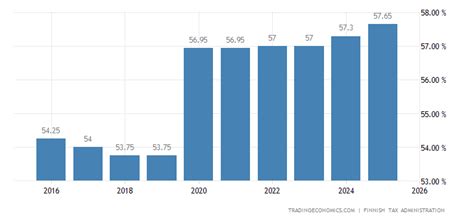

Finland Tax Percentage

Understanding the tax system in Finland is crucial for both residents and businesses operating within the country. Finland has a comprehensive tax structure that contributes significantly to the country's well-functioning economy and social welfare system. This article aims to provide an in-depth analysis of Finland's tax percentages, covering various aspects that impact individuals and businesses.

Finland’s Tax System: An Overview

Finland’s tax system is characterized by a combination of income taxes, value-added tax (VAT), corporate taxes, and various other levies. The government’s tax policies aim to support the country’s economic growth, fund public services, and maintain social equity. The tax structure is designed to be progressive, with higher-income earners contributing a larger proportion of their income.

The Finnish tax system is known for its transparency and efficiency. Taxpayers in Finland have access to comprehensive information about their tax obligations, and the government provides online tools and services to facilitate tax compliance. The country's tax authorities, the Verohallinto, play a crucial role in enforcing tax laws and ensuring fair taxation.

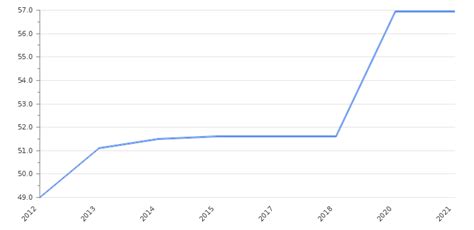

Income Tax in Finland

Income tax is a significant component of Finland’s tax revenue. The country employs a progressive income tax system, which means that the tax rate increases as an individual’s income rises. This system aims to ensure that higher-income earners contribute a larger share of their income to support the country’s social programs and infrastructure.

Progressive Tax Rates

Finland’s progressive tax rates are structured as follows:

- 0-17,160 EUR: 0% tax rate for the basic exemption.

- 17,160-24,830 EUR: 6% tax rate for the first income bracket.

- 24,830-29,980 EUR: 8% tax rate for the second income bracket.

- 29,980-49,700 EUR: 15% tax rate for the third income bracket.

- 49,700-75,160 EUR: 20% tax rate for the fourth income bracket.

- 75,160-111,400 EUR: 24% tax rate for the fifth income bracket.

- 111,400-205,400 EUR: 28% tax rate for the sixth income bracket.

- 205,400 EUR and above: 31.25% tax rate for the highest income bracket.

It's important to note that these tax rates are subject to change annually, and additional surcharges and deductions may apply based on various factors such as personal circumstances, family size, and local tax agreements.

Taxable Income Calculation

To determine taxable income, Finland employs a system of tax deductions and allowances. These deductions can significantly impact an individual’s tax liability. Some common deductions include:

- Basic Deduction: A fixed amount that reduces taxable income for all taxpayers.

- Personal Deductions: Allowances based on personal circumstances, such as age, disability, or family status.

- Work-Related Expenses: Deductions for expenses incurred due to employment, such as commuting costs or professional equipment.

- Child-Related Deductions: Tax benefits for parents with dependent children, which can include child care expenses and educational costs.

Additionally, Finland offers tax credits for various expenses, such as mortgage interest, donations to charitable organizations, and certain health-related costs. These credits can further reduce an individual's tax liability.

Value-Added Tax (VAT) in Finland

Value-Added Tax, commonly known as VAT, is an essential component of Finland’s tax system. It is a consumption tax levied on most goods and services provided within the country. VAT is applied at each stage of the supply chain, from production to retail, and is ultimately borne by the final consumer.

Standard VAT Rate

The standard VAT rate in Finland is currently set at 24%. This rate applies to a wide range of goods and services, including most retail purchases, restaurant meals, and various professional services.

However, it's important to note that certain products and services are subject to reduced VAT rates or are exempt from VAT altogether. These exceptions are designed to support specific sectors and promote social equity.

Reduced VAT Rates

Finland applies reduced VAT rates to certain goods and services deemed essential or beneficial to society. The reduced rates are as follows:

- 14%: This rate applies to food products, catering services, and certain cultural activities.

- 10%: Used for hotel and restaurant accommodation, certain transportation services, and some energy products.

These reduced rates aim to make essential goods and services more affordable for consumers, especially those with lower incomes.

VAT Exemptions

Some goods and services are entirely exempt from VAT in Finland. These exemptions include:

- Financial services

- Healthcare services

- Education and training

- Social services

- Certain cultural and sports activities

VAT exemptions are in place to support these sectors and ensure that they remain accessible to all citizens, regardless of their financial situation.

Corporate Tax in Finland

Corporate taxation in Finland is designed to encourage investment and economic growth while contributing to the country’s overall tax revenue. The corporate tax structure aims to create a favorable business environment while ensuring fairness.

Corporate Tax Rates

The corporate tax rate in Finland is currently set at 20%. This rate applies to the profits of limited companies, cooperatives, and some other legal entities. The corporate tax rate is subject to change, and the Finnish government may offer incentives and tax breaks to specific industries to promote economic development.

Additionally, Finland has implemented a system of tax credits and deductions for businesses. These incentives aim to encourage research and development, innovation, and investment in specific sectors.

Tax Incentives for Businesses

Finland offers various tax incentives to businesses, including:

- Research and Development Tax Credit: Businesses can receive a tax credit for expenses incurred in research and development activities, promoting innovation.

- Angel Investor Tax Deduction: Angel investors who provide funding to startup companies can deduct a portion of their investment from their taxable income.

- Export Tax Incentives: Finnish companies that engage in international trade may be eligible for tax benefits to support their export activities.

These incentives aim to foster a business-friendly environment and encourage economic growth.

Other Taxes in Finland

In addition to income tax, VAT, and corporate tax, Finland imposes various other taxes to support specific sectors and generate additional revenue.

Property Tax

Property tax, also known as municipal tax, is levied on the ownership of land and buildings. The tax rate varies depending on the location and type of property. Property tax contributes to local government revenues and is used to fund public services such as education, healthcare, and infrastructure development.

Capital Gains Tax

Capital gains tax is applicable when an individual or business sells an asset at a profit. The tax rate for capital gains in Finland is currently set at 30%. However, there are certain exemptions and deductions available for long-term investments and certain types of assets.

Inheritance Tax

Finland imposes an inheritance tax on the transfer of assets from a deceased person to their heirs. The tax rate varies depending on the relationship between the deceased and the heir. Spouses and children are generally exempt from inheritance tax, while other relatives and non-relatives may face higher tax rates.

Tax Compliance and Enforcement

Finland’s tax authorities, the Verohallinto, play a crucial role in ensuring tax compliance and enforcing tax laws. The authorities have robust systems in place to collect taxes efficiently and fairly. Taxpayers in Finland have access to online tools and resources to facilitate tax filing and compliance.

The Verohallinto also conducts regular audits to ensure that taxpayers are meeting their tax obligations. Audits can be random or targeted based on specific criteria, and taxpayers are expected to cooperate fully during these audits.

Future Implications and Tax Reform

The Finnish government periodically reviews its tax policies to ensure they remain fair, efficient, and aligned with the country’s economic goals. Recent tax reforms have focused on simplifying the tax system, reducing administrative burdens, and promoting economic growth.

One notable reform is the introduction of the Basic Income Experiment, which aimed to explore the potential of a universal basic income system. While the experiment concluded in 2019, its findings are expected to influence future tax and social welfare policies.

Furthermore, Finland has been actively involved in international efforts to combat tax evasion and tax avoidance. The country has signed various tax treaties and agreements to prevent double taxation and promote transparency in cross-border transactions.

Conclusion

Finland’s tax system is a complex yet well-structured framework that contributes significantly to the country’s economic prosperity and social welfare. The combination of progressive income taxes, value-added tax, corporate taxes, and various other levies ensures a fair and efficient tax system. Understanding these tax percentages is crucial for individuals and businesses operating in Finland, as it allows for effective financial planning and compliance with tax obligations.

The Finnish government's commitment to tax reform and international cooperation demonstrates its dedication to creating a sustainable and equitable tax system. As the country continues to evolve and adapt to changing economic conditions, its tax policies will likely remain a crucial aspect of its success.

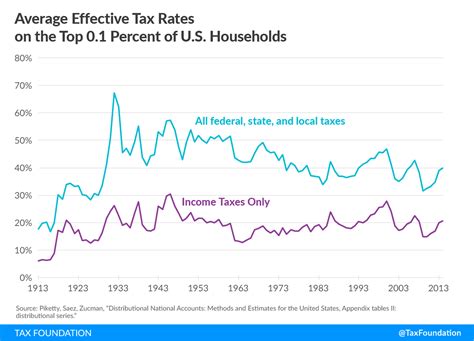

What is the average income tax rate in Finland for individuals?

+

The average income tax rate for individuals in Finland varies depending on their income level. The progressive tax system means that higher-income earners pay a higher proportion of their income in taxes. The average effective tax rate for an individual can range from approximately 20% to 30%, depending on various factors such as deductions, allowances, and personal circumstances.

How does Finland’s corporate tax rate compare to other European countries?

+

Finland’s corporate tax rate of 20% is relatively competitive compared to other European countries. Some countries, such as Ireland and Hungary, have lower corporate tax rates, while others, like France and Italy, have higher rates. Finland’s tax incentives and a supportive business environment make it an attractive destination for foreign investment.

Are there any tax benefits for investing in renewable energy in Finland?

+

Yes, Finland offers tax incentives for investing in renewable energy projects. The government provides various tax benefits, such as reduced corporate tax rates and tax credits, to promote the development of renewable energy sources. These incentives aim to encourage the transition to a more sustainable and environmentally friendly energy sector.

How does Finland’s tax system impact its social welfare programs?

+

Finland’s tax system plays a crucial role in funding its extensive social welfare programs. The progressive income tax structure ensures that higher-income earners contribute more to support public services like healthcare, education, and social security. This tax revenue is essential for maintaining the country’s high-quality social safety net.