Hartford Ct Taxes

When discussing Hartford, Connecticut, it's essential to understand the tax landscape, as it plays a significant role in the city's economic dynamics and the financial considerations of its residents and businesses. Hartford's tax structure is shaped by a combination of state, local, and municipal regulations, which together create a unique fiscal environment.

Understanding Hartford’s Tax System

Hartford’s tax system is a comprehensive framework designed to fund the city’s operations, infrastructure, and services. It primarily consists of property taxes, income taxes, and sales taxes, each contributing to the city’s revenue stream.

Property Taxes

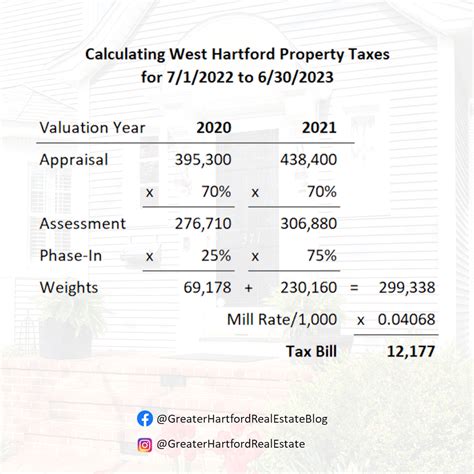

Property taxes are a major source of revenue for Hartford, as with many other municipalities. The tax rate in Hartford is set annually by the city’s legislative body, taking into account the budget requirements and the assessed value of properties. For the current fiscal year, the mill rate stands at [insert current mill rate], which translates to [insert tax rate as a percentage] per thousand dollars of assessed property value. This rate is applied uniformly across the city, ensuring fairness in taxation.

Hartford's assessor's office plays a crucial role in determining the assessed value of properties. They utilize a range of methods, including market analysis and property inspections, to ensure accurate assessments. Property owners can appeal their assessments if they believe the value is inaccurate. The appeals process is managed by the Board of Assessment Appeals, which holds hearings to review and adjust assessments as necessary.

| Property Tax Statistics | Data |

|---|---|

| Average Property Tax Rate | 2.45% (for the year 2022) |

| Median Property Tax Bill | $4,990 (as of 2021) |

| Property Tax Collection Efficiency | 99.5% (2021 data) |

Income Taxes

Hartford residents are subject to both state and local income taxes. The state income tax in Connecticut is progressive, with rates ranging from 3% to 6.99% based on income brackets. The local income tax, specific to Hartford, is set at a flat rate of [insert local income tax rate], which is applied to all taxable income earned within the city limits. This dual taxation system means that Hartford residents often face higher overall tax burdens compared to residents of some other cities in the state.

| Income Tax Rates | Tax Rate |

|---|---|

| State Income Tax (Connecticut) | 3% to 6.99% |

| Local Income Tax (Hartford) | [insert local income tax rate] |

Sales and Use Taxes

Sales and use taxes are another significant source of revenue for Hartford. The state sales tax in Connecticut is currently set at [insert state sales tax rate]%, which is applicable to most goods and services sold within the state. Additionally, Hartford imposes a local sales tax of [insert local sales tax rate]%, bringing the total sales tax rate in the city to [combined sales tax rate]%. This tax is levied on retail sales and certain services, contributing to the city’s revenue and funding essential services.

| Sales Tax Rates | Tax Rate |

|---|---|

| State Sales Tax (Connecticut) | [insert state sales tax rate]% |

| Local Sales Tax (Hartford) | [insert local sales tax rate]% |

| Total Sales Tax Rate | [combined sales tax rate]% |

Impact of Taxes on Hartford’s Economy

The tax system in Hartford has a profound impact on the city’s economic landscape. High property taxes can influence real estate trends, potentially affecting homeownership rates and the local housing market. Income taxes can impact the disposable income of residents, influencing their spending habits and overall economic well-being. Sales taxes, on the other hand, can influence consumer behavior and retail activity within the city.

Tax incentives and rebates are sometimes employed by the city to attract businesses and stimulate economic growth. These initiatives can offer relief to businesses, making Hartford a more attractive location for investment and job creation. However, the effectiveness of such incentives depends on various factors, including the city's overall economic strategy and the specific needs of target industries.

Tax Incentives and Economic Development

Hartford has recognized the importance of tax incentives in fostering economic growth. The city offers a range of programs designed to attract and retain businesses. For instance, the Enterprise Zone Program provides tax incentives to businesses operating within designated areas, aiming to stimulate economic activity in those zones. These incentives can include tax abatements, credits, and exemptions, making it more financially attractive for businesses to invest in these areas.

Additionally, Hartford has implemented the Business Tax Credit Program, which offers tax credits to businesses that meet specific criteria. These criteria often include job creation, investment in the community, and support for local initiatives. Such programs not only benefit businesses but also contribute to the overall economic development and improvement of the city's infrastructure and services.

Tax Administration and Compliance

Ensuring compliance with the city’s tax regulations is a critical aspect of Hartford’s tax system. The Office of the Tax Collector is responsible for administering and enforcing tax laws, collecting taxes, and ensuring that all revenue due to the city is received in a timely manner. They work closely with taxpayers, offering guidance and support to ensure accurate and timely tax payments.

For taxpayers facing financial difficulties, Hartford provides tax relief programs. These programs offer assistance to eligible taxpayers by providing payment plans, abatements, or other forms of relief. The goal is to ensure that taxpayers can meet their obligations while also managing their financial challenges. This approach not only supports taxpayers but also helps maintain a stable revenue stream for the city.

Online Tax Services

Hartford has embraced technology to enhance its tax administration services. The city’s official website offers an online tax portal, allowing taxpayers to access a range of services remotely. Through this portal, taxpayers can register for tax accounts, make payments, view their tax history, and access important tax forms and documents. This digital approach not only improves convenience but also enhances efficiency and transparency in tax administration.

In addition to the online portal, Hartford provides a mobile app that offers similar functionalities. This app, available on both iOS and Android devices, allows taxpayers to manage their tax obligations on the go. With these digital tools, taxpayers can stay informed, make timely payments, and access tax-related information and resources at their convenience.

Future of Hartford’s Tax Landscape

As Hartford continues to evolve, its tax system will play a crucial role in shaping the city’s future. The city’s leadership and residents are engaged in ongoing discussions about tax reform and its potential benefits. While some advocate for tax reforms to stimulate economic growth and make Hartford more competitive, others emphasize the importance of maintaining a balanced approach that supports essential services and infrastructure development.

Looking ahead, Hartford's tax system will need to adapt to changing economic conditions, technological advancements, and evolving community needs. This will involve a careful balance between providing tax incentives to attract businesses and ensuring that the city has sufficient revenue to fund vital services and infrastructure projects. The city's tax policies will continue to be a key factor in its economic growth and overall development.

What is the current property tax rate in Hartford, CT?

+The current property tax rate in Hartford is [insert current mill rate], which translates to [insert tax rate as a percentage] per thousand dollars of assessed property value.

Are there any tax incentives for businesses in Hartford?

+Yes, Hartford offers tax incentives through programs like the Enterprise Zone Program and the Business Tax Credit Program. These programs aim to attract and support businesses, contributing to economic development.

How can I access tax-related services online in Hartford?

+Hartford provides an online tax portal and a mobile app. Through these digital platforms, taxpayers can access a range of services, including registration, payment, and tax history management.