How To Remove Person From Turbo Tax

In today's digital age, online tax preparation platforms have become a popular choice for many individuals seeking convenience and efficiency when filing their taxes. Among these platforms, TurboTax stands out as a widely used and trusted software. However, there may be instances where you need to remove a person from your TurboTax account, whether it's due to changes in your personal circumstances, a desire for privacy, or other reasons.

This comprehensive guide will walk you through the process of removing a person from TurboTax, ensuring you maintain control over your tax-related information and account settings. We'll cover the necessary steps, provide insights into the implications, and offer valuable tips to ensure a smooth and secure transition.

Understanding the Need to Remove a Person from TurboTax

Before we delve into the technical aspects, it’s essential to understand the common scenarios that may lead to the need for removing a person from your TurboTax account.

One common situation arises when a married couple decides to separate or divorce. In such cases, it's crucial to establish financial independence and ensure that sensitive tax information is protected. By removing a former spouse from your TurboTax account, you can regain control over your tax filings and maintain confidentiality.

Another scenario involves joint account holders who wish to separate their tax-related activities. Perhaps you initially filed taxes together with a partner, but now you want to manage your finances independently. Removing the person from your TurboTax account allows you to continue using the platform while maintaining separate tax records.

Additionally, there may be instances where a person no longer requires access to your TurboTax account. This could be due to a change in employment, a shift in financial responsibilities, or simply a desire to streamline your tax-related tasks. In these cases, removing the person ensures that your account remains secure and tailored to your specific needs.

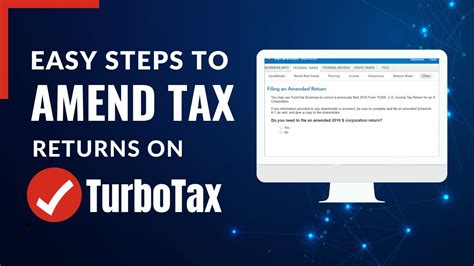

Step-by-Step Guide: Removing a Person from TurboTax

Now that we’ve established the reasons for removing a person from TurboTax, let’s dive into the practical steps to accomplish this task effectively.

Step 1: Access Your TurboTax Account

Begin by opening your web browser and navigating to the TurboTax website. Log in to your account using your credentials. Ensure that you have the necessary security measures in place, such as a strong password and two-factor authentication, to protect your sensitive information.

Step 2: Locate the User Management Section

Once logged in, look for the “User Management” or “Account Settings” section within your TurboTax account. This section is typically found in the top navigation bar or in the settings menu. It may vary slightly depending on the version of TurboTax you are using, but it should be easily accessible.

Step 3: Identify the Person to Remove

Within the user management section, you will find a list of all the users associated with your TurboTax account. Locate the person you wish to remove and click on their name or profile to access their specific settings.

Step 4: Remove User Access

On the user’s profile page, you should find an option to remove their access or revoke their permissions. This may be labeled as “Remove User,” “Revoke Access,” or something similar. Click on this option to initiate the removal process.

TurboTax may prompt you to confirm your decision. Read through the confirmation message carefully to ensure you understand the implications of removing the person. Once you are certain, proceed with the removal by clicking on the confirmation button.

Step 5: Update Tax-Related Information

After removing the person from your TurboTax account, it’s essential to review and update any tax-related information that may have been shared with them. This includes tax returns, financial data, and personal information.

Go through each section of your TurboTax account and ensure that all sensitive data is up to date and reflects your current circumstances. Update any shared documents, forms, or supporting materials to maintain accuracy and confidentiality.

Step 6: Consider Alternative Arrangements

If the person you removed from your TurboTax account had a significant role in your tax filings, such as a spouse or business partner, it’s crucial to establish alternative arrangements. This may involve creating separate TurboTax accounts or exploring other tax preparation options.

Discuss the situation with the person and determine the best course of action to ensure that tax-related responsibilities are handled efficiently and securely. You may consider sharing relevant information or providing access to specific documents as needed, while maintaining a clear separation of accounts.

Implications and Considerations

When removing a person from your TurboTax account, it’s essential to consider the potential implications and take appropriate measures to protect your financial well-being.

Financial Accountability

By removing a person from your TurboTax account, you assume full financial accountability for the tax returns and filings associated with that account. It’s crucial to review and understand your tax obligations thoroughly to avoid any discrepancies or potential issues with the Internal Revenue Service (IRS) or other tax authorities.

Data Privacy

Data privacy is a critical aspect when it comes to tax-related information. When removing a person, ensure that all sensitive data, including personal information, financial details, and tax returns, is securely stored and protected. Regularly monitor your TurboTax account for any suspicious activities or unauthorized access attempts.

Tax Return Amendments

If the person you remove had filed tax returns through your TurboTax account, it’s important to consider the potential need for amendments. Amendments may be required if there are changes to income, deductions, or other factors that impact the accuracy of the tax return. Consult with a tax professional or refer to IRS guidelines to determine if amendments are necessary.

Joint Account Considerations

In the case of joint accounts, where multiple users are associated with a single TurboTax account, removing a person may impact the ability to file taxes jointly. Discuss the implications with your tax advisor or refer to TurboTax’s support resources to understand the best practices for maintaining joint tax filings while ensuring privacy and security.

Tips for a Smooth Transition

To ensure a seamless and stress-free transition when removing a person from your TurboTax account, consider the following tips:

- Communication: Open and honest communication with the person being removed is essential. Discuss the reasons for the removal and ensure that they understand the process and its implications. This can help prevent any misunderstandings or potential conflicts.

- Backup Your Data: Before initiating the removal process, consider backing up important tax-related data. This includes tax returns, financial documents, and any other relevant information. Having a backup ensures that you can access this data if needed in the future.

- Review Tax Obligations: Take the time to review your tax obligations thoroughly. Understand the tax implications of the changes you are making and ensure that you meet all legal requirements. Consult with a tax professional if you have any doubts or complex tax situations.

- Maintain Secure Practices: Continue to practice good cybersecurity habits. Use strong passwords, enable two-factor authentication, and regularly update your security measures. This helps protect your financial information and reduces the risk of unauthorized access.

- Explore Alternative Options: If the person being removed was a significant contributor to your tax filings, explore alternative tax preparation options. TurboTax offers various plans and features that can cater to your specific needs. Consider seeking professional tax advice to ensure you choose the most suitable option.

Conclusion: Taking Control of Your Tax Journey

Removing a person from your TurboTax account is a crucial step in maintaining control over your tax-related information and ensuring privacy and security. By following the step-by-step guide provided, you can effectively manage your TurboTax account and adapt it to your changing circumstances.

Remember to consider the implications, communicate openly, and take the necessary measures to protect your financial well-being. With the right approach and attention to detail, you can navigate the process of removing a person from TurboTax smoothly and confidently.

FAQ

Can I remove a person from my TurboTax account if they have already filed a tax return through it?

+Yes, you can remove a person from your TurboTax account even if they have filed a tax return. However, it’s important to note that removing them will not delete their tax return or any associated data. To maintain the accuracy of your tax records, consider consulting a tax professional to understand the implications and potential need for amendments.

How long does it take for the removal process to be complete after I initiate it?

+The removal process is typically immediate once you confirm your decision. However, it’s recommended to allow some time for the system to update and reflect the changes. TurboTax may provide an estimated time frame for the completion of the removal process, which can vary depending on factors such as system load and account complexity.

Are there any fees associated with removing a person from my TurboTax account?

+Removing a person from your TurboTax account should not incur any additional fees. TurboTax offers this feature as part of its standard user management options. However, if you need to make significant changes to your tax returns or seek professional tax advice, additional fees may apply depending on the specific circumstances and the services provided.

Can I remove a person from my TurboTax account and still use the same tax returns they filed?

+Yes, you can retain the tax returns filed by the person you remove. When you remove a user, their access to your TurboTax account is revoked, but the tax returns they filed will remain in your account. You can continue to access and review these returns as needed, ensuring that your tax history is complete and accurate.

What happens to the tax returns filed by the person I remove? Can I access them after removal?

+The tax returns filed by the person you remove will remain accessible to you after the removal process. TurboTax allows you to view and manage all tax returns associated with your account, regardless of who filed them. This ensures that you have a comprehensive record of your tax history and can address any potential issues or discrepancies.