Figuring Tax Liability

Understanding tax liability is a crucial aspect of personal finance and business operations. Tax liability refers to the amount of tax an individual or entity is legally obligated to pay to the government. It encompasses various taxes, including income tax, property tax, sales tax, and more. Navigating the complexities of tax liability can be daunting, but with the right knowledge and strategies, individuals and businesses can effectively manage their tax obligations.

Tax Liability: Definitions and Components

Tax liability is a fundamental concept in the realm of taxation. It represents the total amount of tax owed to the government by taxpayers, whether they are individuals, businesses, or other entities. This liability arises from various sources and is calculated based on specific criteria and tax rates.

In the United States, the Internal Revenue Service (IRS) is responsible for administering and enforcing federal tax laws. The IRS collects taxes on behalf of the federal government and ensures compliance with tax regulations. Tax liability is determined by assessing an individual's or entity's financial activities, income, assets, and other relevant factors.

Components of Tax Liability

Tax liability consists of several key components, each contributing to the overall tax obligation. These components include:

- Income Tax: The most common type of tax, income tax is levied on an individual's or business's earnings. It is calculated based on the taxpayer's taxable income, which includes wages, salaries, business profits, investment gains, and other forms of income.

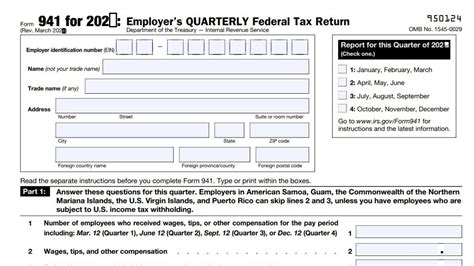

- Payroll Taxes: Employers are responsible for withholding payroll taxes from their employees' wages. These taxes include Social Security and Medicare taxes, which fund social welfare programs. Payroll taxes are deducted at a flat rate and contribute to an individual's entitlement to benefits.

- Property Taxes: Property owners are subject to property taxes, which are levied by local governments. These taxes are based on the assessed value of real estate properties, including land and buildings. Property taxes fund essential services such as education, infrastructure, and public safety.

- Sales and Use Taxes: Sales taxes are imposed on the sale of goods and services, while use taxes apply to the use, storage, or consumption of taxable items. These taxes are typically charged as a percentage of the purchase price and are collected by businesses, who remit them to the government.

- Excise Taxes: Excise taxes are levied on specific goods and activities, such as gasoline, alcohol, tobacco, and certain transactions. These taxes are often used to regulate or discourage certain behaviors and generate revenue for specific purposes.

- Estate and Gift Taxes: Estate taxes are imposed on the transfer of assets upon an individual's death, while gift taxes apply to substantial gifts made during an individual's lifetime. These taxes aim to ensure the equitable distribution of wealth and maintain the fairness of the tax system.

Calculating Tax Liability

Calculating tax liability involves a series of steps to determine the amount owed to the government. The process varies depending on the type of tax and the taxpayer’s circumstances. Here’s an overview of the general steps involved in calculating tax liability:

Determining Taxable Income

The first step in calculating tax liability is to determine taxable income. Taxable income represents the portion of an individual’s or entity’s income that is subject to taxation. It is calculated by subtracting allowable deductions, exemptions, and credits from gross income.

Gross income includes wages, salaries, business income, interest, dividends, rental income, and other forms of income. Allowable deductions reduce the taxable income and may include expenses related to business operations, medical costs, charitable contributions, and certain tax-deductible items.

Exemptions are deductions based on the taxpayer's personal circumstances, such as marital status, number of dependents, and age. Credits, on the other hand, provide a direct reduction of the tax liability and may include credits for childcare expenses, education, and energy-efficient improvements.

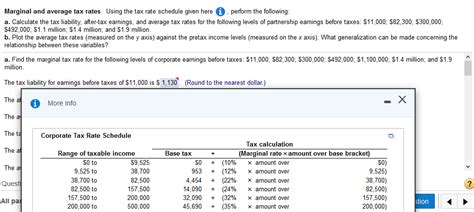

Applying Tax Rates

Once taxable income is determined, the appropriate tax rates are applied. Tax rates vary depending on the taxpayer’s income level, filing status, and the type of tax. Income tax, for example, follows a progressive tax system, where higher income levels are taxed at higher rates.

Tax rates are often presented in tax tables or tax brackets. Taxpayers calculate their tax liability by finding the applicable tax rate for their taxable income and applying it accordingly. It's important to note that tax rates can change annually, so staying updated with the latest tax laws is crucial.

Computing Taxes

After determining taxable income and applying the appropriate tax rates, the next step is to compute the actual tax liability. This involves multiplying the taxable income by the applicable tax rate and making any necessary adjustments based on tax credits and other factors.

For income tax, taxpayers may need to complete tax forms and schedules to calculate their tax liability accurately. These forms guide taxpayers through the process, taking into account various deductions, credits, and adjustments. Online tax software and tax professionals can also assist in computing tax liability.

Paying Tax Liability

Once the tax liability is calculated, taxpayers must pay the owed amount to the government. Payment methods vary depending on the type of tax and the taxpayer’s preferences. Common payment methods include electronic funds transfer, credit or debit card payments, checks, and money orders.

Taxpayers should ensure that they pay their tax liability on time to avoid penalties and interest charges. The IRS and other tax authorities provide guidelines and deadlines for tax payments, and taxpayers should familiarize themselves with these requirements.

| Tax Type | Payment Due Date |

|---|---|

| Income Tax | April 15th of the following year |

| Payroll Taxes | Varies based on filing frequency (monthly, quarterly) |

| Property Taxes | Varies by jurisdiction, typically twice a year |

| Sales and Use Taxes | Varies by jurisdiction and frequency of filing |

| Excise Taxes | Varies based on the type of excise tax |

Strategies for Managing Tax Liability

Effectively managing tax liability is essential for individuals and businesses to optimize their financial well-being. Here are some strategies to consider:

Tax Planning

Tax planning involves taking proactive measures to minimize tax liability within the bounds of the law. It requires a thorough understanding of tax laws, regulations, and available deductions and credits. By engaging in tax planning, taxpayers can legally reduce their tax burden and maximize their after-tax income.

Tax planning strategies may include optimizing business structures, utilizing tax-efficient investment strategies, and taking advantage of tax incentives and deductions. Consulting with tax professionals or financial advisors can provide valuable insights and guidance tailored to an individual's or business's specific circumstances.

Deductions and Credits

Taxpayers can reduce their tax liability by claiming deductions and credits for which they are eligible. Deductions lower taxable income, while credits directly reduce the tax liability. Understanding the various deductions and credits available and meeting the eligibility criteria are crucial for maximizing tax savings.

Common deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. Credits, on the other hand, may include the Child Tax Credit, Earned Income Tax Credit, and credits for education expenses. Taxpayers should carefully review their financial records and consult tax professionals to ensure they are claiming all applicable deductions and credits.

Tax-Efficient Investing

Investing with a tax-efficient approach can help minimize the impact of taxes on investment returns. Tax-efficient investing strategies aim to reduce the tax burden on investment gains and income. This may involve utilizing tax-advantaged accounts, such as 401(k)s, IRAs, or HSAs, which offer tax benefits and deferral of taxes.

Additionally, taxpayers can consider investing in tax-efficient investment vehicles, such as index funds or exchange-traded funds (ETFs). These investments often have lower turnover rates, resulting in fewer capital gains distributions, which can reduce the tax liability. Consulting with financial advisors can provide guidance on tax-efficient investment strategies tailored to an individual's goals and risk tolerance.

Estate Planning

Estate planning is an essential aspect of managing tax liability for individuals with significant assets. By implementing effective estate planning strategies, individuals can minimize estate and gift taxes and ensure the smooth transfer of assets to their beneficiaries.

Estate planning strategies may include establishing trusts, gifting assets, and utilizing life insurance policies. These strategies can help reduce the taxable value of an estate, minimize taxes owed, and preserve wealth for future generations. Consulting with estate planning attorneys and tax professionals is crucial to ensure compliance with tax laws and maximize the benefits of estate planning.

How often should I review my tax liability?

+

It is recommended to review your tax liability annually, especially when there are significant changes in your financial circumstances, such as a change in income, marital status, or the birth of a child. Regular reviews ensure you are taking advantage of all available deductions and credits and allow you to plan for any tax obligations.

What happens if I underestimate my tax liability?

+

Underestimating tax liability can result in penalties and interest charges. It is crucial to accurately estimate your tax liability to avoid financial consequences. If you realize you’ve underestimated your tax liability, it’s advisable to consult a tax professional to determine the best course of action, which may include amending your tax return or making additional payments.

Can I reduce my tax liability by donating to charity?

+

Yes, charitable contributions can help reduce your tax liability. Donations to qualified charitable organizations are tax-deductible, which means they can lower your taxable income. However, it’s important to keep accurate records of your donations and ensure they meet the IRS requirements for deductibility.

What is the penalty for not paying tax liability on time?

+

The penalty for not paying tax liability on time varies depending on the jurisdiction and the amount owed. Generally, taxpayers may face late payment penalties and interest charges on the unpaid balance. It’s crucial to pay your tax liability on time to avoid these penalties and maintain good standing with tax authorities.

Can I negotiate my tax liability with the IRS?

+

In certain circumstances, it may be possible to negotiate your tax liability with the IRS. This typically involves working with a tax professional or representing yourself in a tax dispute. The IRS offers programs such as Offer in Compromise, which allows taxpayers to settle their tax debt for less than the full amount owed. However, it’s important to understand the criteria and requirements for such programs.