lead to confusion and potential non-compliance. Understanding these misconceptions can help taxpayers navigate the estimated tax payment process more effectively.

Misconception: Estimated Tax Payments Are Optional

One common misconception is that estimated tax payments are optional. While not all taxpayers are required to make estimated tax payments, those who are subject to the requirement must make these payments to avoid penalties. Failure to make estimated tax payments can result in significant penalties and interest charges.

Misconception: Estimated Tax Payments Are Due Annually

Another misconception is that estimated tax payments are due annually. In reality, estimated tax payments are due quarterly. The payment schedule is divided into four equal installments, with each payment due on a specific date. Missing a quarterly payment can result in penalties and interest, so it is crucial to stay on top of the payment schedule.

Misconception: Estimated Tax Payments Are Only for the Self-Employed

Many people believe that estimated tax payments are only necessary for self-employed individuals. While self-employed individuals are often required to make estimated tax payments, other taxpayers, such as partners in a partnership or shareholders in an S corporation, may also be subject to this requirement. It is important to understand your specific tax situation and whether you are required to make estimated tax payments.

Conclusion

Navigating the Illinois Estimated Tax Payment system can be complex, but with the right tools and resources, taxpayers can effectively manage their tax obligations. By understanding the requirements, calculating their estimated tax payments accurately, and utilizing the various payment methods available, taxpayers can ensure compliance with state tax laws and avoid penalties and interest charges.

The Illinois Department of Revenue provides valuable resources and guidance to assist taxpayers in navigating the estimated tax payment process. Taxpayers should take advantage of these resources and seek professional advice when needed to ensure they are meeting their tax obligations accurately and efficiently.

Frequently Asked Questions

What happens if I don’t make my estimated tax payments on time in Illinois?

+If you miss the deadline for your estimated tax payments, you may be subject to penalties and interest charges. It is important to make your payments on time to avoid these additional costs. The Illinois Department of Revenue provides guidance on penalty and interest calculations, which can be found on their website.

Are there any exceptions to the estimated tax payment requirement in Illinois?

+Yes, there are certain exceptions to the estimated tax payment requirement. For example, if your total tax liability for the previous year was less than 1,000 and you expect it to remain under 1,000 for the current year, you may not be required to make estimated tax payments. However, it is always best to consult with a tax professional to determine your specific situation.

Can I make estimated tax payments throughout the year instead of quarterly?

+While the estimated tax payment schedule is typically divided into four quarterly installments, you can make additional payments throughout the year if you prefer. This can help you manage your tax liability and ensure you are not underpaying. However, it is important to note that each payment must still be made by the respective due date to avoid penalties.

How can I calculate my estimated tax payments more accurately in Illinois?

+To calculate your estimated tax payments accurately, it is recommended to use the Worksheet for Estimated Income Tax Payments provided by the Illinois Department of Revenue. This worksheet considers various factors, including your expected income, deductions, and credits. It is important to review and update your calculations throughout the year to account for any changes in your financial situation.

What happens if I overpay my estimated taxes in Illinois?

+If you overpay your estimated taxes, you will receive a refund. The Illinois Department of Revenue will process your refund and issue a check or direct deposit, depending on your preferred method of payment. It is important to ensure that you have provided accurate banking information if you opt for direct deposit.