Florida Sales And Use Tax

Florida's Sales and Use Tax is a critical component of the state's revenue system, contributing significantly to its economic landscape. Understanding the nuances of this tax is essential for businesses and individuals alike, as it impacts various aspects of commerce and daily life. This comprehensive guide will delve into the specifics of Florida's Sales and Use Tax, offering an in-depth analysis of its structure, application, and implications.

Understanding Florida’s Sales and Use Tax

Florida’s Sales and Use Tax is a consumption tax levied on the sale or lease of tangible personal property and certain services. It is a crucial source of revenue for the state, with proceeds used to fund essential services and infrastructure. The tax is administered by the Florida Department of Revenue, which provides guidelines and resources for taxpayers.

The tax structure in Florida is relatively straightforward. The state imposes a standard sales tax rate of 6%, which is applied to most transactions. However, it's important to note that certain jurisdictions, like counties and municipalities, can levy additional taxes, resulting in a higher effective tax rate. These local taxes can vary significantly, with some areas having rates as high as 11.5% when combined with the state tax.

Taxable Transactions

The scope of taxable transactions in Florida is broad. It includes sales of goods, rentals, leases, and certain services. Examples of taxable services include repairs, maintenance, installation, and admissions to certain entertainment events. However, there are exemptions and special rules for specific industries and types of transactions. For instance, sales of certain prescription drugs and medical devices are exempt from sales tax.

| Transaction Type | Taxability |

|---|---|

| Sale of Goods | Generally taxable |

| Rental/Lease | Taxable |

| Services | Some services are taxable, like repairs and admissions |

Additionally, Florida has a Use Tax, which is applicable when tangible personal property is purchased from a seller who does not collect Florida sales tax. This tax is the buyer's responsibility and is typically due when the item is brought into Florida for use, storage, or consumption.

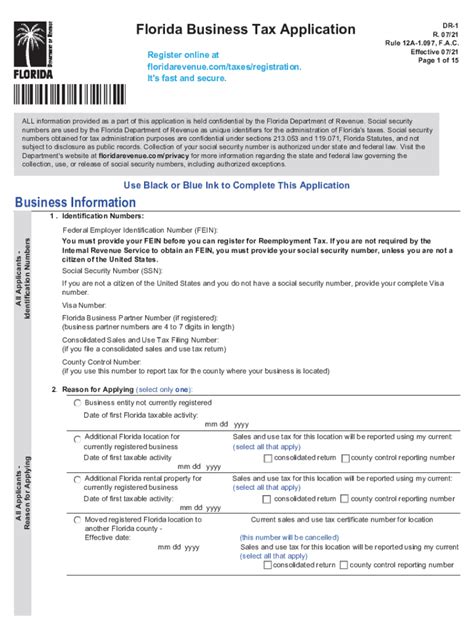

Registration and Compliance

Businesses operating in Florida, or those making sales into the state, are required to register with the Department of Revenue and obtain a sales and use tax permit. This process involves providing detailed information about the business and its operations. Once registered, businesses must collect and remit sales tax on taxable transactions.

Compliance with sales tax regulations is a complex process. Businesses must maintain accurate records of taxable transactions, calculate the applicable tax, and remit it to the state within specified timelines. Failure to comply can result in penalties and interest charges. It's essential for businesses to stay updated with the latest regulations and guidelines to avoid non-compliance issues.

Sales Tax Rates and Variations

As mentioned earlier, Florida’s sales tax rate is 6% at the state level. However, the effective tax rate can vary due to local taxes. For instance, in Miami-Dade County, the total sales tax rate is 7%, while in Monroe County, it’s 7.5%. These variations are important for businesses with operations or sales in multiple counties.

| County | Sales Tax Rate |

|---|---|

| Miami-Dade | 7% |

| Broward | 6.5% |

| Hillsborough | 7% |

Businesses can utilize resources provided by the Department of Revenue to determine the applicable tax rate for a specific location. This ensures accurate tax collection and compliance.

Exemptions and Special Considerations

Florida’s sales and use tax system includes various exemptions and special considerations. These are designed to encourage specific economic activities or provide relief to certain sectors or individuals.

Sales Tax Holidays

Florida occasionally offers sales tax holidays, which are specific periods when certain items are exempt from sales tax. These holidays are often targeted towards essential items like school supplies, hurricane preparedness goods, or energy-efficient appliances. Sales tax holidays provide a boost to consumer spending and can generate significant savings for shoppers.

For instance, during the 2023 Back-to-School Sales Tax Holiday, books, clothing, and school supplies were exempt from sales tax for a three-day period in August. This holiday encouraged parents to stock up on school essentials while saving on sales tax.

Agricultural and Manufacturing Exemptions

Sales of agricultural products, machinery, and equipment used in farming are exempt from sales tax in Florida. This exemption supports the state’s agricultural industry and encourages investment in agricultural technology. Similarly, manufacturing equipment and supplies are also exempt, promoting economic growth in the manufacturing sector.

Resale and Wholesale Exemptions

Transactions involving the resale of goods are generally exempt from sales tax. This exemption applies to businesses that purchase goods for resale, ensuring they are not taxed on their inventory. Similarly, sales to other registered businesses with a valid resale certificate are also exempt, as the tax is typically collected at the final point of sale.

Remittance and Reporting

Registered businesses in Florida are required to remit sales tax on a regular basis. The frequency of remittance depends on the business’s sales volume and tax liability. Most businesses remit monthly or quarterly. However, businesses with high sales volumes may be required to remit more frequently.

The remittance process involves calculating the total sales tax liability for the specified period, including any applicable local taxes. Businesses must then submit this amount to the Department of Revenue within the designated timeline. Failure to remit on time can result in penalties and interest charges.

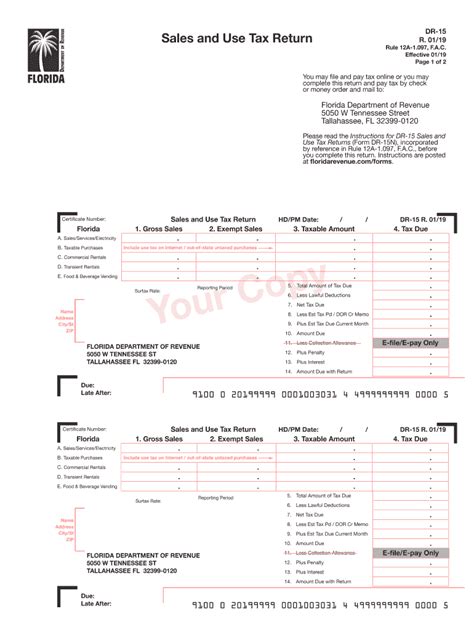

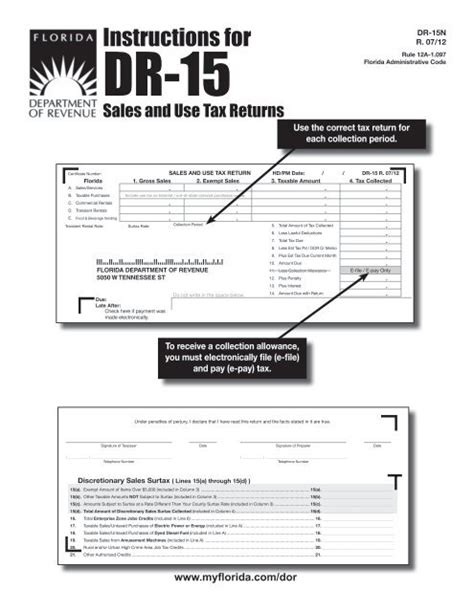

Sales Tax Returns and Filing

In addition to remitting sales tax, businesses must also file sales tax returns. These returns provide detailed information about taxable sales, purchases, and exemptions during the reporting period. The Department of Revenue provides electronic filing options, making the process more efficient and secure.

Businesses should carefully review their sales tax returns before submission to ensure accuracy. Any errors or discrepancies can lead to audits and potential penalties.

Audits and Enforcement

The Florida Department of Revenue conducts audits to ensure compliance with sales tax regulations. Audits can be random or targeted based on specific indicators of non-compliance. During an audit, the Department reviews a business’s records, including sales invoices, purchase orders, and financial statements, to verify the accuracy of reported sales and tax payments.

If an audit reveals underreported sales or unremitted taxes, businesses may face penalties and interest charges. In some cases, businesses may also be required to pay back taxes with interest. Therefore, it's crucial for businesses to maintain accurate records and comply with sales tax regulations to avoid such consequences.

Penalties and Interest

Florida’s sales tax regulations include provisions for penalties and interest charges for non-compliance. The specific penalty amounts and interest rates depend on the nature and severity of the violation. For instance, late payment of sales tax can result in a penalty of 5% of the unpaid tax, while willful neglect or fraud can lead to penalties of up to 25% of the unpaid tax.

Interest on unpaid sales tax is calculated at a rate of 12% per year. This interest accrues from the due date of the tax until it is paid in full. Businesses should prioritize timely payment of sales tax to avoid these additional charges.

Future Implications and Trends

Florida’s sales and use tax system is likely to evolve in response to changing economic conditions and legislative priorities. Here are some potential future implications and trends to consider:

- Increased Use of Technology: The Department of Revenue is likely to continue embracing technology to streamline tax administration. This could include more robust online filing and payment systems, real-time tax calculation tools, and improved data analytics for compliance monitoring.

- Expansion of Exemptions: As the state's economic landscape evolves, there may be calls for additional exemptions or modifications to existing ones. For instance, there have been discussions about expanding the sales tax exemption for certain types of machinery and equipment to promote innovation and job creation.

- Sales Tax Rate Changes: While the state sales tax rate has remained stable at 6% for many years, there is always the possibility of rate adjustments. This could be driven by budget considerations, economic conditions, or political priorities.

- Enhanced Compliance Measures: The Department of Revenue may implement more stringent compliance measures to address evolving tax avoidance schemes and fraud. This could include more frequent audits, increased data sharing with other state agencies, and the use of advanced data analytics to identify non-compliance.

- Online Sales Tax Collection: With the growth of e-commerce, there may be increased emphasis on collecting sales tax from online sellers, particularly those who are not physically present in the state. This could involve more rigorous registration requirements and enforcement actions against non-compliant online sellers.

Conclusion

Florida’s Sales and Use Tax is a vital component of the state’s revenue system, impacting businesses and individuals across the Sunshine State. Understanding the tax’s structure, compliance requirements, and potential future changes is essential for effective tax management and compliance. By staying informed and proactive, businesses can navigate the complexities of Florida’s tax landscape and contribute to the state’s economic growth while avoiding potential pitfalls.

FAQ

What is the current sales tax rate in Florida?

+The current sales tax rate in Florida is 6% at the state level. However, local taxes can vary, resulting in a higher effective tax rate. For instance, in Miami-Dade County, the total sales tax rate is 7%.

Are there any sales tax holidays in Florida?

+Yes, Florida occasionally offers sales tax holidays, which are specific periods when certain items are exempt from sales tax. These holidays are often targeted towards essential items like school supplies or hurricane preparedness goods.

What is the use tax in Florida, and when is it applicable?

+The use tax in Florida is applicable when tangible personal property is purchased from a seller who does not collect Florida sales tax. It’s the buyer’s responsibility and is due when the item is brought into Florida for use, storage, or consumption.

How often do businesses need to remit sales tax in Florida?

+The frequency of remittance depends on the business’s sales volume and tax liability. Most businesses remit monthly or quarterly, but those with high sales volumes may be required to remit more frequently.

What are the penalties for non-compliance with Florida’s sales tax regulations?

+Penalties for non-compliance can include late payment charges, interest on unpaid tax, and potential audits. The specific penalty amounts depend on the nature and severity of the violation. For instance, late payment of sales tax can result in a penalty of 5% of the unpaid tax.