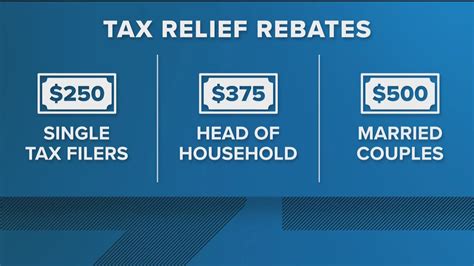

Georgia Tax Rebates

Georgia, a vibrant state in the southeastern region of the United States, is renowned for its diverse landscape, rich history, and thriving business environment. Beyond its natural beauty and cultural attractions, Georgia also boasts a robust economy and a government that actively supports its citizens through various initiatives, including tax rebates.

The state's commitment to providing financial relief to its residents through tax rebates has not only fostered economic growth but also enhanced the overall quality of life for Georgians. This article delves into the intricacies of Georgia's tax rebate system, exploring its benefits, eligibility criteria, and the positive impact it has had on the state's economy and its people.

Understanding Georgia’s Tax Rebate Program

Georgia’s tax rebate program is a strategic initiative designed to return a portion of the state’s tax revenue to its citizens. This program is an essential component of the state’s fiscal policy, aiming to stimulate economic growth, encourage consumer spending, and provide financial relief to individuals and businesses.

The tax rebate program in Georgia is not a one-size-fits-all approach. Instead, it is tailored to cater to the diverse needs of its residents, offering various types of rebates to different sectors of the population. This ensures that the program is inclusive and beneficial to a wide range of Georgians.

Types of Tax Rebates in Georgia

Georgia offers a comprehensive range of tax rebates, each with its own set of eligibility criteria and benefits. Here’s an overview of the primary types of tax rebates available in the state:

- Individual Income Tax Rebates: This rebate is aimed at providing financial relief to individuals and families. It is typically calculated as a percentage of the total income tax paid by eligible taxpayers, with the rebate amount varying based on income levels and family size.

- Business Tax Rebates: Georgia recognizes the significant role businesses play in the state's economy and, as such, offers tax rebates to eligible businesses. These rebates can take the form of tax credits, deductions, or refunds, depending on the nature of the business and its contributions to the state's economy.

- Sales Tax Rebates: To encourage consumer spending and support local businesses, Georgia provides sales tax rebates to eligible consumers. These rebates can be claimed on a wide range of goods and services, making it easier for residents to afford essential purchases and discretionary spending.

- Property Tax Rebates: Property owners in Georgia can also benefit from tax rebates. The state offers property tax relief to eligible homeowners, renters, and landowners, helping to reduce the financial burden of property ownership and stimulate investment in real estate.

- Specialty Tax Rebates: In addition to the above, Georgia also provides tax rebates for specific industries and sectors. For instance, the state offers rebates for renewable energy initiatives, film and media production, and agricultural development, among others. These specialty rebates are designed to support strategic industries and foster economic growth in specific sectors.

| Tax Rebate Type | Eligibility Criteria | Benefits |

|---|---|---|

| Individual Income Tax Rebate | Varies based on income, family size, and residency status. | Financial relief, reduced tax burden, and increased disposable income. |

| Business Tax Rebate | Varies based on business type, size, and contributions to the state's economy. | Tax credits, deductions, or refunds to support business growth and investment. |

| Sales Tax Rebate | Varies based on purchase type and eligibility criteria set by the state. | Reduced cost of living, increased purchasing power, and support for local businesses. |

| Property Tax Rebate | Varies based on property ownership, residency, and income levels. | Reduced property tax burden, increased homeownership, and improved financial stability. |

| Specialty Tax Rebate | Varies based on industry sector and state initiatives. | Support for strategic industries, economic growth, and innovation. |

By offering a diverse range of tax rebates, Georgia ensures that its tax system is not only fair but also incentivizes economic activity and supports the well-being of its residents.

Eligibility and Application Process

Understanding the eligibility criteria and application process for Georgia’s tax rebates is crucial for both individuals and businesses. The state has implemented a straightforward and accessible system to ensure that eligible residents can claim their rebates with minimal hassle.

Individual Tax Rebates

Eligibility for individual tax rebates in Georgia is primarily based on income, residency status, and family size. The state’s tax agency sets specific income thresholds, and individuals whose income falls within these brackets are entitled to claim a rebate.

To apply for an individual tax rebate, residents typically need to file their annual tax returns. The tax return form will include a section dedicated to claiming rebates. Residents must ensure they provide accurate and complete information to avoid delays or disqualification.

It's important to note that the rebate amount may vary depending on the individual's circumstances. For instance, families with dependent children may receive a higher rebate compared to single individuals. The state's tax agency provides clear guidelines and resources to help residents understand their eligibility and the application process.

Business Tax Rebates

Businesses in Georgia are eligible for tax rebates based on their contributions to the state’s economy. The state evaluates factors such as job creation, investment in research and development, and overall economic impact to determine eligibility.

The application process for business tax rebates often involves submitting detailed financial statements and business plans. The state's tax agency works closely with businesses to ensure they receive the rebates they are entitled to, fostering a supportive environment for economic growth.

Businesses may also be eligible for specialty tax rebates, such as those related to renewable energy initiatives or media production. These rebates are designed to encourage investment in specific sectors and promote innovation.

Sales and Property Tax Rebates

Sales tax rebates in Georgia are typically claimed by individuals when they file their tax returns. The state provides clear guidelines on which purchases are eligible for rebates, making it easy for residents to understand their rights.

Property tax rebates, on the other hand, may require a separate application process. Homeowners and renters should consult the state's tax agency for specific guidelines and application forms. These rebates are often aimed at reducing the financial burden on property owners, especially those with limited incomes.

By providing clear eligibility criteria and a streamlined application process, Georgia ensures that its tax rebate program is accessible to all eligible residents and businesses.

Impact and Benefits of Georgia’s Tax Rebates

Georgia’s tax rebate program has had a significant and positive impact on the state’s economy and its residents. The financial relief provided through these rebates has not only improved the quality of life for individuals and families but has also stimulated economic growth and development.

Economic Growth and Consumer Spending

One of the primary benefits of tax rebates is their ability to boost consumer spending. When individuals receive rebates, they often use this additional income to purchase goods and services, stimulating economic activity. This increased spending benefits local businesses, which in turn creates a positive feedback loop that drives further economic growth.

For instance, consider the impact of sales tax rebates on consumer behavior. When Georgians receive a rebate on their sales tax payments, they are more likely to make discretionary purchases, such as electronics, home improvement items, or leisure activities. This increased spending not only benefits the businesses selling these products but also creates a ripple effect throughout the economy.

Similarly, business tax rebates encourage investment and job creation. When businesses receive tax relief, they are more inclined to expand their operations, hire additional staff, and invest in research and development. This not only strengthens the business sector but also creates new job opportunities, contributing to a thriving economy.

Social Welfare and Financial Stability

Beyond economic growth, tax rebates in Georgia have played a crucial role in improving the social welfare of its residents. Individual and property tax rebates, in particular, have provided much-needed financial relief to families and homeowners.

For low-income families, individual tax rebates can mean the difference between struggling to make ends meet and having some financial breathing room. These rebates help families afford essential expenses, such as healthcare, education, and basic necessities. By reducing the financial burden on families, the state ensures that its residents can lead healthier and more fulfilling lives.

Property tax rebates, on the other hand, have made homeownership more accessible and affordable. By reducing the tax burden on property owners, especially those with limited incomes, the state encourages homeownership and improves financial stability. This, in turn, leads to more vibrant communities and a stronger sense of social cohesion.

Strategic Development and Innovation

Georgia’s tax rebate program is not just about providing financial relief; it’s also a strategic tool for economic development and innovation. The state’s specialty tax rebates, in particular, are designed to support specific industries and sectors, fostering growth and innovation.

For example, the state's renewable energy tax rebates have encouraged the development of clean energy technologies and infrastructure. By providing financial incentives for renewable energy initiatives, Georgia has positioned itself as a leader in sustainable development, attracting investment and creating green job opportunities.

Similarly, tax rebates for media production and film have stimulated the growth of Georgia's entertainment industry. The state has become a hub for film and media production, bringing in significant revenue and creating a thriving creative sector. These rebates have not only supported the industry's growth but have also contributed to the state's cultural and economic diversity.

Future Implications and Opportunities

As Georgia continues to evolve and adapt to changing economic landscapes, its tax rebate program will play a crucial role in shaping the state’s future. By leveraging the program’s success and making strategic adjustments, the state can further enhance its economic growth and social welfare.

Expanding Eligibility and Rebate Types

One area of focus for the future of Georgia’s tax rebate program could be expanding eligibility criteria. While the current system is inclusive, there may be opportunities to extend rebates to additional sectors or demographics. For instance, exploring rebates for small businesses or start-ups could foster entrepreneurship and innovation.

Additionally, the state could consider introducing new types of rebates to support emerging industries and technologies. With the rapid advancement of fields like artificial intelligence, biotechnology, and clean energy, Georgia could position itself as a leader by offering strategic tax incentives to businesses operating in these sectors.

Streamlining the Application Process

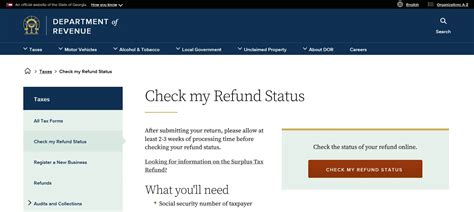

To further enhance the accessibility and efficiency of its tax rebate program, Georgia could invest in digitalizing and streamlining the application process. By leveraging technology, the state can make it easier for residents and businesses to apply for rebates, reducing paperwork and minimizing administrative burdens.

Implementing an online portal or mobile app dedicated to tax rebates could significantly improve the user experience. Residents and businesses could access clear guidelines, eligibility criteria, and application forms with just a few clicks. This not only saves time and resources but also ensures that more eligible individuals and businesses can claim their rightful rebates.

Collaborative Initiatives for Economic Growth

Finally, Georgia could explore collaborative initiatives with other states or regions to enhance its tax rebate program’s effectiveness. By sharing best practices and strategies, the state can learn from other jurisdictions and adapt its program to meet the evolving needs of its residents and businesses.

Collaborative efforts could involve joint research, policy development, and even cross-state partnerships to attract investment and foster economic growth. By working together, states can leverage their collective strengths and resources to create a more prosperous and sustainable future for their residents.

Conclusion

Georgia’s tax rebate program is a testament to the state’s commitment to its residents and its economy. By offering a diverse range of rebates, the state has not only provided financial relief to its citizens but has also stimulated economic growth, supported strategic industries, and improved social welfare.

As Georgia continues to adapt and innovate, its tax rebate program will remain a vital tool for economic development and social progress. By expanding eligibility, streamlining processes, and exploring collaborative initiatives, the state can ensure that its tax rebates continue to benefit its residents and businesses, fostering a brighter and more prosperous future for all.

How often does Georgia offer tax rebates, and when can I expect to receive mine?

+Georgia typically offers tax rebates on an annual basis, coinciding with the tax filing season. The timing of the rebate distribution can vary, but it is generally within a few months of filing your tax return. It’s important to stay updated with the state’s tax agency for specific timelines and any changes to the rebate program.

Are there any income restrictions for claiming individual tax rebates in Georgia?

+Yes, there are income restrictions for claiming individual tax rebates. The state sets specific income thresholds, and individuals whose income falls within these brackets are eligible for rebates. The thresholds vary based on family size and residency status. It’s recommended to check with the state’s tax agency for the most up-to-date income limits.

Can businesses claim tax rebates if they operate in multiple states, including Georgia?

+Yes, businesses that operate in multiple states, including Georgia, can claim tax rebates. However, the eligibility criteria and application process may vary depending on the state. It’s essential for businesses to consult with tax professionals and the relevant state tax agencies to ensure they are complying with the regulations in each state they operate in.

What happens if I don’t receive my tax rebate, even though I believe I’m eligible?

+If you believe you are eligible for a tax rebate but have not received it, the first step is to review your tax return and ensure that you correctly claimed the rebate. If you are certain you met the eligibility criteria and followed the application process, contact the state’s tax agency. They can provide guidance and assist in resolving any issues related to your rebate claim.

Are there any special considerations for claiming tax rebates as a senior citizen or person with disabilities in Georgia?

+Yes, Georgia offers special considerations for senior citizens and individuals with disabilities when it comes to tax rebates. The state recognizes the unique financial challenges faced by these groups and provides additional support. It’s recommended to consult with the state’s tax agency or seek advice from relevant support organizations to understand the specific benefits and eligibility criteria for these special rebates.