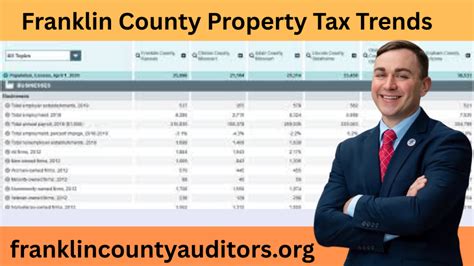

Franklin County Property Tax

Understanding property taxes is crucial for homeowners and prospective buyers alike, as these taxes play a significant role in the overall cost of owning a home. In this comprehensive guide, we will delve into the intricacies of Franklin County's property tax system, providing you with a detailed understanding of how it works, what factors influence tax assessments, and how you can effectively manage your property tax obligations.

The Basics of Franklin County Property Tax

Franklin County, located in the vibrant state of Ohio, operates a comprehensive property tax system that contributes to the funding of various local services and infrastructure. The property tax in Franklin County is primarily based on the assessed value of real estate properties, which includes both residential and commercial properties.

The county's property tax system is designed to ensure fairness and equity, taking into account a range of factors to determine the tax liability for each property owner. Here's a closer look at the key aspects of Franklin County's property tax system.

Property Assessment Process

The journey towards determining property taxes begins with a comprehensive assessment process. Franklin County employs a team of professional assessors who are responsible for evaluating the value of each property within the county. These assessments are typically conducted at regular intervals, often every few years, to ensure that property values remain up-to-date.

During the assessment process, various factors are taken into consideration, including the property's location, size, age, condition, and any recent improvements or additions. The assessors use a combination of market data, sales comparisons, and other valuation methods to arrive at an estimated fair market value for each property.

It's important to note that property assessments are not set in stone. Property owners have the right to review and appeal their assessments if they believe the value assigned to their property is inaccurate. The county provides a transparent process for appeals, allowing homeowners to present evidence and arguments to support their case.

| Assessment Year | Average Assessment Increase |

|---|---|

| 2022 | 3.5% |

| 2021 | 2.8% |

| 2020 | 4.2% |

Tax Rates and Calculations

Once the assessed value of a property is determined, it forms the basis for calculating the property tax liability. Franklin County, like many other jurisdictions, uses a millage rate to determine the tax amount. A millage rate is expressed in mills, where one mill represents 1 of tax for every 1,000 of assessed property value.

The millage rate is established by the county government and various local taxing authorities, such as school districts and municipalities. These entities determine the rate based on their budgetary needs and the level of services they aim to provide. The combined millage rate from all taxing authorities determines the overall tax rate for a particular property.

To calculate the property tax liability, the assessed value of the property is multiplied by the applicable millage rate. For instance, if a property has an assessed value of $200,000 and the combined millage rate is 30 mills, the property tax liability would be $6,000 ($200,000 x 0.030). This calculation provides a straightforward way to estimate property tax obligations.

Property Tax Exemptions and Relief

Franklin County recognizes the importance of providing tax relief to certain groups of property owners. As such, the county offers a range of exemptions and relief programs to alleviate the tax burden for eligible homeowners.

One notable exemption is the Homestead Exemption, which provides a reduction in property taxes for primary residences. To qualify for this exemption, homeowners must meet specific criteria, such as owning and occupying the property as their primary residence for a certain period. The Homestead Exemption helps ensure that homeowners can continue to afford their properties over time.

Additionally, Franklin County offers Senior Citizen and Disabled Person Tax Relief programs. These programs provide reduced property tax bills for eligible senior citizens and individuals with disabilities. The county understands the financial challenges faced by these groups and aims to provide assistance through these targeted relief measures.

| Exemption Type | Eligibility Criteria |

|---|---|

| Homestead Exemption | Primary residence ownership, occupancy requirements, and income limits. |

| Senior Citizen Relief | Age, income, and residency requirements. |

| Disabled Person Relief | Disability status, income, and residency criteria. |

Managing Your Property Tax Obligations

Understanding your property tax obligations is only the first step. Effective management of these obligations is crucial to ensure you remain in good standing with the county and avoid any potential penalties or complications.

Payment Options and Due Dates

Franklin County offers a range of payment options to accommodate different preferences and circumstances. Property owners can choose to pay their taxes in full or opt for installment plans, allowing them to spread the payments throughout the year. This flexibility ensures that homeowners can manage their finances effectively.

The county provides clear guidelines on payment due dates, typically dividing the tax year into multiple payment periods. It's important for property owners to mark these dates on their calendars and ensure timely payments to avoid late fees and penalties. The county's website often provides detailed information on payment deadlines and acceptable payment methods.

Online Tools and Resources

Franklin County recognizes the importance of technology in streamlining property tax management. The county’s official website offers a wealth of online tools and resources to assist property owners in various aspects of tax management.

One notable tool is the Property Tax Lookup feature, which allows homeowners to easily access information about their property taxes, including current assessments, tax rates, and payment history. This tool provides transparency and empowers homeowners to stay informed about their tax obligations.

Additionally, the website often includes a Tax Calculator, which enables property owners to estimate their tax liability based on different scenarios. This calculator is particularly useful for prospective buyers who want to understand the potential tax implications of purchasing a specific property.

Appeals and Dispute Resolution

In cases where property owners believe their tax assessment or liability is inaccurate or unfair, Franklin County provides a structured appeals process. This process allows homeowners to present their case, provide evidence, and seek a review of their tax assessment.

The county's Board of Revision handles tax assessment appeals. Property owners can initiate the appeal process by submitting the necessary documentation and providing evidence to support their claim. The Board of Revision carefully reviews each case, considers all relevant factors, and makes a determination based on the available information.

It's essential for homeowners to understand the appeal process, including the required documentation, deadlines, and any potential fees associated with the appeal. Being well-prepared and presenting a strong case can increase the chances of a favorable outcome.

Conclusion: Navigating Franklin County’s Property Tax System

Franklin County’s property tax system, while comprehensive and fair, requires a proactive approach from property owners. By understanding the assessment process, tax calculations, and available exemptions, homeowners can effectively manage their tax obligations and take advantage of relief programs where applicable.

Staying informed about assessment values, exploring online resources, and utilizing payment options can contribute to a smoother tax management experience. Additionally, being aware of the appeals process and understanding one's rights as a property owner ensures that any disputes or concerns can be addressed effectively.

In conclusion, navigating Franklin County's property tax system involves a combination of knowledge, vigilance, and proactive management. With the right approach, property owners can ensure their tax obligations are met while taking advantage of the benefits and support offered by the county's tax system.

How often are property assessments conducted in Franklin County?

+Property assessments in Franklin County are typically conducted every three years. However, certain circumstances, such as significant property improvements or changes, may trigger an assessment outside of this cycle.

What happens if I miss a property tax payment deadline in Franklin County?

+Missing a property tax payment deadline in Franklin County can result in late fees and penalties. It’s important to stay informed about payment due dates and take advantage of the county’s online payment system to ensure timely payments.

Can I appeal my property tax assessment in Franklin County?

+Yes, property owners in Franklin County have the right to appeal their property tax assessments. The appeals process is handled by the Board of Revision, and homeowners can initiate the process by submitting the necessary documentation and evidence to support their case.

Are there any property tax relief programs for senior citizens in Franklin County?

+Yes, Franklin County offers specific tax relief programs for senior citizens. These programs provide reduced property tax bills based on certain eligibility criteria, such as age, income, and residency requirements.