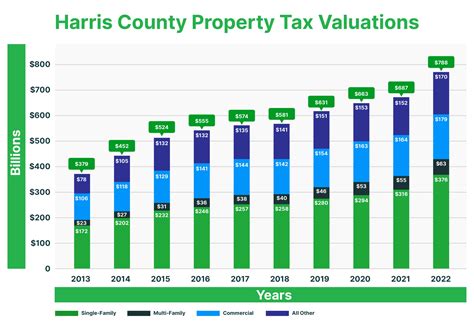

Harris County Property Tax Rate

Understanding property taxes is essential for homeowners and prospective buyers, especially in regions like Harris County, Texas. This article delves into the specifics of the Harris County Property Tax Rate, offering an in-depth analysis of its structure, impact, and implications for property owners.

The Harris County Property Tax System

Harris County, the third-most populous county in the United States, employs a comprehensive property tax system to fund various public services and operations. This system is intricate, reflecting the diverse needs and services of the county’s sizable population. Here’s a detailed breakdown of how it works.

Assessment and Appraisal

The Harris County Appraisal District (HCAD) is a key player in the property tax process. Its role is to assess and appraise all taxable property within the county. This includes residential, commercial, and special-use properties.

HCAD employs a team of professionals who regularly visit and inspect properties to ensure accurate valuation. They consider various factors such as location, size, age, and recent improvements when determining a property’s market value. This value serves as the basis for calculating property taxes.

| Property Type | Appraisal Method |

|---|---|

| Residential | Market Value |

| Commercial | Income-based or Market Value |

| Special-use Properties (e.g., agricultural land) | Specialized Appraisal Methods |

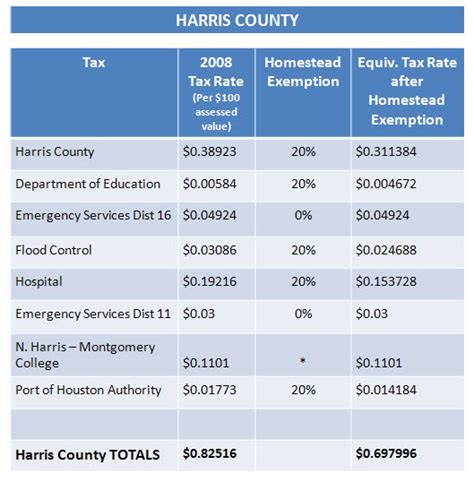

Tax Rate Determination

Once properties are appraised, the focus shifts to setting the tax rate. In Harris County, this rate is not uniform but varies depending on the taxing entity, which could be a school district, city, or special district.

Taxing entities submit their proposed budgets to the county, outlining their projected expenses for the upcoming year. The Harris County Tax Assessor-Collector’s office then calculates the necessary tax rate to generate the required revenue. This rate is expressed as dollars per $100 of assessed property value.

Tax Calculation

The property tax bill for an individual property is calculated by multiplying the property’s assessed value by the applicable tax rate. This process can vary slightly depending on the property’s location within the county and the taxing entities it falls under.

Residential Tax Relief

Harris County offers several tax relief programs to assist homeowners. These include the Homestead Exemption, which reduces the taxable value of a property by a set amount for homeowners who occupy their residence as their primary residence. Additionally, there are programs like the Over-65 Exemption and Disability Exemptions, providing further tax relief to eligible homeowners.

The Impact of Property Taxes

Property taxes in Harris County play a crucial role in funding essential public services and infrastructure. Here’s an in-depth look at their impact.

Funding Public Services

A significant portion of the revenue generated from property taxes goes towards funding public schools. This includes not only the operational costs of schools but also the maintenance and improvement of school facilities.

Additionally, property taxes support various other public services like emergency response, road maintenance, law enforcement, and social services. They are a vital source of revenue for local governments and taxing entities.

Economic Impact

The property tax system in Harris County can influence the local economy. For homeowners, higher property taxes can increase the cost of homeownership, potentially impacting their financial decisions and spending power. On the other hand, stable and well-managed property taxes can attract businesses and investors, fostering economic growth.

Community Development

Property taxes contribute to the development and improvement of communities within Harris County. Funds are directed towards enhancing public spaces, supporting local arts and culture, and investing in initiatives that improve the quality of life for residents.

Strategies for Managing Property Taxes

For property owners in Harris County, understanding and managing property taxes is crucial. Here are some strategies and considerations.

Understanding Tax Bills

Property tax bills can seem complex, with various entities and rates involved. It’s essential to carefully review and understand these bills. This includes verifying the assessed value of your property and ensuring it aligns with your expectations and the market value of similar properties in your area.

Appealing Property Assessments

If you believe your property’s assessed value is too high, you have the right to appeal. The HCAD provides a formal process for property owners to challenge their assessments. This can be a beneficial strategy if you feel your property has been overvalued.

Utilizing Tax Relief Programs

As mentioned earlier, Harris County offers various tax relief programs. It’s crucial to explore and understand these programs to determine if you’re eligible and how they can benefit you. These programs can significantly reduce your property tax burden.

Stay Informed and Engaged

Property taxes are a dynamic and evolving topic. Staying informed about changes in tax rates, assessment methods, and available relief programs is essential. Engage with your local government and taxing entities to understand their budgetary plans and how they might impact your property taxes.

The Future of Property Taxes in Harris County

As Harris County continues to grow and evolve, the property tax system will likely undergo changes and adjustments. Here are some potential future implications and considerations.

Population Growth and Development

With Harris County’s population projected to increase, the demand for public services and infrastructure will likely rise. This could lead to adjustments in tax rates and assessment methods to meet the growing needs of the community.

Technological Advancements

Advancements in technology could revolutionize the property tax system. From more efficient assessment methods to digital platforms for tax management and payments, technology has the potential to streamline the process and enhance transparency.

Community Engagement

The future of property taxes in Harris County may also involve increased community engagement. This could manifest as more public forums, town hall meetings, and online platforms where residents can actively participate in discussions about tax rates, budgets, and the allocation of tax revenues.

Tax Reform Proposals

There may be proposals for tax reform, aiming to make the system more equitable and efficient. These could include changes to the assessment process, the introduction of new tax relief measures, or adjustments to the distribution of tax revenues among different taxing entities.

How often are property taxes assessed in Harris County?

+Property taxes in Harris County are assessed annually. The HCAD typically completes the appraisal process by May 1st of each year.

Can I pay my property taxes online in Harris County?

+Yes, Harris County offers online payment options for property taxes. You can visit the Harris County Tax Office’s website to make secure online payments.

What happens if I don’t pay my property taxes on time in Harris County?

+Late payment of property taxes in Harris County may result in penalties and interest charges. In extreme cases, non-payment can lead to tax liens and potential foreclosure.

Are there any property tax exemptions or discounts available in Harris County for seniors or veterans?

+Yes, Harris County offers several tax exemptions and discounts for eligible seniors, veterans, and individuals with disabilities. These include the Over-65 Exemption, Disabled Veteran Exemption, and Disabled Person Exemption.

How can I appeal my property tax assessment in Harris County if I believe it’s incorrect or too high?

+To appeal your property tax assessment in Harris County, you can file a protest with the HCAD. This process typically involves submitting documentation to support your claim, and you may also have the opportunity to attend a hearing to present your case.