How Much Is New York City Sales Tax

New York City, the bustling metropolis and cultural hub of the United States, boasts a thriving economy and a diverse range of industries. One of the key aspects that influences the financial landscape of this vibrant city is its sales tax system. Understanding the sales tax rates and their impact is crucial for both residents and businesses alike. In this comprehensive guide, we will delve into the intricacies of New York City's sales tax, providing you with an in-depth analysis and insights to navigate this essential aspect of the city's financial ecosystem.

Unraveling the Complexity: Sales Tax in New York City

Sales tax in New York City is a multifaceted component of the city’s fiscal framework, comprising various rates and regulations. This intricate system is designed to generate revenue for the city while ensuring a fair and balanced approach to taxation. Let’s explore the key elements that make up New York City’s sales tax landscape.

Understanding the Basic Sales Tax Rate

At its core, New York City imposes a standard sales tax rate applicable to a wide range of goods and services. This base rate forms the foundation of the city’s sales tax structure. As of the latest available information, the basic sales tax rate in New York City stands at 4.5%. This rate is a crucial starting point for understanding the overall sales tax landscape and its implications.

It's important to note that the basic sales tax rate is subject to change periodically, reflecting the evolving needs and priorities of the city's fiscal policy. Therefore, staying updated with the latest rate is essential for accurate financial planning and compliance.

Exploring Additional Taxes and Fees

Beyond the basic sales tax rate, New York City employs a variety of additional taxes and fees to further enhance its revenue streams. These supplementary charges are applied to specific goods, services, or activities, creating a more nuanced and targeted approach to taxation. Here’s a glimpse into some of the key additional taxes and fees that contribute to the city’s overall sales tax framework:

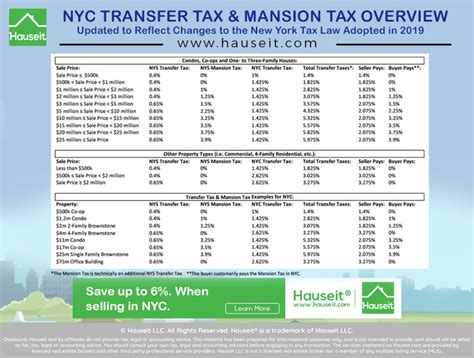

- City Sales Tax: On top of the basic rate, New York City levies an additional sales tax of 4.875%. This city-specific tax brings the total sales tax rate to 9.375%, further contributing to the city's revenue generation.

- State Sales Tax: In addition to the city sales tax, the state of New York imposes its own sales tax rate. As of the latest data, the state sales tax rate is 4%. When combined with the city sales tax, the total sales tax rate becomes 13.375%, making it one of the highest sales tax rates in the country.

- Local Taxes: Beyond the state and city sales taxes, certain localities within New York City may impose their own additional taxes. These local taxes can vary based on the specific jurisdiction and are applied on top of the existing sales tax rates. It's essential for businesses and consumers to be aware of these localized taxes to ensure accurate tax compliance.

- Use Tax: New York City also enforces a use tax, which is applicable to certain transactions that are not subject to sales tax. This includes purchases made online or out of state, but are ultimately used or consumed within the city limits. The use tax rate aligns with the total sales tax rate, ensuring a consistent approach to taxation.

Analyzing Exemptions and Special Considerations

While the sales tax rates in New York City may seem straightforward, there are certain exemptions and special considerations that can impact the overall tax liability. Understanding these nuances is crucial for businesses and individuals to navigate the tax landscape effectively.

One notable exemption in New York City is the food exemption. Certain food items, such as unprepared food products, are exempt from sales tax. This exemption provides a relief to consumers, allowing them to save on their grocery bills. However, it's important to note that this exemption only applies to specific categories of food and may not cover all food-related purchases.

Additionally, New York City offers tax incentives and credits for certain industries and activities. These incentives aim to promote economic growth and development within the city. Businesses operating in designated zones or engaging in specific activities may be eligible for tax credits or reduced tax rates. Staying informed about these incentives can provide significant financial benefits for eligible entities.

Impact on Businesses and Consumers

The sales tax system in New York City has a direct impact on both businesses and consumers. For businesses, the sales tax rates influence their pricing strategies, operational costs, and overall financial planning. It’s crucial for businesses to accurately calculate and remit sales tax to avoid legal repercussions and maintain a positive relationship with their customers.

Consumers, on the other hand, bear the brunt of the sales tax rates through increased prices. The cumulative effect of the various sales tax rates can significantly impact the affordability of goods and services, especially for individuals with limited financial means. Understanding the sales tax landscape empowers consumers to make informed purchasing decisions and budget accordingly.

Compliance and Enforcement

Ensuring compliance with the sales tax regulations is a critical aspect of doing business in New York City. The city’s tax authorities have established stringent guidelines and enforcement mechanisms to monitor and collect sales tax. Businesses are required to register for sales tax permits, collect and remit sales tax on taxable transactions, and maintain accurate records.

Non-compliance with sales tax regulations can result in significant penalties, fines, and legal consequences. Therefore, it's imperative for businesses to stay updated with the latest tax laws, seek professional guidance when necessary, and implement robust sales tax compliance systems.

The Future of Sales Tax in New York City

As the economic landscape of New York City continues to evolve, so does its sales tax system. The city’s fiscal authorities regularly review and adjust tax rates, regulations, and exemptions to align with changing economic conditions and policy priorities.

Looking ahead, the future of sales tax in New York City is likely to be shaped by technological advancements, economic trends, and policy shifts. The increasing adoption of e-commerce and digital platforms may influence the way sales tax is collected and enforced. Additionally, ongoing debates surrounding tax reform and revenue generation strategies may lead to further adjustments in the sales tax landscape.

Staying informed about these developments is crucial for businesses and individuals to adapt their financial strategies and ensure compliance with the ever-evolving sales tax regulations.

Navigating the Sales Tax Landscape: A Comprehensive Guide

Understanding the sales tax system in New York City is essential for both businesses and consumers to navigate the financial landscape effectively. By unraveling the complexities of sales tax rates, exemptions, and compliance requirements, individuals and entities can make informed decisions, plan their finances strategically, and contribute to the city’s vibrant economy.

As New York City continues to thrive as a global hub of commerce and culture, its sales tax system remains a critical component of its fiscal framework. By staying informed and engaged with the latest tax developments, residents and businesses can ensure their financial well-being and contribute to the city's prosperity.

How often are sales tax rates updated in New York City?

+Sales tax rates in New York City are subject to periodic updates, typically aligned with the city’s fiscal calendar. These updates are driven by various factors, including economic conditions, budget requirements, and policy changes. It’s essential to stay informed about any changes to ensure compliance with the latest tax rates.

Are there any sales tax holidays in New York City?

+New York City does not observe traditional sales tax holidays like some other states. However, the city may implement temporary tax relief programs or incentives to stimulate certain industries or promote specific initiatives. These initiatives are typically time-bound and may offer reduced tax rates or exemptions for qualifying purchases.

How can businesses ensure accurate sales tax compliance in New York City?

+Businesses operating in New York City should prioritize sales tax compliance by staying updated with the latest tax regulations, seeking professional guidance when needed, and implementing robust sales tax management systems. Accurate record-keeping, timely remittance of sales tax, and compliance with registration requirements are essential to avoid penalties and legal repercussions.